24 Crypto Update, 28 Feb: BTC Rally Sparks Altcoin Bonanza

- Bitcoin surpassed $60,000, reaching $64,000, following the launch of new U.S. spot Bitcoin exchange-traded products.

- Bitcoin's current trading price is approximately $61,500, with Ethereum hovering around $3,450.

- The cryptocurrency market experienced a 6.70% increase, reaching a total market capitalization of $2.40 trillion.

Crypto market jumped by 6.70% to $2.40 trillion

Bitcoin briefly touches $64,000, marking its first such high since November 2021.

Investor enthusiasm for BTC ETFs, with a daily trading volume surpassing $7.7 billion, fuels the current rally.

Major Events To Watch

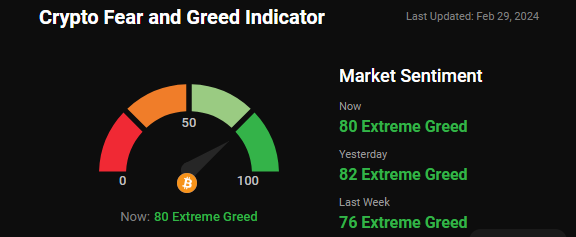

Crypto Fear and Greed Index:

In the past day, the "Fear and Greed Index" saw a 2-point drop, landing it at 80 on the 0 to 100 scale. Despite this slight decrease, market sentiment remains strongly optimistic.

Latest Market Update:

#Bitcoin ($BTC) surged above $64,000 on Wednesday, reaching levels not seen since November 2021.

#Ethereum ($ETH), #Dogecoin ($DOGE), #Solana ($SOL), #Bonk ($BONK), and #Pepe ($PEPE) saw their values rise by over 20%.

#Bonk ($BONK) emerged as the top performer, boasting a remarkable 54% surge in value within 24 hours.

Conversely, #Dymension ($DYM) experienced the most significant decline, with a nearly 5.30% decrease over the same period.

Total cryptocurrency market volume surged to $190.1 billion in the last 24 hours, marking an impressive 97.40% increase.

DeFi volume is presently at $14.11 billion, accounting for 7.42% of the total cryptocurrency market volume within the same period.

Stablecoin volume reached $170.88 billion, constituting a significant 89.89% of the total cryptocurrency market volume in the past 24 hours.

Bitcoin dominance now stands at 52.99%, reflecting a 0.89% increase over the course of the day.

Major Worldwide News Update:

Bitcoin ETF trading surged this week, with volumes doubling, hitting $6B. BlackRock's $IBIT led with $3.3B, followed by Fidelity at $1.4B. Total trades exceeded half a million. Including $GBTC, the Ten ETFs reached $8B in volume, soaring past records. Morgan Stanley considers integrating spot Bitcoin ETFs, potentially driving widespread adoption among major brokerage platforms.

Gemini, under an agreement with NYDFS, faces a $37M fine and pledges $1.1B reimbursement to Earn program users affected by Genesis Global's bankruptcy. Regulatory scrutiny extends as NYAG and SEC probe crypto loans and securities offerings. The case underscores the importance of due diligence in the crypto sphere, potentially shaping future regulations for investor protection.

Coinbase faced a technical glitch amid surging Bitcoin prices, leaving users seeing zero balances. The company is investigating the issue. Bitcoin soared to $60,000, prompting heavy traffic. Inflows into Bitcoin ETFs surged, with Coinbase reporting improvements but warning of ongoing issues due to high traffic. Maintaining system stability amid the bull run is crucial.

Bitcoin ETFs broke daily volume records, reaching $2.6 billion on Tuesday. BlackRock's iShares Bitcoin ETF saw $520 million inflow, pushing Bitcoin to $60,000. Grayscale's GBTC witnessed increased outflows. BlackRock climbed to the fourth position in ETF markets. BTC ETFs' surge suggests strengthening investor sentiment, bridging the gap between digital currencies and traditional markets.

Morgan Stanley's Europe Opportunity Fund considers investing up to 25% in spot Bitcoin ETFs, signaling a strategic shift from its focus on European companies. This diversification aims to capitalize on cryptocurrency's potential returns while ensuring compliance and risk management. Analysts view this move as a cautious approach within the tightly regulated mutual fund environment.

El Salvador's President Nayib Bukele asserts the country won't sell its Bitcoin holdings despite significant unrealized profits. Since September 2021, El Salvador has accumulated 2,798 BTC, valued at $130.5 million in January. Similarly, MicroStrategy plans to retain its 193,000 BTC, currently worth over $11.7 billion, despite substantial profits.

AI industry demand surges, driving growth prospects and investor interest in AI and robotics-focused ETFs. Tech giants like Apple and Google intensify AI investment. Nvidia's strong earnings highlight AI's importance. The global AI market is projected to grow by 37.3% CAGR by 2030, with significant economic impacts, particularly in China and North America.

COIN GABBAR Views: What is the next target for Bitcoin? Will BTC price cross the $100K milestone post-halving, amidst wild swing moves? Are we witnessing an extension of the uptrend towards a new all-time high, or is this a potential bull trap? Despite Bitcoin bulls eyeing record highs, could we anticipate some 'chop at the top'? To get latest news Stay tuned us at coingabbar

Disclaimer: Coingabbar's guidance and chart analysis on cryptocurrencies, NFTs, or any other decentralized investments is for informational purposes only. None of it is financial advice. Users are strongly advised to conduct their research, exercise judgment, and be aware of the inherent risks associated with any financial instruments. Coingabbar is not liable for any financial losses. Cryptocurrency and NFT markets could be highly volatile; users should consult financial professionals and assess their risk tolerance before investing.

Also Read: Crypto Daily Roundup, 28 Feb: Bitcoin Inches Closer to $60K