Today, the global cryptocurrency market is weakly positive, having a 1.10% rise over the last 24 hours. CoinMarketCap reports that the global market capitalization is at $3.36 trillion with a daily trade volume of $89.62 billion. Bitcoin today's price is at approximately $108,728.80 after breaking over 1% gain, and Ethereum today's price rose by 2% to trade at $2,561.29.

But aside from these figures, numerous indicators now look toward a potential bull run and even a general crypto bull run 2025. Some have termed it the next Battle of bull run as giants are both showing up stronger. Below are the reasons why experts and indicators look toward a Bull run 2025 being imminent.

Institutions are purchasing and holding the crypto king, demonstrating firm long-term commitment.

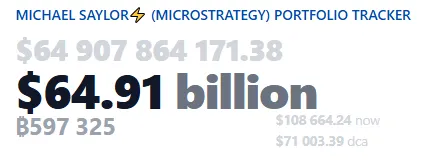

MicroStrategy Bitcoin holding has now reached 597,325 BTC, with a total value of about $64.95 billion. MicroStrategy began buying it in 2020 at a paltry 21,454 coins and is now the largest publicly held investor.

Source: Michael Saylor (MicroStrategy) Portfolio Tracker

Metaplanet Bitcoin news shows that it added 2,205 BTC recently, bringing its total to 15,555 BTC — valued at nearly $1.69 billion.

In BlackRock Bitcoin news, the giant now holds 696,275 BTC worth over $75.69 billion.

These moves suggest confidence in BTC’s future and are seen as strong signals by the community.

Politics is also playing a role in the coming crypto surge 2025. Elon Musk has announced his own political group, the America Party Elon Musk, saying that both U.S. parties are broken. He wants better financial control and could turn to the top cryptocurrency as a safer money option.

Tesla already owns 11,509 BTC, worth $1.25 billion. As per Treasuries.net, Tesla is currently the 8th-largest public BTC holder. If Elon Musk increases Tesla’s holdings, it could help push prices higher.

Source: Treasury.Net

Meanwhile, Bitcoin and Ethereum are also at the center of a different battle. According to Arkham Intelligence, Trump’s LibertyFi wallet holds 21.943 ETH worth $56.18K, and 95% of its holdings are on the Ethereum network. This shows that Trump is possibly more bullish on Ethereum.

At the same time, BlackRock is betting on Ethereum too, with 1.753 million ETH valued at $4.48 billion. So while one side supports the crypto king, the other is boosting Ethereum — a political and financial tug of war that may trigger the next altcoin season 2025.

Technical analysis also supports the idea of a Bitcoin Bull Run 2025. Analyst Ali Martinez shared a chart that tracks BTC growth across cycles:

Source: X

The 2013 cycle saw +1,900% from the low.

The 2017 cycle hit +500%.

The current cycle (2021+) has only reached about +200–250% from its low so far.

We’re now 42 months past Bitcoin’s last all-time high (ATH) in November 2021. Historically, bull runs often start 30–40 months after ATHs. If this trend continues, we may witness an overwhelming rally by December 2025, and it could reach $200,000 or higher. This would be the high of the crypto season 2025 and the high of a new crypto bull run.

From institutional purchases to politics and technology trends, there are a number of indicators which support the prospect of a strong crypto season 2025. And with crypto king taking the lead, followed by Ethereum, market traders can't wait. But don't ever forget: do your own research first before investing your money.

Disclaimer: This article has been prepared for academic study purposes only and is not providing any investment tips. Kindly consult a financial advisor before making any investment.

Deepmala Upadhyay is an experienced crypto journalist, content strategist, and News writer with over 5 years of expertise in writing and the crypto industry. Holding a Bachelor's Degree in Computer Science and a deep understanding of blockchain technology and financial markets, she excels in delivering exclusive news, in-depth research blogs, and expertly crafted on-page SEO content. As a team lead and content writer at CoinGabbar, Deepmala is responsible for analyzing blockchain technologies, cryptocurrency, price movements, and the crypto market with precision and insight. Her keen ability to create well-researched, impactful content, combined with her expertise in market analysis, makes her a trusted voice in the crypto space.