There is a huge change that is rocking the cryptocurrency market today. Bitcoin is going through unexpected turbulence, whales are transferring millions, and Ethereum is being active. The market responds- what does this imply to investors?

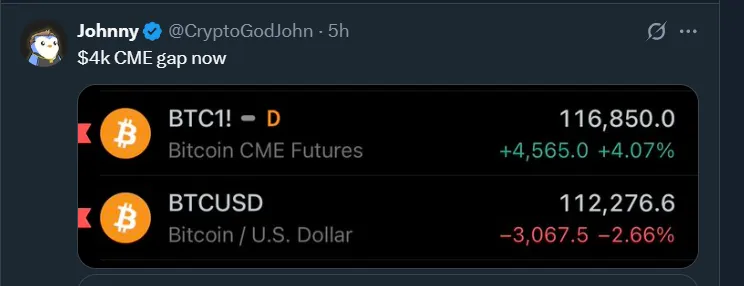

Bitcoin (BTC) suffered a flash crash today, losing 4,000 in just a few minutes, as a result of large sell-offs by a single whale. This action liquidated more than $310 million long positions, demonstrating how concentrated positions can impact the market. Despite the dip, Bitcoin remains resilient, trading at $112549, down 2.1% over the past 24 hours. Its 24-hour trading volume stands at $74.28 billion, representing 44.21% of market activity, while the total market capitalization is $2.25 trillion, up 1.58% in the past day.

Source: X

The flash crash demonstrates one of the main factors that currently influence the crypto market situation: the concentration of supply among early investors, or OG whales. These first-time buyers had acquired BTC for $10 or below in 2011 and now hold between 30 and 40% of the total supply. Their unwillingness to sell implies over $110,000 of new money to change the market prices, which slows down the upward movement of Bitcoin despite the interest of institutional investors.

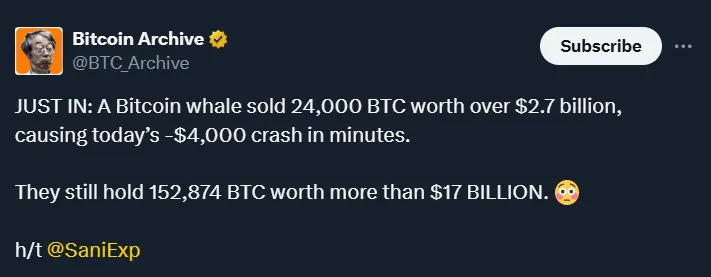

Source: X

This background can be used to understand why a sell-off as large as $2.7 billion by a whale results in only short-term volatility and not an extended crypto crash. Institutional purchases like that of the Japanese-listed company Metaplanet buying 103 BTC worth about $11.78 million strengthen the long-term faith. Their aggregate positions have increased to 18,991 BTC, worth approximately $1.942 billion, which indicates that institutional investors are continuing to wager on the long-term viability.

On-chain data shows that one whale sold more than 24,000 BTC, including those that have not been moved in over five years. Today alone, over 12,000 BTC were sent to the Hyperunite trading platform, contributing to the flash crash. To date, 18,000 BTC or approximately $2 billion have been sold, and the rest of 6,000+ BTC or $670 million are still being sold.

Source: X

Interestingly, much of this money has been transferred to Ethereum. The whale has acquired $2 billion of ETH and staked 1.3 billion as the ETH hit a new all-time high of $4950. This action is reflective of a larger trend in the market: institutional inflows into Ethereum are surpassing Bitcoin, signaling a shift in institutional dominance that is not necessarily retail-driven.

Analyst Willy Woo states that the reason Bitcoin is taking longer to grow in price this cycle is that most of the supply is in the hands of OG whales. The people who purchased in 2011 at a price of below $10 are not willing to sell, and any market change necessitates mammoth capital inflow. Historical data indicate that by the year 2011, 41% of the total supply had already been mined, a group of long-term holders whose behavior exerts a significant impact on the price dynamics.

Source: Willy WOO X

The analysis of Woo is also consistent, which shows that whales do not reduce their holdings, remaining at the level of 30-40% of the total supply. That is why even when whales sell, it only causes temporary dips, and why BTC is evolving into a mega-cap asset, which needs large amounts of capital to break the resistance of those that have been holding it long.

Nevertheless, it's still not that shaken by the flash crash today. Prominent names such as Michael Saylor have been stressing long-term strength against short-term volatility, and institutional purchases such as that of Metaplanet are an indication of continued faith in the asset. It is estimated that as whales slowly rebalance their positions, the industry will stabilize, once again asserting its strength and status as a long-term store of value.

Sakshi Jain is a crypto journalist with over 3 years of experience in industry research, financial analysis, and content creation. She specializes in producing insightful blogs, in-depth news coverage, and SEO-optimized content. Passionate about bringing clarity and engagement to the fast-changing world of cryptocurrencies, Sakshi focuses on delivering accurate and timely insights. As a crypto journalist at Coin Gabbar, she researches and analyzes market trends, reports on the latest crypto developments and regulations, and crafts high-quality content on emerging blockchain technologies.