What is going on with the Royal Government? Rotating, dumping, or getting ready for something big? The Royal Government of Bhutan Bitcoin sell has significantly increased. The country continuesly selling 512.84 $BTC ($59.47M) in the past four days, while maintaining a holding of 11,411 $BTC ($1.4B).

Source

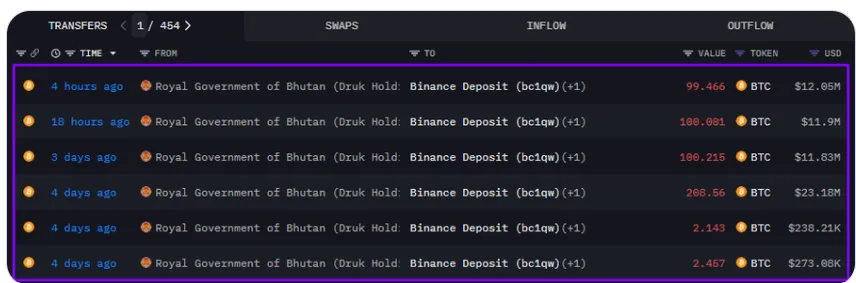

The Bhutan Bitcoin Sell has made six transfers to the same Binance deposit address since last Thursday, according to Arkham data. The latest transfer of 99 BTC occurred earlier today. The series of transfers comes two weeks after the government moved 137.245 tokens to the same address at the end of June, which is the most significant movement of its holdings since a $33 million deposit in November when the coin was approaching $100,000. This may indicate a pattern of Bhutan Bitcoin sell the token during price rallies.

Country’s moves reflect profit-taking and treasury optimization strategy and not panic selloff. As this coin is all-time high for the first time in history, the move sparked global debate on whether it was a sell-off or a masterclass in digital asset strategy.

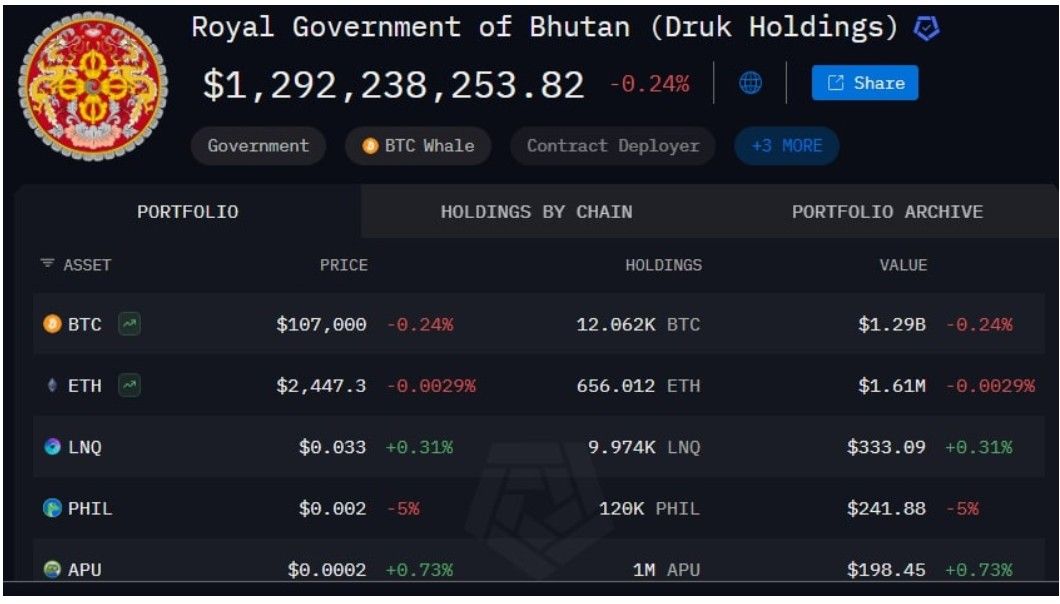

Country has established a $1.3B reserve in less than five years. It started mining in 2020 and mined approx 12,000 coins, with an estimated value of $1.3 billion, utilizing 100% hydropower with six mines, including facilities with bitdeer. The reserve in country isn't just an idle hypothetical idea; it is already having a noticeable economic impact.

According to Arkham Intelligence, the Royal Government, through Druk Holding & Investments (DHI), holds about 12,000 coins, as well as smaller reserves of Ethereum, BNB and Polygon.

Source: Arkham Data

Country's digital asset reserve is self-mined, and now holds the top three position among sovereign holders in Q2 2025. This differs from the United States, where over 200,000 token is mainly seized through law enforcement actions, El Salvador, which purchased around 5,750 BTC under government programs.

Bhutan Bitcoin Sell : What's inside? .

BTC hit an all-time high, indicating a profit-taking strategy rather than dumping. This move is not just due to luck but also market intelligence and strategizing.

It's digital gold is reinvested, redirected towards infrastructure, education, and healthcare initiatives. This makes it one of the few nations using cryptocurrency as an operational asset, not just a speculative one.

The nation is hedging itself by moving coin onto Binance, allowing it to reallocate into BTC or make a stablecoin or fiat hedge with perpetual contracts to remove the risk of market fluctuations. This means coubtry has a well-designed treasury management system.

Through collaborations with DK Bank and Binance Pay, Bhutan bitcoin sell is initiating crypto tourism pilot programs in anticipation of the development of a blockchain ecosystem. In the country digital payments are now accepted by more than 100 local businesses.

Furthermore, BTC, ETH, and BNB are being added to the official reserves of Gelephu Mindfulness City, a new economic zone. The foundational infrastructure for this next-generation smart region may be fueled by nation's cryptocurrency sales.

Should Retail Investors Follow Bhutan’s Lead?

The important question remains: Should You Copy Bhutan Bitcoin Sell Strategy, considering it's all time record high. Retail investors should consider portfolio diversification, risk appetite, and macro market trends before copying this selloff strategy. Its actions demonstrate that cryptocurrencies are a crucial part of modern government finances and are no longer a theoretical side project.

Sheetal Jain is a seasoned crypto journalist, content strategist, and news writer with over three years of experience in the cryptocurrency industry. With a strong grasp of financial markets, she specializes in delivering exclusive news, in-depth research articles and expertly optimized on-page SEO content. As a Crypto Blog Writer at CoinGabbar, Sheetal meticulously analyzes blockchain technologies, cryptocurrency trends and the overall market landscape. Her ability to craft well-researched, insightful content, combined with her expertise in market analysis, positions her as a trusted voice in the crypto space.