New Bitcoin all time high just reached $118,000 on July 11, 2025, surpassing its previous high of $111,970 on Bitcoin Pizza Day, May 22. In contrast, the US Dollar is going in the opposite direction, losing almost 11% this year, its worst first-half performance since 1973.

Source: The Kobeissi Letter

This gap between BTC and the USD is more than just a market move. It shows how people are losing trust in fiat money while turning to decentralized alternatives like this digital currency.

Trump Tariffs: Back in April, It was dropping due to rising trade war fears. Then on April 9, the US delayed new tariffs for 90 days, and the digital asset began to turn around.

Source: The Kobeissi Letter

Elon Musk Leaving DOGE: By April 20, it started rallying, and by April 22, when Elon Musk distanced himself from the DOGE department, BTC took the lead as the crypto market’s favorite.

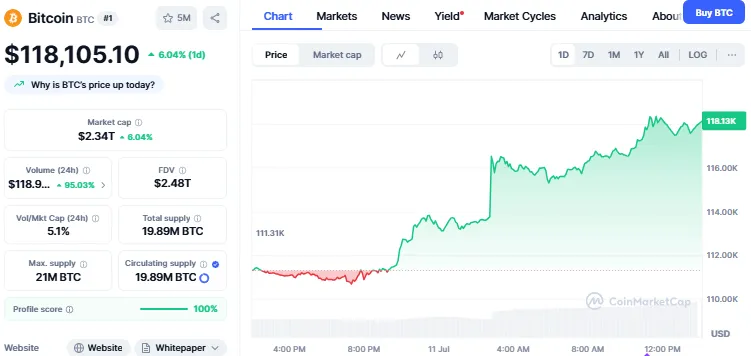

Since then, the price has soared 55%, eventually reaching today’s Bitcoin all time high. The currency is now trading at $118,105 with an increase of 6.04%, while trading volume has spiked by 90%.

Source: CoinMarketCap

What’s surprising is that the US Dollar has continued falling, even as the Federal Reserve takes a more hawkish stance as evident from the 17-18 June meeting minutes released by the Fed on 10th of July. Policymakers expect zero interest rate cuts in 2025.

Usually, higher interest rates support the Dollar, but in 2025 that hasn’t happened. Despite the Fed showing no signs of cutting rates, the Dollar is still down over 10%, a sharp contrast to BTC’s rise.

This unusual pattern tells us that traditional tools may no longer work to protect the value of fiat.

A big reason behind the USD’s fall is the passing of President Trump’s "One Big Beautiful Bill" (OBBB), which could add up to $5.5 trillion to US debt.

As the bill moved through Congress in early July, the currency rallied. On July 4, when the bill was signed into law, BTC exploded upward, leading to the new Bitcoin all time high.

In the same period, the Dollar kept falling, showing how investors now see this digital currency as a better store of value during fiscal instability.

Both gold and BTC have increased in value by over double since 2021. The two assets are considered to be hedges against inflation and government debt.

The United States debt ceiling was increased last time to $41.1 trillion, and the national debt is already nearing $37 trillion.

This long-term risk is now being reflected in the market, as people move money away from the USD and into this cryptocurrency. The Bitcoin all time high reflects this growing shift.

When Elon Musk was asked if his new "America Party" supports this digital asset, he replied, “Fiat is hopeless, so yes.” That one sentence created a huge impact. Evident from the Bitcoin all time high.

It’s not just a political comment, it’s a message to investors that the USD can’t be trusted to hold value forever. His support added even more momentum to the recent crypto rally.

The Bitcoin all time high of $118,000 doesn’t stand alone. It comes as the USD weakens, inflation rises, and debt grows.

These two currencies, one traditional, the other digital are moving in opposite directions. As BTC climbs and the Dollar drops, we may be witnessing the start of a major change in how the world views money.

Muskan Sharma is a crypto journalist with 2 years of experience in industry research, finance analysis, and content creation. Skilled in crafting insightful blogs, news articles, and SEO-optimized content. Passionate about delivering accurate, engaging, and timely insights into the evolving crypto landscape. As a crypto journalist at Coin Gabbar, I research and analyze market trends, write news articles, create SEO-optimized content, and deliver accurate, engaging insights on cryptocurrency developments, regulations, and emerging technologies.