Imagine a world where owning a piece of a Picasso painting or a share in a luxury apartment far away is as easy as owning a stock.

Where old, slow financial systems are replaced by quick, cheap transactions.

Tokenization makes this possible—a world full of exciting opportunities.

2025 is looking like a big year for tokenized assets. Banks and financial institutions are speeding up their tokenization efforts, thanks to clearer rules and more interest from big investors.

But is this the big change we’ve been waiting for? Or just another overhyped trend?

Tokenization means turning real-world things into digital versions on a blockchain.

Think of it like slicing your favorite pie into pieces you can trade—except, instead of pie, we’re talking about things like bonds, property, or even Picasso paintings.

Despite its potential, tokenization is still in its infancy.

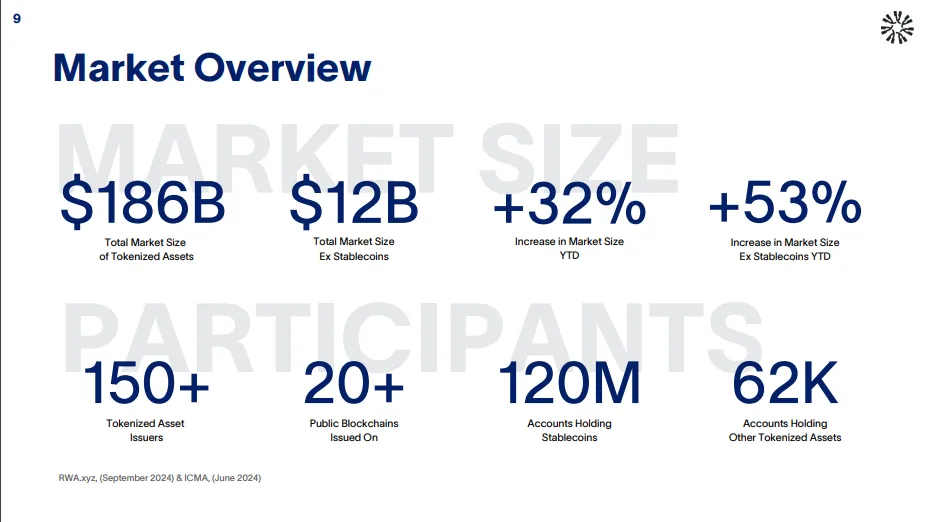

According to the Tokenized Asset Coalition’s (TAC) State of Asset Tokenization 2024 report, only 0.003% of global assets have been tokenized, representing just $12 billion excluding stablecoins.

For context, the global equity market alone stands at $109 trillion, while real estate investments add up to $11 trillion.

This stark contrast underscores how far tokenization must go to become mainstream.

But here’s the good news: the market is growing.

In 2024, tokenized assets grew 53% year-to-date, driven by increasing adoption, regulatory clarity, and the participation of financial heavyweights.

Regulation has long been the elephant in the room for blockchain. For years, unclear policies stifled tokenization’s growth, forcing projects to navigate a fragmented legal environment.

But 2025 is shaping up to be a turning point.

With Donald Trump’s re-election, the crypto market is brimming with optimism.

Bitcoin has surged past $100K, institutional adoption is rising, and the incoming administration’s stance on financial innovation could reshape tokenization’s future.

Key regulatory shifts include:

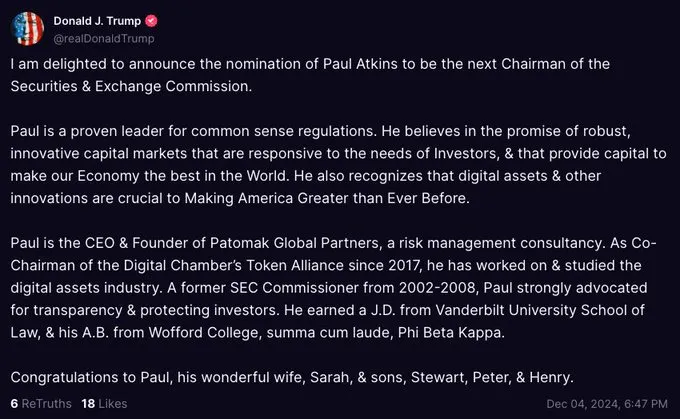

Paul S. Atkins has taken over as the new SEC chairman, signaling a pro-crypto stance.

Under his leadership, the focus is likely to shift from enforcement-driven regulation to a more innovation-friendly approach.

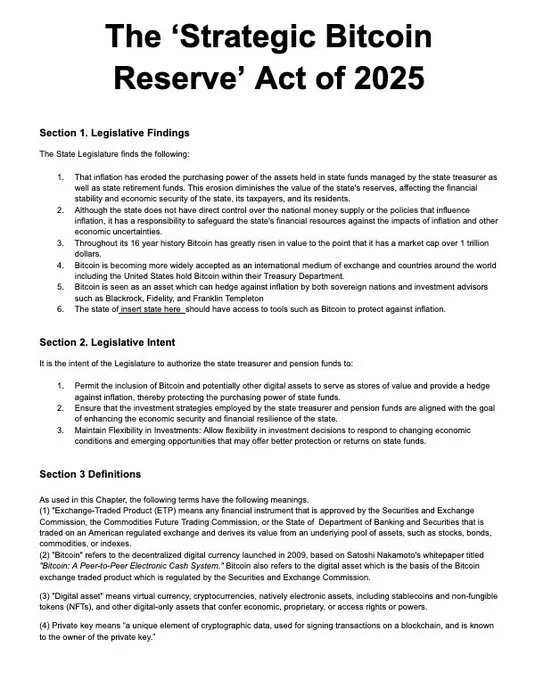

The U.S. government is now actively considering accumulating Bitcoin as part of its national reserves—a move that could reinforce America’s leadership in digital finance.

In addition, a new executive order—"Strengthening American Leadership in Digital Financial Technology"—aims to position the U.S. as the global hub for blockchain and tokenization.

The order focuses on regulatory clarity, stablecoin integration, and public blockchain access, setting the stage for institutional participation at an unprecedented scale.

When industry giants like BlackRock and Visa step in, you know the tide is shifting.

BlackRock’s tokenized Treasury fund, BUIDL, crossed $500 million in market cap within five months, delivering $7 million in dividends.

Visa launched platforms enabling banks to issue fiat-based tokens, while Mastercard partnered with JPMorgan’s Kinexys platform to process $2 billion daily in blockchain-based transactions.

Even beyond traditional finance, companies like Franklin Templeton and Ondo Finance are driving innovation.

Ondo’s tokenized treasury products now boast over $560 million in total value locked (TVL).

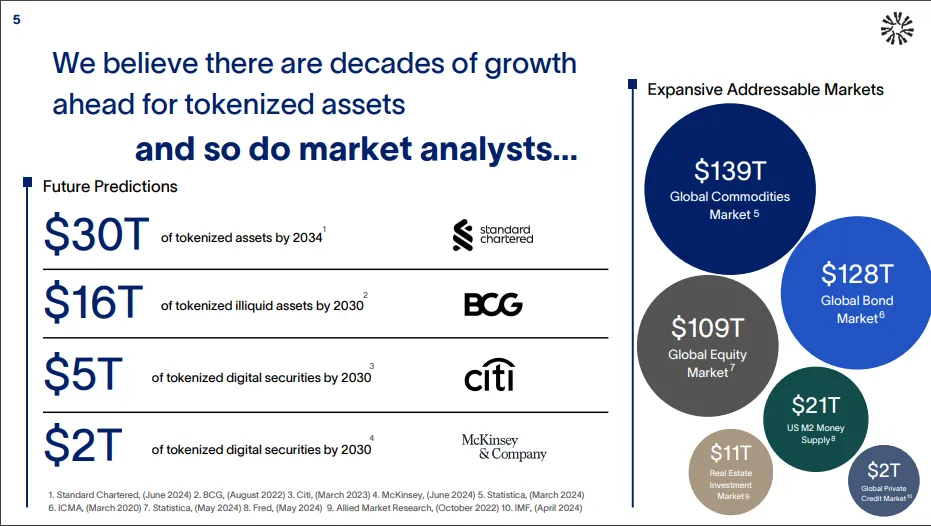

According to TAC, the addressable market for tokenized assets is enormous.

By 2030, predictions include:

$16 trillion in tokenized illiquid assets.

$5 trillion in tokenized digital securities.

$30 trillion in total tokenized assets by 2034.

These numbers aren’t just optimistic projections.

They’re backed by the real-world utility of tokenization—unlocking liquidity, reducing inefficiencies, and democratizing access to investments.

Treasuries: The Star Performer

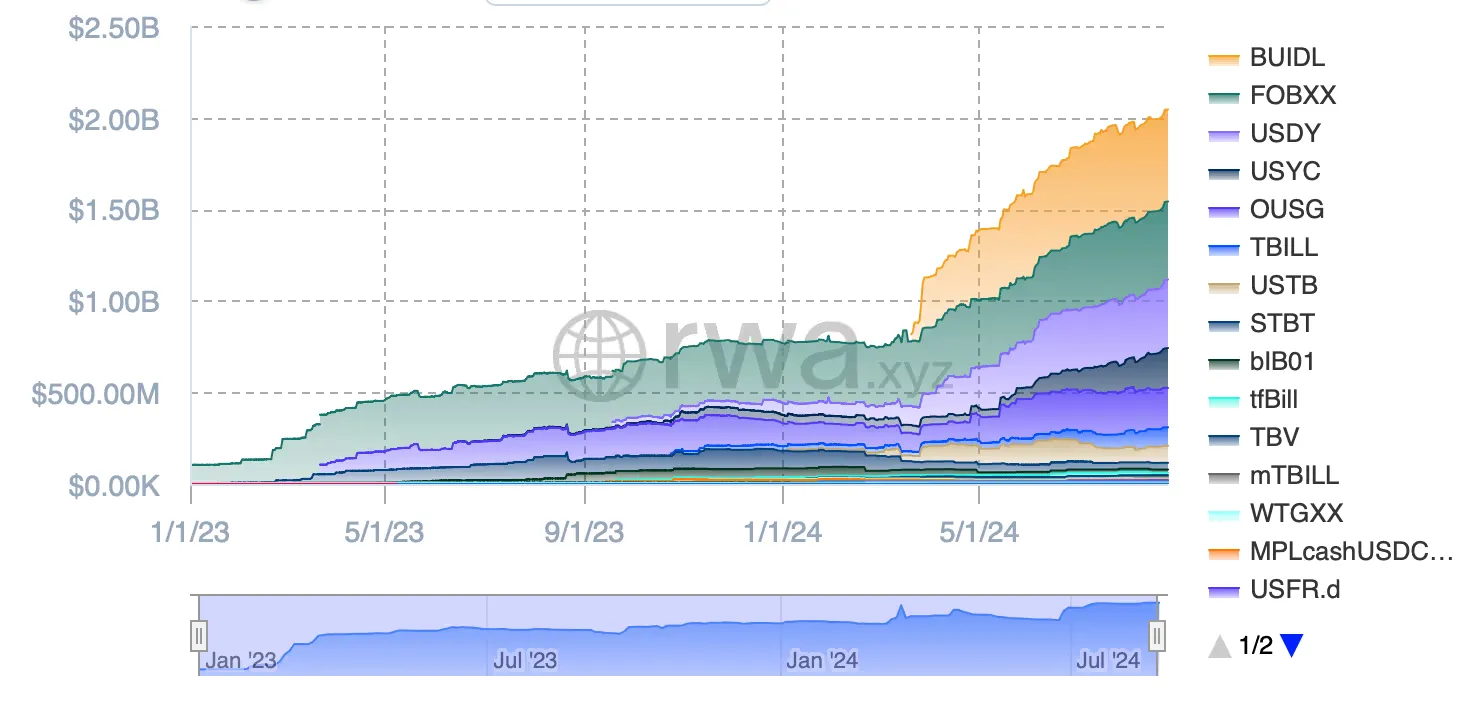

Tokenized treasuries have emerged as a flagship use case.

These products offer features traditional markets can’t match, such as 24/7 liquidity, programmable automation, and peer-to-peer transfers.

For instance, Ondo Finance’s USDY integrates seamlessly with DeFi, bridging traditional finance and blockchain.

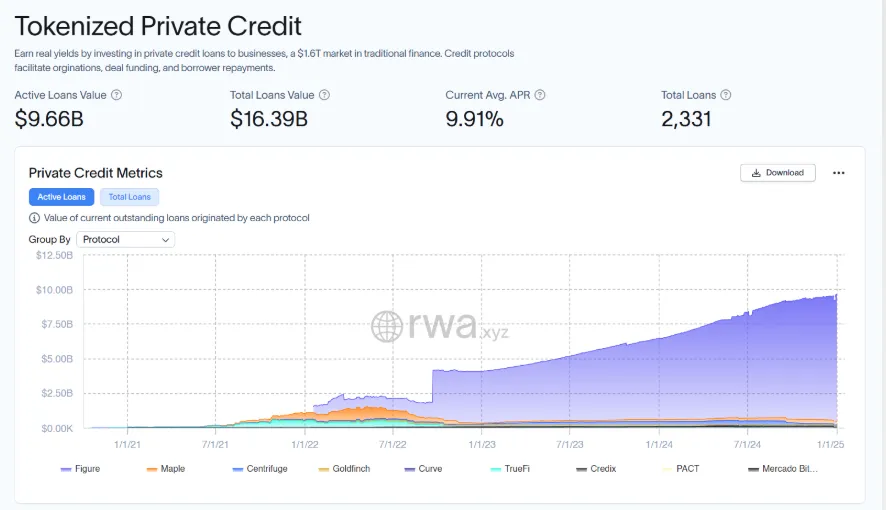

Private Credit: A $2 Trillion Market

Private credit tokenization is gaining momentum, with platforms like Centrifuge leading the charge.

In 2024, Centrifuge tokenized over $8 billion in loans, offering investors exposure to high-yield assets traditionally reserved for institutions.

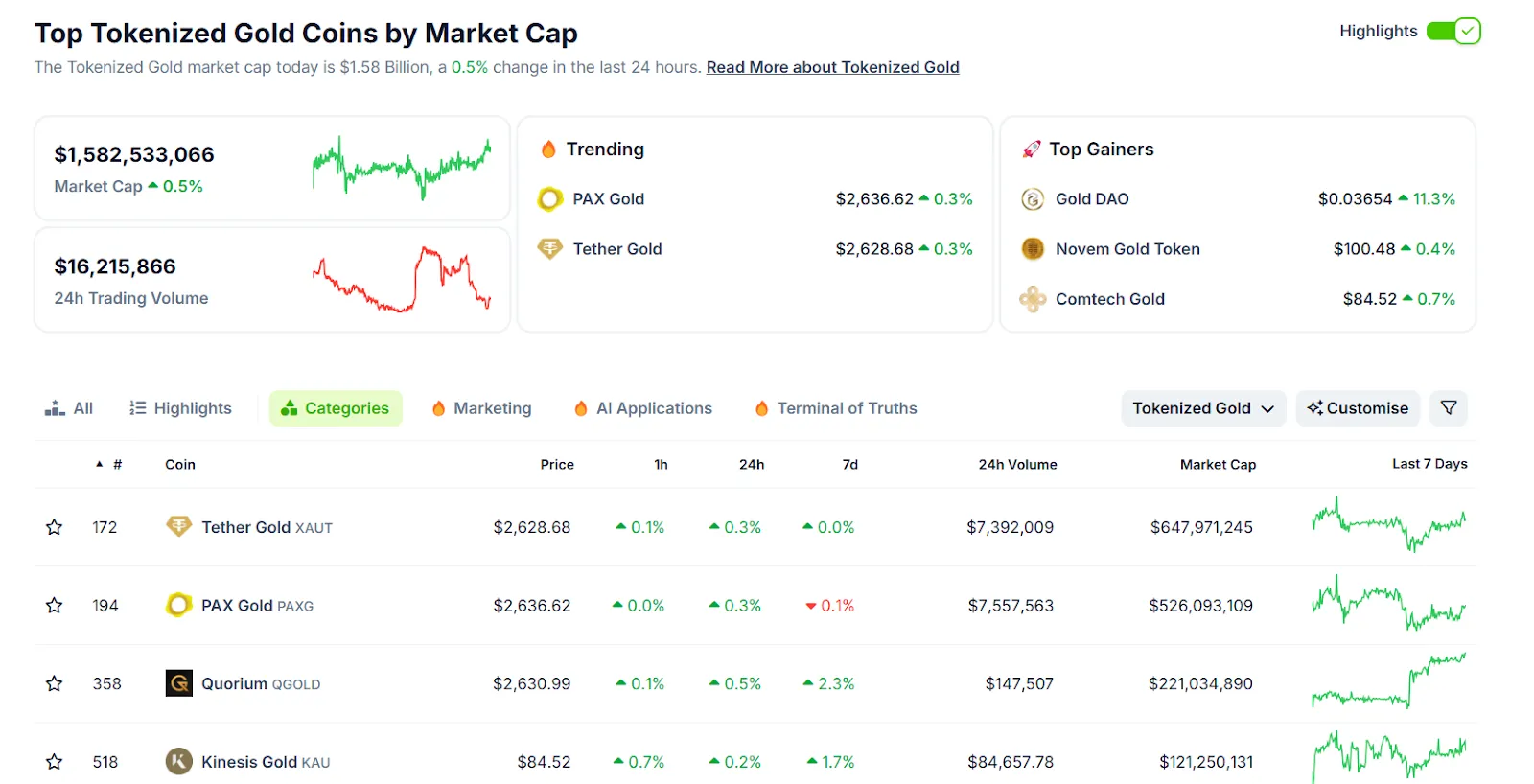

Tokenized gold-backed products like Paxos Gold and Tether Gold have a combined market cap nearing $1 billion.

These assets provide a new way to trade commodities, blending stability with digital convenience.

While real estate tokenization faces hurdles, it remains a promising sector.

Projects like tokenized REITs (Real Estate Investment Trusts) aim to make property investments more accessible and liquid.

Challenges: The Roadblocks Ahead

Tokenization isn’t without its challenges. Here’s what we’re up against:

While tokenization promises liquidity, poorly designed projects can lead to illiquid markets.

As TAC notes, many early tokenization projects struggled with low-quality assets and high fees, discouraging investors.

Despite progress, the regulatory landscape remains fragmented.

Countries are at different stages of adopting tokenization frameworks, creating compliance challenges for global projects.

Tokenization introduces new complexities. Educating investors—especially retail participants—is critical to ensure widespread adoption.

Insights from the TAC Report

The State of Asset Tokenization 2024 report by TAC offers invaluable insights:

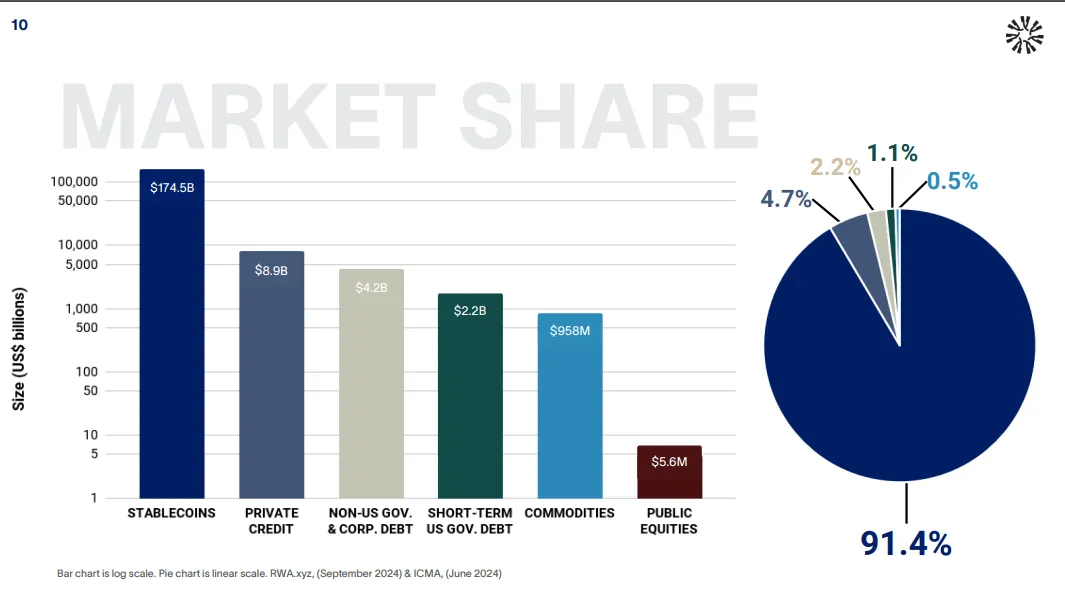

1 - Market Growth

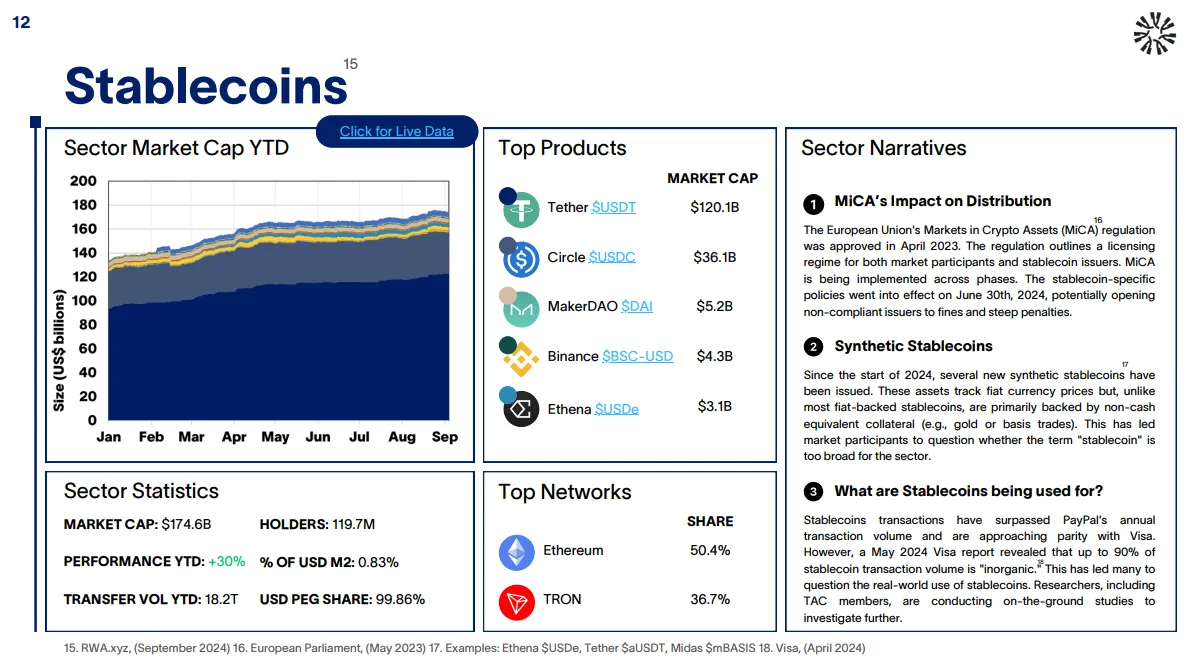

The total tokenized asset market, including stablecoins, reached $186 billion, showing a 53% year-over-year increase.

This is a significant leap considering the nascent stage of the industry.

2 - Diverse Applications

Tokenized assets span various categories, with stablecoins dominating at $120 billion, followed by tokenized treasuries and private credit.

3 - Participation Metrics

Over 150 issuers are now actively involved in tokenized asset projects, leveraging 20+ public blockchains to facilitate transactions.

4 - Regional Leaders

Asia and Europe are leading the tokenization charge, with regulatory sandboxes enabling pilots in markets like Singapore and Switzerland.

5 - Institutional Trust

Surveys conducted for the report reveal that 70% of financial institutions view tokenization as a viable solution for unlocking illiquid assets.

6 - Tokenized Treasury Growth

This category alone surpassed $2 billion in market cap, with innovative products offering unprecedented liquidity and efficiency.

As we look ahead, the trajectory of tokenization seems clear:

DeFi Integration: The fusion of tokenized assets with decentralized finance will unlock new opportunities for lending, staking, and trading.

Institutional Scaling: Expect more Fortune 500 companies to explore tokenization. A recent survey found that 35% of executives are planning tokenization projects, and 86% recognize its potential.

Emerging Markets: Tokenization can democratize access to global markets, particularly in emerging economies where traditional infrastructure is lacking.

At Kalp Studio, we’re focused on making Real-World Assets (RWA) easier to manage by turning them into digital tokens. This helps make assets more accessible and easier to trade, unlocking new opportunities for liquidity.

We combine blockchain technology with real-world needs to provide businesses with strong tools and solutions, no matter where they are in the world.

Liquidity Enhancement

We help businesses turn their physical assets into digital tokens, allowing them to tap into new markets and trade assets that were once hard to sell.

Automated Compliance

Our smart contract solutions make sure that businesses follow the rules and regulations, so they don’t have to worry about legal issues.

Fractional Ownership

High-value assets like real estate can now be shared among many smaller investors, making it easier for everyone to get involved.

Secure and Transparent Transactions

Blockchain makes every transaction safe and easy to trace. This builds trust and makes sure everyone’s information stays protected.

Rapid Deployment

With our easy-to-use tools, businesses can set up blockchain networks quickly and start using them faster, cutting down on time and costs.

Enabling Global Accessibility

We want to make RWA tokenization available to everyone, everywhere. Using blockchain’s decentralized nature, we are breaking down barriers and offering investment opportunities to a wider range of people.

At Kalp Studio, we offer:

Single Sign-On (SSO) for secure access to important data.

Smart Contract Templates that can be easily customized and used.

Interoperability through APIs and IPFS, ensuring everything works smoothly with existing systems.

So far, we’ve helped over 349 businesses worldwide, from real estate to finance, use tokenization in their systems.

Beyond the Hype

Tokenization isn’t just a buzzword—it’s a big change in how we handle finance. But like any new technology, it comes with challenges. The key isn’t whether tokenization will change finance; it’s how we will all work together to make it happen.

Deepak Choudhary is a solid two years of writing experience and crypto enthusiast. He writes about blockchain games, Telegram games, and tap-to-earn platform. Like his audience, he writes with clarity, simplicity, and lots of useful tips in his articles. He helps those unfamiliar with various aspects of crypto world in a very simple way. He also provides regular updates on the fast growing world of blockchain, with great articles covering current and expected trends and guides. His writings on crypto games as well as crypto earning apps on Telegram are quite useful and informative for people novice and experienced. His aim is to help more people explore and profit from Web3 ecosystem.

9 months ago

Bitcoin market trends

9 months ago

Crypto news and analysis

9 months ago

Top cryptocurrency news sites

9 months ago

Cardano news

9 months ago

Bitcoin market trends

9 months ago

Ripple news

9 months ago

Cryptocurrency tax news

9 months ago

Cryptocurrency security updates