Blockchain tech and mining firm BTC Digital has made an astonishing announcement. Following the completion of a $6 million fundraising through the sale of 2,000,000 Ordinary Shares at $3.00 per share to institutional investors,, the company is completely switching from Bitcoin to Ethereum. They've already taken a $1 million bet on ETH and intend to swap all their existing and future Bitcoin holdings into Ethereum. The objective? To construct a stable, long-term, on-chain asset base based in the booming Ethereum ecosystem.

Source: BTC Digital

According to CEO of BTC Digital Siguang Peng, this is best known for its smart contracts, decentralized finance DeFi, and tokenization features. It is not only a cryptocurrency- it supports a platform of apps and tools that are transforming finance. Peng thinks this makes second best cryptocurrency the best bet as a core asset and foundation for next-generation crypto businesses.

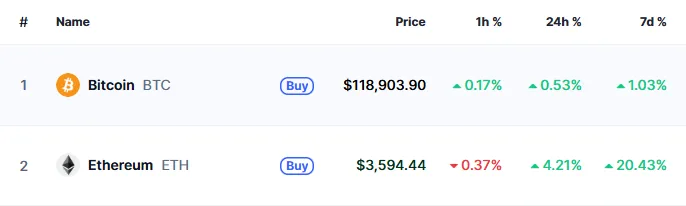

Market Snapshot

Source: CoinMarketCap

Ethereum currently commands around 13.15% of the crypto market cap, growing in power as Compony realigns its efforts toward ETH staking and DeFi. Its $6 million raise, including a $1 million purchase has lifted ETH 4.5% 24-hour spike to $3,599, and BTCT shares.

It has rallied to a six-month high of ~$3,600, up roughly 40% over two weeks, driven by upbeat U.S. legislation such as the CLARITY and GENIUS Acts (Meanwhile, Bitcoin has risen above $120,000 due to increasing institutional demand and regulatory favor.

Other listed firms such as SharpLink, and BitMine are also adding more holdings. This indicates a larger institutional diversification trend.

Given its focus, The Organisation aims to:

Scale ETH reserves into the tens of millions of dollars by year-end.

Utilize to earn income in the form of staking rewards, DeFi plays, and real-world asset initiatives.

Venture into new infrastructure such as stablecoins, layer‑2 scaling, and NFTs.

This is a significant departure from being a mining‑oriented company to being a cryptocurrency operator that receives returns by putting its crypto reserves to good use.

ETH’s current rally, combined with institutional and legislative momentum, makes this a smart time for such a pivot. But this reserves grow, so will scrutiny-from regulators and investors alike. Ultimately, BTC Digital isn’t just answering a question- they’re showing confidence in Ethereum’s future. Time will tell if the move pays off.

Muskan Sharma is a crypto journalist with 2 years of experience in industry research, finance analysis, and content creation. Skilled in crafting insightful blogs, news articles, and SEO-optimized content. Passionate about delivering accurate, engaging, and timely insights into the evolving crypto landscape. As a crypto journalist at Coin Gabbar, I research and analyze market trends, write news articles, create SEO-optimized content, and deliver accurate, engaging insights on cryptocurrency developments, regulations, and emerging technologies.