BitMEX co-founder Arthur has sold millions worth of crypto just as markets began showing signs of weakness. Could BTC fall to $100K and Ethereum to $3K as as Arthur Hayes Bitcoin and Ethereum prediction suggests?

Arthur made headlines after moving large amounts of crypto within a few hours. In total, he sold:

2,373 ETH (worth about $8.32 million)

7.76 million ENA tokens ($4.62 million)

38.86 billion PEPE tokens (around $415,000)

The timing wasn’t random; it came right as the market started reacting to the latest U.S. economic stress signals.

Shortly after his transfers, he posted online saying that the "U.S. tariff bill is coming due" in Q3. He pointed to weak U.S. job data and said the broader market now expects serious macroeconomic pressure.

According to him, no major country is creating credit fast enough to support GDP growth. And in such a stressed economy, he believes risk assets like crypto could take a hit. This is the core part of Arthur Hayes Bitcoin and ETH prediction.

Arthur Hayes Bitcoin prediction has turned sharply cautious. Despite BTC reaching a record high near $123,000 in mid-July, he now expects it to drop to $100,000. Ethereum, he adds, might also fall toward $3,000.

Source: X (Formerly Twitter)

Arthur Hayes Bitcoin prediction is not without any reason. The market has experienced a dramatic flip since August 1, following the U.S. imposition of new tariffs under Trump's suggested 10% global import tariff. The action scared investors, rallied the dollar, and initiated a risk asset selloff such as crypto.

Ethereum was hardest hit. More than $300 million worth of ETH positions were liquidated between August 1 and August 2.

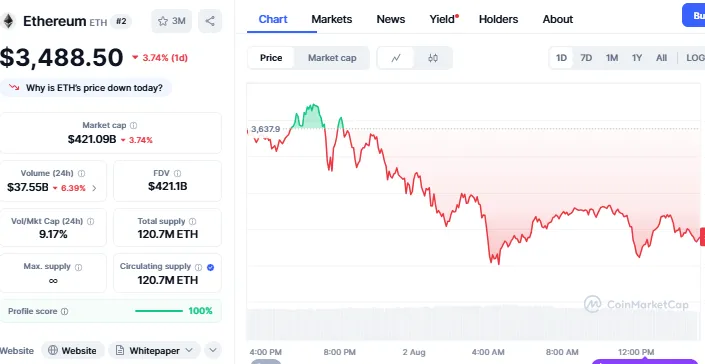

That’s a massive amount, and it reflects growing fear among traders. The 3.94% drop in Ethereum’s price over 24 hours shows how much pressure it's under, caused by macro news, technical breakdowns, and overall risk aversion.

The coin is now trading at $3,488.50 with a decrease of 3.74%, while trading volume has dropped by 4.39% to reach $37.55 Billion in the last 24 hours.

Source: CoinMarketCap

Arthur Hayes Bitcoin view ties directly into these events. He sees both BTC and ETH reacting not just to technical levels, but to bigger economic trends slowing growth, weak jobs numbers, and shrinking liquidity.

BTC has already broken below:

Its 7-day average and the 23.6% Fibonacci support around $119,000.

The MACD is falling

RSI is declining toward 42, all suggesting fading momentum.

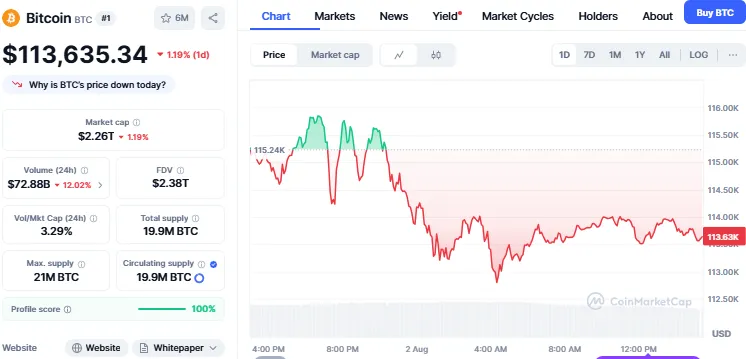

In just one day, $38.6 million value of BTC longs were liquidated

$21 million of that during the tariff news hour alone.

Source: CoinMarketCap

Currently the coin is trading at $113,635 with a decrease of 1.15%, trading volume has reduced by 12% to reach $72.88 Billion in the last 24 hours.

These kinds of numbers tell a clear story: traders are nervous. And when someone like him known for calling both crashes and rallies starts offloading his holdings, people take notice.

Although the short-term picture looks rough, he hasn’t given up on crypto entirely. His long-term Arthur Hayes Bitcoin outlook remains positive, but only after this wave of macro stress passes. For now, he’s cutting exposure and playing defense waiting for a cleaner setup before jumping back in.

Arthur Hayes Bitcoin prediction acts as a strong warning: even in a bull market, macro risks can strike.

Muskan Sharma is a crypto journalist with 2 years of experience in industry research, finance analysis, and content creation. Skilled in crafting insightful blogs, news articles, and SEO-optimized content. Passionate about delivering accurate, engaging, and timely insights into the evolving crypto landscape. As a crypto journalist at Coin Gabbar, I research and analyze market trends, write news articles, create SEO-optimized content, and deliver accurate, engaging insights on cryptocurrency developments, regulations, and emerging technologies.