Is the Arichain listing date finally getting closer, or is the market moving too fast with expectations? Recent updates from the official website suggest the project is actively preparing for major milestones, including a Token Generation Event (TGE), airdrop distribution, and a public token sale. These developments indicate progress, yet questions remain about whether a market debut can realistically happen within Q1 2026.

Originally launched as a Telegram tap-to-earn game, the platform has rapidly evolved toward becoming a full crypto ecosystem. With refreshed distribution data and fundraising plans now public, investors are closely tracking every signal.

The latest Arichain tokenomics reveal a total supply of 500 million ARI, structured to support long-term growth.

Source: Official Website

77.8% (389M) allocated to foundation funds covering liquidity, ecosystem expansion, and market support

14% (70M) reserved for ICO sales

3.2% (16M) for angel participants

5% (25M) assigned to the team

This allocation highlights a user-focused approach, reinforcing confidence around decentralised participation. Strong community weighting often attracts early adopters, especially when paired with an expected Arichain airdrop.

Operational metrics also reflect scale:

Total Transactions: 534,384,159

Total Holders: 5,391,905

Community Members: 1,145,375

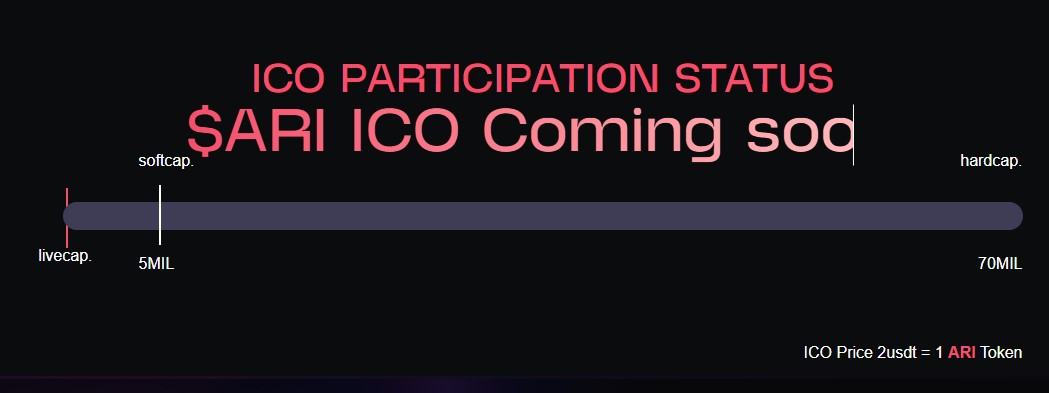

The upcoming token sale is drawing attention because the ARI ICO price is set at 2 USDT, targeting a $70 million raise with a $5 million soft cap. While the exact date is unconfirmed, estimates point toward February–March 2026.

Source: Official Site

Here lies the challenge: launching an ICO, activating mainnet infrastructure, and debuting on exchanges simultaneously is operationally complex. If fundraising begins within Q1, analysts believe the Arichain listing date could shift into Q2 2026. Community speculation continues, but no official confirmation has been issued.

Despite occasional criticism over low social activity, the team recently reposted hints about a “big announcement,” suggesting development is ongoing rather than stalled.

Early ARI price prediction models remain conservative. Short-term estimates place the debut range between $0.20 and $0.60. If liquidity strengthens and the roadmap executes smoothly, long-term projections suggest a possible move toward $1–$3.

Some community forecasts even mention $3.10+, though such targets remain highly speculative and depend heavily on adoption, trading volume, and broader market sentiment.

The growing conversation around the Arichain listing date reflects rising investor curiosity after updated distribution data and the approaching ICO. While Q1 expectations remain uncertain, steady development signals momentum. Whether the debut arrives in Q1 or shifts later, transparency and roadmap delivery will ultimately define long-term trust and valuation.

YMYL Disclaimer: This article is for informational purposes only and should not be considered financial advice. Cryptocurrency investments carry high risk and volatility. Always conduct independent research and verify details from official sources before making investment decisions.

Deepmala Upadhyay is an experienced crypto journalist, content strategist, and News writer with over 5 years of expertise in writing and the crypto industry. Holding a Bachelor's Degree in Computer Science and a deep understanding of blockchain technology and financial markets, she excels in delivering exclusive news, in-depth research blogs, and expertly crafted on-page SEO content. As a team lead and content writer at CoinGabbar, Deepmala is responsible for analyzing blockchain technologies, cryptocurrency, price movements, and the crypto market with precision and insight. Her keen ability to create well-researched, impactful content, combined with her expertise in market analysis, makes her a trusted voice in the crypto space.