On Wednesday, Bitcoin dropped briefly to $112,565, its lowest in two weeks before bouncing back to $113,545, ahead of the Fed’s Jackson Hole Meeting. Investors were waiting for Fed Chair Jerome Powell’s speech on a 3 day long event, which could affect interest rates before the September Fed meeting and its effects are already in sight.

Source: Crypto Rover

Ryan Lee, chief analyst of Bitget, said the drop below $113,000 shows market nerves. If BTC stays above $112,000 before Powell’s Jackson Hole Meeting speech, it could start rising again.

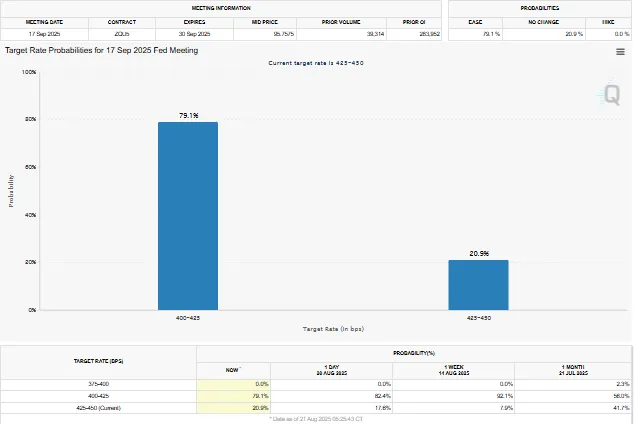

On August 12, the CPI report showed prices rose 2.7% from last year, higher than the Fed’s 2% goal. After this, chances of a September rate cut dropped from over 94% to 82%, said CME Group’s FedWatch tool.

André Dragosch, head of Bitwise’ European research, said a 2025 rate cut could help Bitcoin grow by adding more money to the arena.

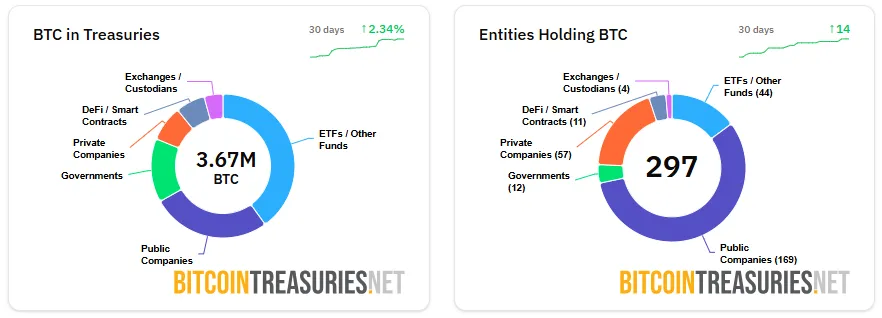

Even with price swings as of Jackson Hole Meeting, big investors are still buying Bitcoin. By August 2025, 297 groups, including companies, funds, and governments, holding 3.67 million BTC, which is over 17% of all Bitcoin, according to Bitcointreasuries.NET.

The drop happened as many traders sold to take profits after the summer rally. At the same time, too many risky trades, called leveraged positions, were removed, over $500 million in the last 24 hours, according to Coinglass. Now, investors wait for Powell's speech, which can move economy.

Traders are keeping an eye on key price levels. BTC has strong support at $110k, while $115k acts as a short term pivot. The $120k level is seen as major resistance, and if the currency closes above, the recent drop may only be temporary.

Bitcoin controls 52.3% of the crypto market, so its price affects other coins like Ethereum, Solana, and Dogecoin. If Bitcoin rises, Ethereum which is currently at $2,530 could move towards $3,000, and smaller coins may go up or down even faster depending on economy's mood.

Jackson Hole Meeting speech, U.S. Treasury yields, and the dollar index will be closely watched by the investors in the next 1-2 days, as U.S. regulations are important for long term market stability.

Bhumika Baghel is a rising crypto content writer with a deepening interest in blockchain technology and digital finance. With a keen understanding of market trends and cryptocurrency ecosystems, she breaks down intricate subjects like Bitcoin, altcoins, DeFi, and NFTs into accessible and engaging content. Bhumika blends well-researched insights with a clear, concise writing style that resonates with both newcomers and experienced crypto enthusiasts. Committed to tracking price fluctuations, new project developments, and regulatory shifts, she ensures her readers stay informed in the fast-moving world of crypto. Bhumika is a strong advocate of blockchain’s potential to drive innovation and promote financial inclusion on a global scale.