The crypto market is bustling with Santa Rally optimism this 2025 December. A confluence of major developments – from central-bank policy shifts in the U.S. to regulatory changes in Japan and renewed institutional interest, is giving Bitcoin and altcoins fresh momentum heading into the month. Yet lurking in the background is a potential policy jolt from Japan’s central bank that could upset the rally’s rhythm.

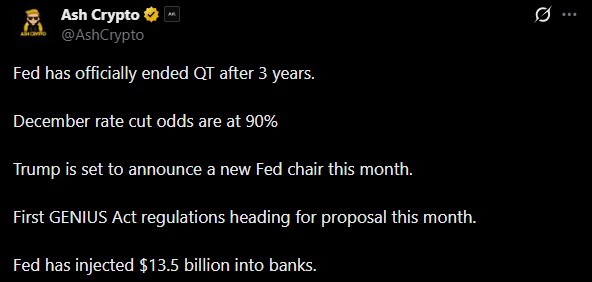

Source: AshCrypto

The biggest boost for the Santa rally this month comes from the United States.

On December 1, 2025, the Federal Reserve (Fed) officially ended its long-running quantitative tightening (QT) program, halting the reduction of its balance sheet. That move freed up roughly US$ 13.5 billion in liquidity, easing one of the largest drains on global market cash in recent years.

At the same time, markets are widely pricing in a rate cut – with about 88–90% odds of a Fed rate reduction in mid-December. Lower rates and restored liquidity typically benefits Bitcoin, Ethereum, and altcoins.

For risk-asset investors, that’s an encouraging backdrop: less pressure on liquidity, lower borrowing costs, and renewed appetite for high-reward assets like digital tokens.

Adding to the momentum the country’s president, a pro-crypto supporter, is set to announce a new Federal Reserve Chair early 2026. Any shift in leadership brings fresh expectations for interest rates and financial policy – both heavily linked to crypto market performance.

One of the biggest institutional signals for Santa Rally this December 2025 came from a traditionally cautious corner: Vanguard. As of December 2, Vanguard – managing roughly US$ 11 trillion, reversed its long crypto-averse stance, allowing clients to buy third-party crypto ETFs and mutual funds (e.g., those tracking Bitcoin, Ethereum, and other major assets).

This move dramatically widens the investor base for cryptocurrency, letting tens of millions of Vanguard clients easier access digital-asset funds under a familiar regulatory framework.

Meanwhile, market fear tied to Strategy – Largest Bitcoin Holding Institution, selling pressure ended after the company confirmed a strong $1.44 billion reserve, easing concerns of forced liquidations.

These developments come against a backdrop of regulatory clarity improving in multiple jurisdictions – lowering institutional risk thresholds and opening the door to larger capital inflows.

The most breakthrough digital coins act of the world’s largest economy (USA) – GENIUS Act, is expected to present its first regulation proposals this month, offering more clarity for digital assets and crypto services.

In parallel, Japan also appears ready to overhaul its crypto tax and regulatory regime, and that’s being viewed as a major bullish signal for the 2025 Santa Rally. The government is reportedly preparing legislation under which the crypto asset tax rate will be fixed at 20%, much lower than the top rate of up to 55%.

Alongside the tax reform, Japan has approved a huge $185 billion stimulus package, which boosts economic liquidity and indirectly supports inflows to speculative and growth assets.

Given that Japanese investors already hold tens of billions in crypto, with holdings surging in recent months, easier taxation and clearer regulation could reignite domestic demand and liquidity in Asian markets.

Despite the bullish setup, the biggest risk to the santa rally is policy from the Bank of Japan. A BoJ interest-rate hike is expected in its December 18–19 meeting, with a majority of economists forecasting a rise from 0.50% to 0.75%.

A rate hike, and possible further tightening, could unravel global ‘yen-carry’ trades, draining liquidity in risk assets. Crypto, which often benefits from carry-trade flows, could face sharp sell-offs, like in August 2024, when Bitcoin and altcoins fell after Japan’s monetary tightening pressured global markets.

For now, the upside face looks more potential with easing liquidity, institutional access, regulatory clarity, and renewed investor appetite. For bulls, the next few weeks could be promising. But with the BoJ’s December policy meeting looming, volatility remains a live threat.

Bhumika Baghel is a rising crypto content writer with a deepening interest in blockchain technology and digital finance. With a keen understanding of market trends and cryptocurrency ecosystems, she breaks down intricate subjects like Bitcoin, altcoins, DeFi, and NFTs into accessible and engaging content. Bhumika blends well-researched insights with a clear, concise writing style that resonates with both newcomers and experienced crypto enthusiasts. Committed to tracking price fluctuations, new project developments, and regulatory shifts, she ensures her readers stay informed in the fast-moving world of crypto. Bhumika is a strong advocate of blockchain’s potential to drive innovation and promote financial inclusion on a global scale.