Bitcoin is showing strong momentum within its current trading range, supported by rising global liquidity and increased on-chain and chart activity. With the market price currently around $93,128, traders view this behaviour as closely linked to broader liquidity conditions, and several short-term signals point to strengthening momentum in the near term.

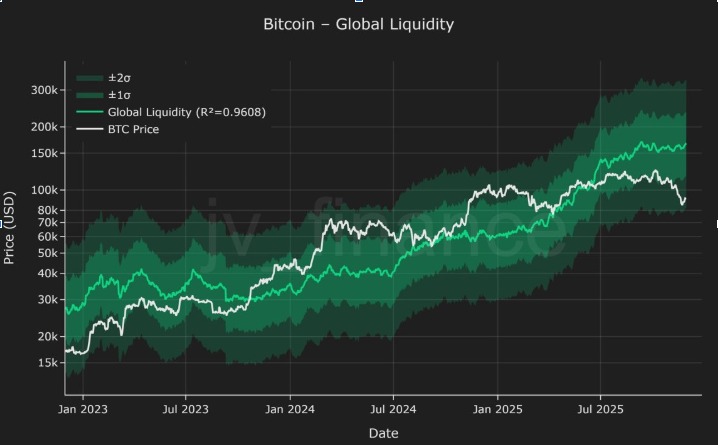

According to Crypto.Andy, using chart data, there is an indication that Bitcoin’s price has a strong, direct correlation with Global market conditions from early 2023 to late 2025. This chart shows Bitcoin within its standard deviation bands, which are based on rising capital levels, increasing from approximately the $30,000 range to nearly $150,000 by the end of 2025. This will be the primary basis for BTC price prediction.

“Bitcoin closely tracks rising global liquidity, showing strong macro support and potential for upward continuation despite recent correction.” (Cryptoandy coinmarketcap)

“Bitcoin closely tracks rising global liquidity, showing strong macro support and potential for upward continuation despite recent correction.” (Cryptoandy coinmarketcap)

As of press time, on the 4-hour chart, Bitcoin trades around $93,189 after recovering from a late-November low near $86,000. Price forms a consolidation range between $90,000 and $95,000. A break above the upper level may open targets between $98,000 and $100,000, while rejection could lead to moves toward $92,000 or $90,000.

Momentum indicators show improving strength. The RSI moves around 65 and stays below the overbought threshold, while the MACD confirms a bullish crossover with expanding histogram bars.

These indicators support the view that buyers remain active. Analysts note that these readings continue shaping short-term models for BTC price prediction, especially if the price holds above key support.

“Bitcoin shows strengthening bullish momentum as price tests the key $95,000 resistance, with RSI and MACD confirming upside pressure.” (TradingView)

Recent announcements also influence long-term expectations for Bitcoin’s market path. Crypto Rover reported that New Zealand will add digital-currency studies to its national curriculum in 2026, followed by full rollout in 2027.

The programme introduces blockchain topics and digital-asset handling at early stages, and analysts say future participation may grow as financial literacy improves. Broader awareness can support steadier market behaviour, which feeds into long-range BTC price prediction models.

Investments_CEO has also shared President Trump's recent comments supporting the passage of a federal Crypto Bill outlining a Federal System of Crypto Regulation. The bill proposes to establish a single set of National Rules for reporting, operating standards, and regulatory oversight of Cryptocurrencies.

Analysts frequently assert that clearer regulatory frameworks will create greater institutional access to Bitcoin and thereby may also impact the underlying demand assumptions utilised in BTC price prediction research.

Analysts continue to look at liquidity statistics, chart signals, and regulatory changes as they fine-tune their predictions for BTC prices. As liquidity increases and momentum improves, traders will be watching resistance zones closely for any indications of what will be the next major price move.

Shristy Malviya is a skilled English Blog Writer and Content Writer associated with Coin Gabbar, specializing in producing well-researched and SEO-friendly content on cryptocurrency, blockchain innovation, and financial technology. She is passionate about making complex industry topics accessible and valuable to a wide audience. Shristy’s work reflects her commitment to delivering credible and high-quality information that aligns with current market trends. Outside her writing career, she enjoys reading books, an activity that deepens her understanding of global markets and continuously inspires her professional growth.