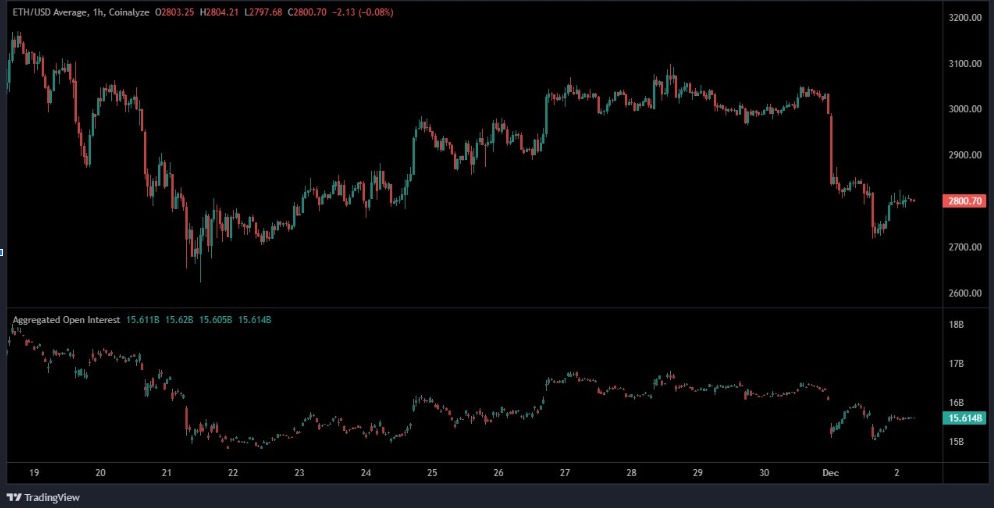

Ethereum is exhibiting early signs of stabilization after a sharp spike in volatility, with improving momentum indicators and rising buyer activity at key support levels. Strengthening MACD signals and steady rebound patterns suggest the market may be preparing for a short-term recovery phase.

Crypto Price Prediction analysis reveals that the coin has experienced significant volatility throughout the observed timeframe. Price initially declined before entering a prolonged consolidation phase, with tight ranging and reduced momentum indicating hesitancy among market participants.

This consolidation eventually gave way to a breakout, leading the token toward the $3,100 region, where a rounded top formation signaled fading bullish strength and an emerging reversal setup.

Source: Open Interest

Following this structure, the asset experienced a sharp decline, dropping toward the $2,700 area as sellers accelerated activity. The decline was followed by a modest rebound, marking the early stages of stabilization as buyers returned near key support levels.

For the Ethereum Price Prediction frameworks, this pattern reflects a typical volatility cycle, ranging, breakout, exhaustion, and corrective pullback before markets attempt to rebalance and determine a new direction.

The crypto is currently trading at $2,800.49, down 1.01% over the past 24 hours. Market capitalization stands at $338 billion, equal to the fully diluted valuation due to the crypto’s uncapped supply structure.

Trading volume rose sharply to $29.12 billion, a 43.01% increase, highlighting elevated activity during the recent selloff. With a circulating supply of 120.69 million tokens, liquidity remains robust even during high-volatility environments.

Source: CoinMarketCap

Over the past session, the coin traded near $2,828.6 before undergoing a notable intraday downturn, falling below $2,750 and reaching lows in the $2,720s.

The intense downward momentum corresponds with the chart’s red-shaded region, representing accelerated selling. A rebound soon followed, with the asset recovering toward the $2,800 level, where price stabilized inside a narrow band.

For Ethereum Price Prediction 2030 models, this stabilization suggests improving short-term footing as the market digests earlier forced selling and liquidity stress.

At the time of writing, the crypto trades at $2,802.7 with a slight daily gain of 0.16%. The broader chart shows the coin declining from the $4,000–$5,000 range earlier in the year into a consolidation zone between $2,700 and $2,900.

Volume remains elevated at 1.88K tokens, with clear spikes visible during the earlier selloff phase. These volume surges reflect aggressive selling followed by sustained buying interest, a common feature of markets preparing for stabilization after extended downside pressure.

Source: TradingView

Technical indicators show early signs of momentum recovery. The MACD (12, 26, close) displays identical readings on both panels, with the MACD line at -163.3 approaching the signal line at -184.0.

The histogram at 20.7 indicates growing positive momentum, suggesting that selling pressure is beginning to ease. Upward convergence of the MACD lines signals a potential early bullish shift. Within Crypto Price Prediction assessments, these signals point toward improving short-term conditions, though confirmation requires the asset maintaining support above $2,750 and reclaiming momentum toward the $2,900–$3,000 range.

Shristy Malviya is a skilled English Blog Writer and Content Writer associated with Coin Gabbar, specializing in producing well-researched and SEO-friendly content on cryptocurrency, blockchain innovation, and financial technology. She is passionate about making complex industry topics accessible and valuable to a wide audience. Shristy’s work reflects her commitment to delivering credible and high-quality information that aligns with current market trends. Outside her writing career, she enjoys reading books, an activity that deepens her understanding of global markets and continuously inspires her professional growth.