What happens when two newly-activated whale wallets place huge leverage trades in opposite directions? This is exactly what the market is experiencing today, as a fresh Bitcoin Whales Showdown has quickly captured trader focus. With more than $64 million at risk, this battle of long-vs-short is setting short-term sentiment and setting the stage for sudden volatility.

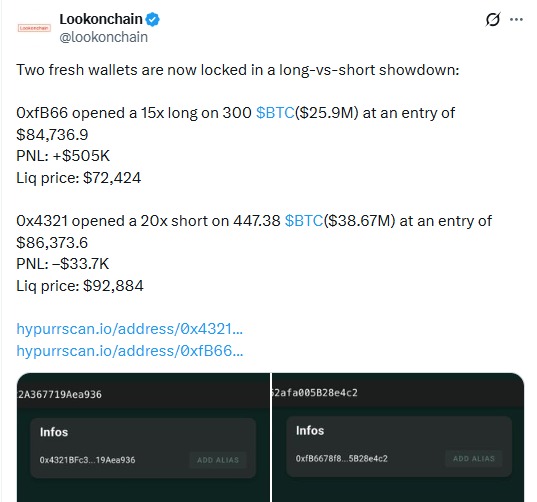

On-chain data from Lookonchain shows two new wallets taking aggressive positions within hours of each other:

Wallet 0xfB66 opened a 15x long on 300 BTC worth nearly $25.9 million at an entry of $84,736.9. The position is already showing a $505,000 profit, and with a liquidation level at $72,424, this whale sits comfortably as long as BTC stays near current levels.

Source: X (formerly Twitter)

On the contrary, wallet 0x4321 opened a 20x short on 447.38 BTC valued at over $38.6 million with an entry of $86,373.6. That trade is currently down about $33,700 and its liquidation price sits higher at $92,884, leaving the short exposed if it extends its rebound.

This head-to-head setup has become the buzzing topic in the market. While a rising price favors the long whale and puts pressure on the short whale, any sharp pullback would turn the tables. Therefore, traders are closely following this Bitcoin Whales Showdown, which is already up 125% month-over-month in derivatives open interest.

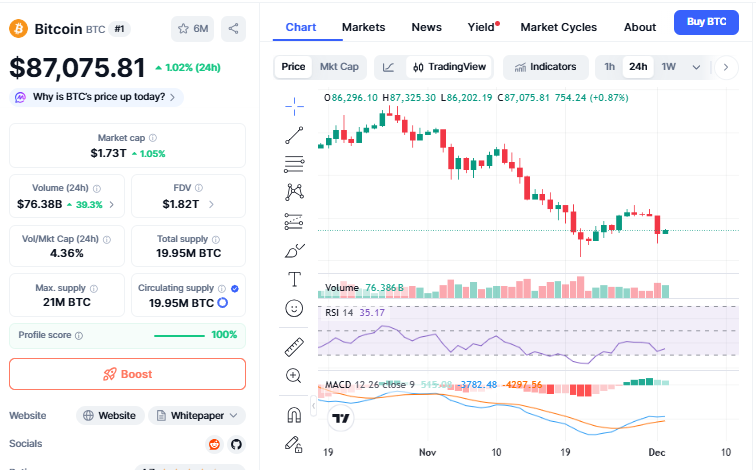

Following the action of whales, as per the CMC, Bitcoin price today moved to $87,075, up about 1.02% in the last 24 hours. Though the daily chart presents a mild recovery, the broader market still reflects notable weakness from 30-day and 90-day declines near 20.95% and 21.71%, respectively.

A contributing factor to today's rebound is the highly oversold state of BTC: The seven-day RSI fell to 35.17, opening a window for possible short-term recovery. Readings below 40 have very often triggered bounce attempts, and this time has proved no different.

Source: CMC

BTC also managed to stay above the 100-week SMA at $84,000, a support line that has cushioned deeper losses during previous market drawdowns.

Indicators of momentum further support the bullish case: The MACD histogram flipped positive into +754.24, which could suggest that sellers are losing momentum. Traders now view $88,000 as the next key area of interest, aligning with the 50% Fib level from the recent drop.

Despite this short-term reprieve, global conditions remain uncertain. U.S. 10-year Treasury yields held above 4%, which caps Bitcoin's utility as a dollar hedge. Japan's rising bond yields and continuing BOJ tightening fears further pressured risk assets.

Meanwhile, the U.S. Bitcoin ETFs had $3.4 billion in outflows during November, reducing the effect of technical support levels.

If the bullish momentum continues, it might head toward $88,000-$89,200 as the long whale takes over. If macro pressure returns, it could retest the $85,000 zone. Much depends on how the Bitcoin Whales Showdown goes and whether the short whale can survive another push higher.

Muskan Sharma is a crypto journalist with 2 years of experience in industry research, finance analysis, and content creation. Skilled in crafting insightful blogs, news articles, and SEO-optimized content. Passionate about delivering accurate, engaging, and timely insights into the evolving crypto landscape. As a crypto journalist at Coin Gabbar, I research and analyze market trends, write news articles, create SEO-optimized content, and deliver accurate, engaging insights on cryptocurrency developments, regulations, and emerging technologies.

3 days ago

I want to take a moment to sincerely thank FAST WEB HACKERS and their team for their outstanding service. They successfully helped me recover my stolen cryptocurrency worth $150,000 after it was taken through a fraudulent online investment. At first, I was skeptical, but their professionalism, transparency, and technical expertise quickly built my trust. They handled the process efficiently and delivered exactly as promised. I’m genuinely grateful for their help and the relief of getting my funds back. If you ever find yourself in a similar situation, you can contact them via Email: fastwebhackers@gmail. com/ fastwebhackers@aol. com or visit their Telegram: t.me/@fastwebhackers

1 month ago

I have read a lot of stories about people losing money to investment scams. I too have been a victim of this scams. I lost about $500k Bitcoin last year, I searched around and tried to work with people ,unfortunately I was scammed as well. This happened for months until I came across coinhackrecovery@gmail.com They came to my rescue and all my funds were recovered.

1 month ago

I have read a lot of stories about people losing money to investment scams. I too have been a victim of this scams. I lost about $500k Bitcoin last year, I searched around and tried to work with people ,unfortunately I was scammed as well. This happened for months until I came across coinhackrecovery@gmail.com They came to my rescue and all my funds were recovered.

2 months ago

I was scammed by a Bitcoin investment online website I lost about $50,000 to them and they denied all my withdrawal request, and gave me all sort of filthy request. It was a really hard time for me because that was all I had and they tricked me into investing the money with a guarantee that I will make profit from the investment. They took all my money and I did not hear from them anymore. I was able to recover all the money I lost with the help of Coin Hack Recovery. I paid 10% of the recovered funds as their service charge after I got all my money back. I am really grateful to him because I know a lot of people here have been scammed and need help. Contact Them via; coinhackrecovery (@) gmail (.) com .