24 Crypto Update, 03 March: Memecoin Rally Breaks Records

- The Bitcoin block size has surged, reaching an All-Time High (ATH) record of 3.97MB, which includes the largest single transaction ever.

- Bitcoin is trading above $63,500, while Ethereum remains close to $3,500.

- The cryptocurrency market has witnessed a modest 1.90% increase, bringing the total market capitalization to $2.50 trillion.

Crypto currency market jumped by 1.90% to $2.50 trillion

As the U.S. Securities and Exchange Commission (SEC) prepares to decide on a potential Ethereum ETF spot in May, anticipation mounts for a significant milestone in the crypto sphere.

FTX initiates a claim window offering major crypto assets like BTC, ETH, SOL, and BNB at prices notably below current market values.

Major Events To Watch

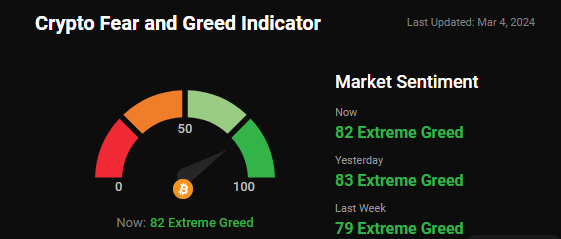

Crypto Fear and Greed Index:

Despite the "Fear and Greed Index" stabilizing at 82 out of 100 over the past day, the market remains highly optimistic.

Latest Market Update:

Bitcoin (BTC) remained stable in the $63,000 range over the weekend, continuing its streak from last week.

Other top coins such as Ethereum (ETH), Dogecoin (DOGE), Solana (SOL), Ripple (XRP), and ShibaInu (SHIB) experienced a mix of gains and losses.

Memecoin PEPE emerged as the biggest gainer, with a 24-hour jump of over 56%.

Bitcoin SV (BSV) faced the largest decline, with a 24-hour dip of over 13%.

Total crypto market volume in the last 24 hours: $109.91B, marking a 26.33% increase.

DeFi volume stands at $9.61B, constituting 8.74% of the total crypto market volume in the last 24 hours.

Volume of all stable coins: $96.87B, representing 88.14% of the total crypto market volume in the last 24 hours.

Bitcoin dominance: 52.43%, up by 0.56% over the day.

Major Worldwide News Update:

Skybridge Capital founder Anthony Scaramucci hinted at Qatar possibly adding Bitcoin to its reserves, sparking Bitcoin's surge past $64,000. Although Qatar's interest in Bitcoin surfaced in 2023, no official confirmation exists. Speculation arises as wealthy Middle Eastern nations consider Bitcoin investments, potentially driving massive inflows into the asset class.

The Paris Olympics plans to employ AI-powered cameras capable of detecting eight disturbances, including traffic violations and presence of weapons. French police test these cameras at Depeche Mode concerts, abiding by Parisian laws permitting AI use in public events. Industries, including security and entertainment, increasingly adopt AI technology for diverse applications.

Bitcoin block size reaches an All-Time High (ATH) at 3.97 MB amidst Inscription hype. Marathon’s Slipstream service breaks record with 3.9 MB block featuring a Runestone airdrop image. Blockchain blocks verify transactions; Bitcoin's typically 1 MB, Bitcoin SV up to 100 MB. Increasing block size may expedite transactions but risks decentralization.

There's uncertainty among crypto enthusiasts regarding SEC approval for spot Ethereum ETFs by May 31. Polymarket's odds show less than 50% chance. Initial optimism waned since January. Analysts vary in their predictions, with some estimating 60% chance, while others suggest a decline in optimism due to SEC delays and market dynamics.

Solana's SolChat introduces audio call feature using WebRTC for wallet-to-wallet communication. Co-founder Anatoly Yakovenko promotes the feature, emphasizing encrypted peer-to-peer conversations. WebRTC's DTLS encryption ensures security and privacy, preventing eavesdropping or message forgery. Solana's innovation challenges other blockchains amid recent community tensions, highlighted by ARK Invest CEO Cathie Wood's praise for Solana and clashes with Ethereum supporters.

Ark Invest, led by Cathie Wood, divests $43.4 million of Coinbase shares and $8.6 million of Robinhood shares amidst crypto market rally. Despite positive stock performance, Ark Invest continues selling throughout the week, signaling a strategic shift in investment approach amid market volatility and evolving trends.

Bitcoin NFT sales surged past Ethereum's in the last week, driven by a spike in Bitcoin Ordinals-based collections like NodeMonkes. Sales reached $168.5 million, up 80% from the previous week. NodeMonkes led with $41 million in sales, followed by Uncategorized Ordinals with $43 million. Natcats also performed well.

COIN GABBAR Views: What historical trends suggest for Bitcoin's behavior in March as the crypto market cap surpasses $2.5 trillion, Bitcoin breaches $69k, and Ethereum crosses $3,500? Will top coins prepare for a breakout rally this week? Could SHIB, PEPE, DOGE, and WIF prices see a 10x rally soon? To get latest news Stay tuned us at coingabbar

Disclaimer: Coingabbar's guidance and chart analysis on cryptocurrencies, NFTs, or any other decentralized investments is for informational purposes only. None of it is financial advice. Users are strongly advised to conduct their research, exercise judgment, and be aware of the inherent risks associated with any financial instruments. Coingabbar is not liable for any financial losses. Cryptocurrency and NFT markets could be highly volatile; users should consult financial professionals and assess their risk tolerance before investing.

Also Read: Crypto Roundup, 2 March: Is Altcoin Season Around the Corner