The Bank of Japan may raise its key interest rate to 1.0% by June or July 2026, according to former BOJ board member Makoto Sakurai. As the central bank gradually moves away from decades of ultra-low and negative rates, how will this potential Bank of Japan interest rate policy shift affect the yen, Japanese bonds, and crypto markets worldwide? Let’s understand its need and effects.

On December 18, the Bank of Japan raised its key interest level to 0.75%, marking the highest rate since 1995. Former BOJ board member Makoto Sakurai forecasted that rates could reach 1.0% by June-July 2026 and approach a neutral level of around 1.75%.

Source: Crypto Rover

This price increase comes as Japan faces high inflation and mixed economic signals, with the central bank aiming to balance growth with price stability.

Japan ended negative interest rates in March 2024, targeting inflation above 2%. Current inflation stands at 2.9% year-on-year in November 2025, exceeding the BOJ’s target 2% for four consecutive years. Real wages have fallen for 10 straight months, while GDP contracted by 0.6% in Q3 2025 (-2.3% annualized).

In comparison, the U.S. inflation stands slightly lower at 2.7%, with higher interest rates at 3.75% and unemployment at 4.6%, highlighting Japan’s slower growth and weaker wage dynamics despite tighter labor conditions.

Japan’s 10-year government bond yield jumped to a record 2.10%, up 100 basis points (1%). This means investors now demand higher returns, reflecting rising inflation expectations, possible Bank of Japan interest rate hikes, and changing economic outlooks.

On the other hand, Japanese yen rebounded to around 157 per dollar after hitting an eleven-month low, with authorities signaling potential intervention to curb excessive exchange-rate movements. Finance Minister Satsuki Katayama and top currency diplomat Atsushi Mimura emphasized action against speculative moves in the yen.

Source: Trading Economics

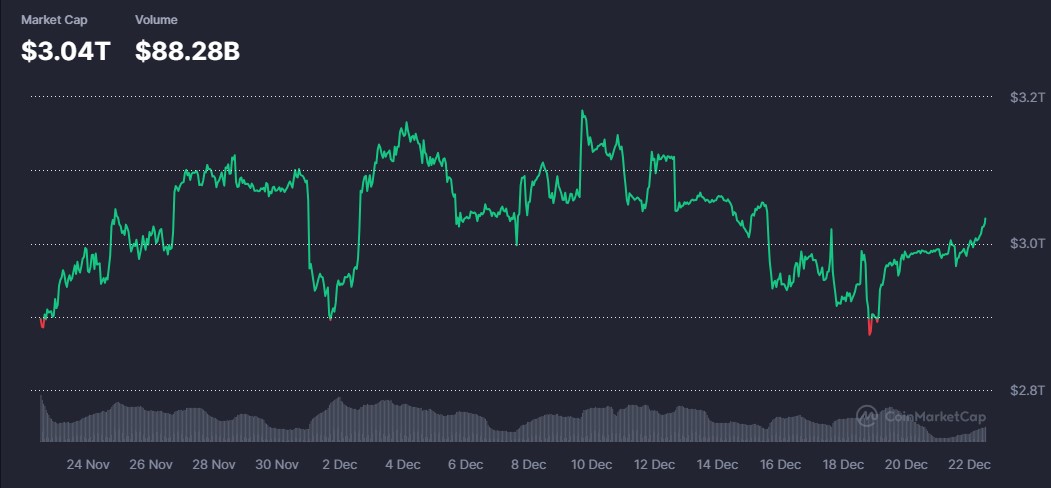

The crypto market also responded in a fair way, rising 1.04% today, and 0.43% on the day of the 0.75% hike announcement, in the 24 hours space amid institutional accumulation and Fed liquidity optimism.

Source: CoinMarketCap

In general, rising rates usually put downward pressure on crypto prices because borrowing is costlier, investors seek safer returns, and liquidity tightens. However, looking at the current scenario, it could be a result of the strong bull run in the market.

Japan’s gradual rate hikes signal the BOJ’s cautious approach to normalizing policy, but inflation and weak GDP growth may require careful monitoring in 2026. Markets will watch whether rates reach the projected 1.0% by mid-2026 and how further tightening affects the yen, borrowing costs, and investor sentiment.

For crypto and risk assets, aside from this, the outlook depends on global liquidity and macro events, including U.S. CPI data (Jan 13, 2026), the MSCI DAT ruling (Jan 15, 2026), and the Fed meeting (Jan 28, 2026), which could shift risk appetite.

Bhumika Baghel is a rising crypto content writer with a deepening interest in blockchain technology and digital finance. With a keen understanding of market trends and cryptocurrency ecosystems, she breaks down intricate subjects like Bitcoin, altcoins, DeFi, and NFTs into accessible and engaging content. Bhumika blends well-researched insights with a clear, concise writing style that resonates with both newcomers and experienced crypto enthusiasts. Committed to tracking price fluctuations, new project developments, and regulatory shifts, she ensures her readers stay informed in the fast-moving world of crypto. Bhumika is a strong advocate of blockchain’s potential to drive innovation and promote financial inclusion on a global scale.