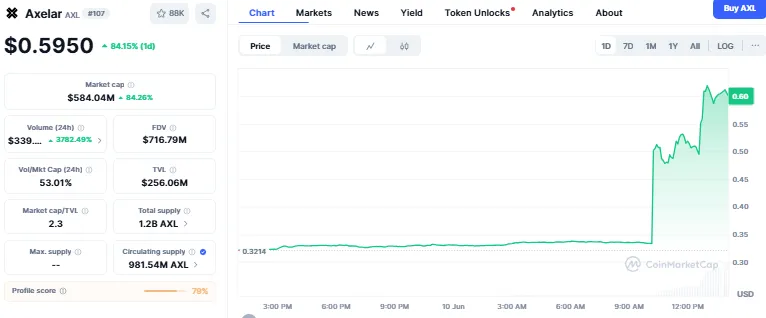

On June 10, Axelar token saw a surprising 90% price jump within 24 hours. Currently it is trading at $0.5950 with an increase of 84% in a day. The trading volume has also skyrocketed by 3793% reaching the value of $339.7 million. Total market cap is $584.04 million. The community is 86% bullish for this token as per the CoinMarketCap.

Axelar (AXL) is a blockchain project created to connect different blockchain networks via secure cross-chain communication. Developed using the Cosmos SDK. It uses a Delegated Proof-of-Stake (DPoS) infrastructure to power its operations.

Source: CoinMarketCap

Looking at the chart, it is evident that, just before the price surge, the coin was lagging around $0.3343. Then what triggered this sudden price spike up? Let us look at prominent reasons behind this upward momentum of AXL.

SUI Bridge Integration Boosted Utility

A major reason for the Axelar price hike came, because Axelar recently integrated with the Sui blockchain. On May 8, it launched a cross-chain bridge for Sui assets. This step assisted in improving cross-chain liquidity while enhancing Axelar’s relevance in the whole ecosystem. After the integration, Total Value Locked (TVL) of SUI rose by 21% to reach a value of $2.18 billion.

Exchange Listing Amplified Momentum

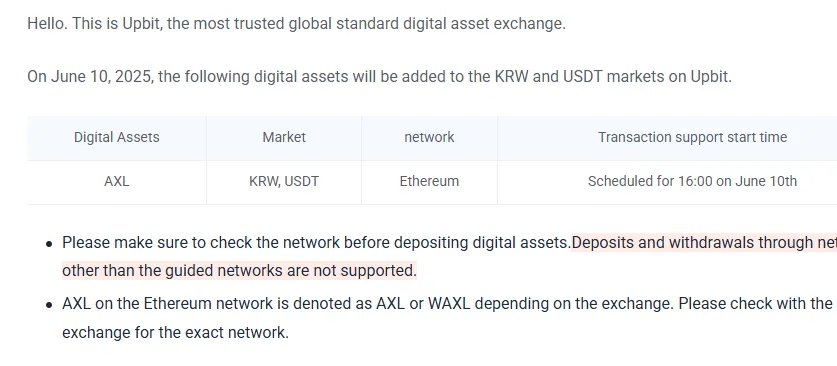

Announcement by Korea’s biggest stock exchange Upbit, to list new AXL trading pairs added more fuel to the rally. Korean investors can now invest in AXL using Korean Won (KRW) and USDT. When big exchanges list tokens, it usually pumps new demand from domestic traders.

Source: Upbit

Strong Technical Breakout

Its price breakout was driven by bullish chart patterns and higher trading volume. Technical indicators depict neutral RSI, which means the token has not been over-purchased even now after the rally.

Market Sentiment Turned Greedy

The general mood of the crypto market also contributed. The Crypto Fear & Greed Index reached 64 (categorized as "Greed"), and this usually triggers a pattern of buying in the altcoins. This further contributed to AXL's rally as more traders piled in, hoping to catch the momentum.

As Axelar (AXL) will come to the UPBIT, analysts will consider the increased volatility. New listings on prominent exchanges like UPBIT tend to draw retail traders as well as whales. This tends to result in furious price swings both ways. Some whales have already begun to trade funds in and out of AXL, and increased social media discussion has fueled the speculation. Still, social opinion is divided, with some traders concerned that AXL's price has risen too steeply, while others believe in the token's long-term prospects based on its increasing cross-chain utility.

Axelar's 90% surge derived from a combination of strong fundamentals, enhanced cross-chain utility, and bullish sentiments of investors. It also includes the boost from the announcement of Upbit listing. Even though some people believe the token is overpriced, its strong and flowing volume as well as a neutral RSI make it difficult to consider the rally finished.

Nevertheless, during the UPBIT listing, traders are advised to regularly see what the whales are doing and check the pre-listing activities. No matter if AXL keeps its gains or pulls back, its participation in connective cross-chain tools is being noticed more.

Disclaimer: This article is for information purposes only. Kindly conduct your own research before investing in the crypto market.

Muskan Sharma is a crypto journalist with 2 years of experience in industry research, finance analysis, and content creation. Skilled in crafting insightful blogs, news articles, and SEO-optimized content. Passionate about delivering accurate, engaging, and timely insights into the evolving crypto landscape. As a crypto journalist at Coin Gabbar, I research and analyze market trends, write news articles, create SEO-optimized content, and deliver accurate, engaging insights on cryptocurrency developments, regulations, and emerging technologies.