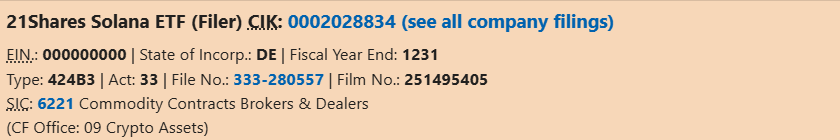

Solana ETF news is heating up today as 21Shares confirmed its final SEC filing for a new 21Shares Solana ETF under the ticker TSOL. According to the SEC official doc, the Chicago Board Options Exchange (Cboe) has officially approved the listing, clearing the last step for the traded fund launch in the U.S. This product will become the sixth fund on the Solana ETF list as institutional demand for SOL continues to rise.

Source: sec.gov

The new Spot Solana ETF will charge a 0.21% management fee, currently the lowest among all existing SOL-focused ETFs. The filing – submitted under Forum 424B3, appeared in the SEC database, signaling that trading could begin as early as today.

This development marks another major milestone for investors searching for regulated exposure to SOL-coin, following a month of strong inflows across the sector.

The competition around Spot SOL ETFs has accelerated.

Fidelity launched its FSOL fund yesterday on NYSE Arca with a 0.25% fee and a 15% staking reward charge. It is now the largest asset manager with a SOL-ETF.

Canary Capital introduced the SOLC-ETF on Nasdaq, partnering with Marinade Finance for staking. The fund plans to stake all its SOL holdings during normal market conditions.

VanEck released the VSOL fund on November 17, waiving all management fees until the ETFs reach $1 billion in assets.

With the entry of 21Shares, investors now have six different Solana-ETF options, each offering unique fee structure, staking methods, and exposure levels. This is one of the fastest-growing categories in the crypto-ETF space.

According to the latest data, inflow trends remain strong despite recent market weakness. On November 18, SOL funds reported $26.2 million in net inflows, led by Bitwise’s BSOL with $23 million.

Latest cumulative totals:

Bitwise BSOL: $388.1M

Grayscale: $28.5M

Fidelity: $2.1M

VanEck: $1.8M

This comes even as Solana’s current price trades near $134.64, down 3.82% in the past 24 hours following the weekly and monthly lows.

Source: CoinMarketCap

Market analysts noted that the asset recently swept liquidity near $130, forming a potential short-term base.

A reclaim above $150 could shift momentum upward, while long-term liquidity targets around $210 remain in play.

The strong Exchange Traded Funds demand may help support price recovery if inflows continue.

The new 21Shares Solana Spot ETF follows last week’s launch of two crypto index ETFs covering Bitcoin, Ethereum, SOL, and Dogecoin. These were the first crypto index funds registered under the Investment Company Act of 1940, adding credibility to the firm’s regulated product lineup.

21Shares already offers the popular 21Shares Solana Staking ETP (ASOL.SW) in Europe, which currently trades near $73.90 with $1.45B in net assets. The new U.S. spot ETF expands their global presence in Solana-based investment products.

As the SEC filing now moves into the trading phase, the market will watch closely to see how investors respond on day one.

Bhumika Baghel is a rising crypto content writer with a deepening interest in blockchain technology and digital finance. With a keen understanding of market trends and cryptocurrency ecosystems, she breaks down intricate subjects like Bitcoin, altcoins, DeFi, and NFTs into accessible and engaging content. Bhumika blends well-researched insights with a clear, concise writing style that resonates with both newcomers and experienced crypto enthusiasts. Committed to tracking price fluctuations, new project developments, and regulatory shifts, she ensures her readers stay informed in the fast-moving world of crypto. Bhumika is a strong advocate of blockchain’s potential to drive innovation and promote financial inclusion on a global scale.