Ethereum is once again back in the spotlight, and this time, it's not just crypto enthusiasts. Major financial institution BlackRock bought over $750 million worth of ETH in the month of June alone and has not sold a single currency. This bullish step by the largest asset management firm on the globe, has many asking: Is BlackRock betting big on Ethereum’s future? Could this be the moment it could finally catches up to Bitcoin?

Source: Arkham X Handle

Despite weak prices and recent sell-offs from retail investors, BlackRock’s bold move shows something major is brewing beneath the surface. In fact, $15 million in ETH was added in a single day, and ETF inflows across institutions crossed $1.25 billion in just 19 days, the largest buying spree since 2017.

At the same time, whale wallets holding this crypto are growing, and many believe this quiet accumulation phase is no accident. Analysts say the price is being held down through aggressive shorting so that big investors can keep buying at lower levels before an explosive move.

It is not just another cryptocurrency, it is the base of some of the most crucial crypto infrastructure. And with the Genius Act approaching full approval, the momentum is real. This legislation will regulate stablecoins, which are already dominated by Ethereum. About 40% of USDT and 75% of USDC exist on the Ethereum network.

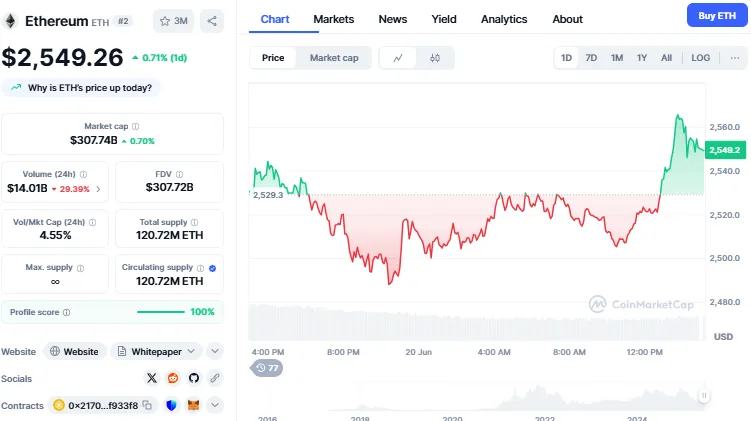

Even major banks like JP Morgan are building tokenized deposits on Base, which runs on Ethereum. If stablecoins become the biggest part of crypto, as many predict, this crypto will benefit the most.Currently it is trading at $2549.26 with an increase of 0.71% within a day. The trading volume has decreased by 29.39% amid geopolitical tension happening due to the Iran-Israel war.

Source: CoinMarketCap

The other main reason for the growth of ETH is staking. Now, 29% of total ETH is staked and receives passive rewards for the holder. And with a Staking ETF by Bitwise scheduled for approval on July 4th, institutions can potentially soon stake ETH through a regulated product.

This would funnel billions more into this digital currency and make the asset even more appealing. The possibility of generating yield on a safe, regulated token would be a game-changer for traditional finance (TradFi) investors.

Real-World Assets and Layer 2 Expansion

This digital asset already has 55% of all Total Value Locked (TVL) in the entire crypto industry. Its supremacy is obvious. But its future is even brighter. From Layer 2 networks to real-world asset (RWA) tokenization, Ethereum is the go-to platform.

As banks, governments, and fintechs explore crypto solutions, this network is their top pick, meaning its use case will only grow.

Interestingly, well-known investor Peter Schiff recently posted about silver's current position, saying it may follow the same breakout gold saw. Some are now comparing this crypto to silver, just as Bitcoin was once compared to gold. If Bitcoin followed gold’s path, could ETH follow silver’s?

As of now ETH is maintaining its calm before exploding. BlackRock’s massive ETH purchases, growing whale activity, upcoming staking ETFs, and stablecoin dominance all point to one thing, this coin is gearing up for a major breakout.

Once the shorts unwind and institutional players are done loading up, it could be heading straight for $10,000, fast.

Muskan Sharma is a crypto journalist with 2 years of experience in industry research, finance analysis, and content creation. Skilled in crafting insightful blogs, news articles, and SEO-optimized content. Passionate about delivering accurate, engaging, and timely insights into the evolving crypto landscape. As a crypto journalist at Coin Gabbar, I research and analyze market trends, write news articles, create SEO-optimized content, and deliver accurate, engaging insights on cryptocurrency developments, regulations, and emerging technologies.