24 Crypto Update, 29 Feb: Eyes on US ISM Manufacturing PMI

- Bitcoin surged over 10% in a single day but has retraced to around $60,000, finding potential support at this level.

- Bitcoin's current trading price sits at approximately $61,000, while Ethereum is holding above $3,350.

- The overall cryptocurrency market saw a modest increase of 0.40%, pushing the total market capitalization to $2.40 trillion.

Crypto market rose by 0.40% to $2.40 trillion

US initial jobless claims rose by 13,000 to 215,000, with a four-week moving average of 212,500, down 3,000 from before.

Investors await US ISM Manufacturing PMI, Michigan Consumer Sentiment Index, and S&P Global Manufacturing PMI, alongside speeches from Fed officials, influencing crypto markets.

Major Events To Watch

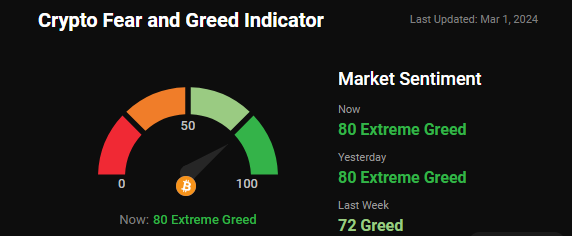

Crypto Fear and Greed Index:

Over the last 24 hours, the "Fear and Greed Index" experienced minimal movement, settling at 80 on its 0 to 100 scale. Nevertheless, market sentiment remains notably optimistic.

Latest Market Update:

#Bitcoin ($BTC), the oldest and most valuable cryptocurrency, briefly dropped to the $61,000 range early Friday, yet it has shown resilience after surging to $64,000 on February 28.

Other major coins like #Ethereum ($ETH), #Dogecoin ($DOGE), #Ripple ($XRP), and $#Litecoin ($LTC) experienced slight declines across the market.

#Fetch.ai ($FET) token stood out as the top gainer, boasting a 24-hour surge of over 22%.

Conversely, Memecoin #Pepe ($PEPE) faced the most significant loss, plummeting nearly 15% over the same 24-hour period.

Total crypto market volume in the last 24 hours stands at $146.12 billion, marking a 23.32% decrease.

DeFi's total volume is presently $10.56 billion, representing 7.23% of the overall crypto market's 24-hour volume.

The volume of all stable coins has reached $132.44 billion, constituting 90.63% of the total crypto market's 24-hour volume.

Bitcoin's dominance is currently at 52.73%, experiencing a decrease of 0.25% throughout the day.

Major Worldwide News Update:

In the week ending Feb. 24, jobless claims rose by 13,000 to 215,000, exceeding economists' expectations of 210,000. The four-week moving average slightly decreased to 212,500. Continuing claims reached 1.91 million, surpassing estimates and rising by 45,000 from the previous week. The four-week average for continuing claims is at its highest since Dec. 11, 2021.

Amid Bitcoin ETF momentum, WIF surged 12% in 24 hours, hitting $137. WIF's recent gains include a 38% rise in a week and a 46% increase in 30 days, with a staggering 540% growth in a year. Its $8 billion trading volume reflects intensified bullish sentiment and FOMO, underpinned by strong fundamentals.

Bitcoin dropped over 4.50% from its 24-hour high as investors withdrew $598.9 million from Grayscale's spot Bitcoin ETF on Feb. 29, the second-largest outflow recorded. BTC hit $64,005 on Feb. 28 but fell to around $61,500. Grayscale Bitcoin Trust saw daily outflows of $600 million, nearing the Jan. 22 record of $640.5 million.

Blast, Ethereum's layer-2 scaling WIFution, launched its mainnet, releasing over $2.3 billion in locked crypto assets. Spearheaded by Blur's founder, it aims to improve Ethereum's transaction efficiency. Despite withdrawals post-launch, Blast plans May airdrops, competing with scaling WIFutions like Arbitrum and Polygon, despite facing criticism for delayed withdrawals.

OpenAI secured its trademark name in a California court, blocking another company's use of "Open AI." The ruling cited potential confusion among consumers. OpenAI faces legal battles, including a copyright infringement case with The New York Times, alleging unfair use of its written works. OpenAI accused NYT of fabricating evidence.

Grayscale Investments and the SEC remain entangled in a prolonged legal battle over Options trading for Grayscale Bitcoin Trust. CEO Michael Sonnenshein advocates for approval, citing discrimination concerns. With the SEC possibly delaying a decision until September, Grayscale may resort to legal action, mirroring past strategies.

Vanguard CEO Tim Buckley will retire by the end of 2024, leading to speculation about the firm's stance on Bitcoin ETFs. Current CIO Greg Davis steps in as President, potentially signaling a shift in strategy. While Vanguard traditionally avoided crypto, Davis' appointment may bring openness to new investment trends.

COIN GABBAR Views: Will BTC skyrocket to $69K this week? Could it cross the $100K milestone post-halving? With Bitcoin price rising 45% in Feb 2024, its best performance since Dec 2020, what lies ahead for BTC price? To get latest news Stay tuned us at coingabbar

Disclaimer: Coingabbar's guidance and chart analysis on cryptocurrencies, NFTs, or any other decentralized investments is for informational purposes only. None of it is financial advice. Users are strongly advised to conduct their research, exercise judgment, and be aware of the inherent risks associated with any financial instruments. Coingabbar is not liable for any financial losses. Cryptocurrency and NFT markets could be highly volatile; users should consult financial professionals and assess their risk tolerance before investing.

Also Read: Crypto Daily Roundup,29 Feb: Market Rally Maintains Momentum