The world’s second largest crypto exchange by trading volume, Bybit report has been published for the half-year 2025, highlighting how it overcame one of the toughest phases in crypto history and used it as a launchpad for growth, security and compliance.

Bybit report, first half of 2025 was shaped by a massive $1.4 billion cyberattack carried out by the Lazarus Group (North Korean hacker group) in February 2025 on one of the firm's vendors.

Importantly the stolen Ethereum was taken from a third-party custodian and not from firm’s system. Still the exchange took full responsibility in leading the industry response.

The firm rolled out real time updates, presented onchain proofs, commissioned nine separate audits and introduced over 50 news security measures. It also launched a bounty program and stepped up its asset tracing efforts.

Through its new Bybit.eu platform it now offers local onboarding, fiat transaction options and plans to add MiFID compliant derivatives in the coming months.

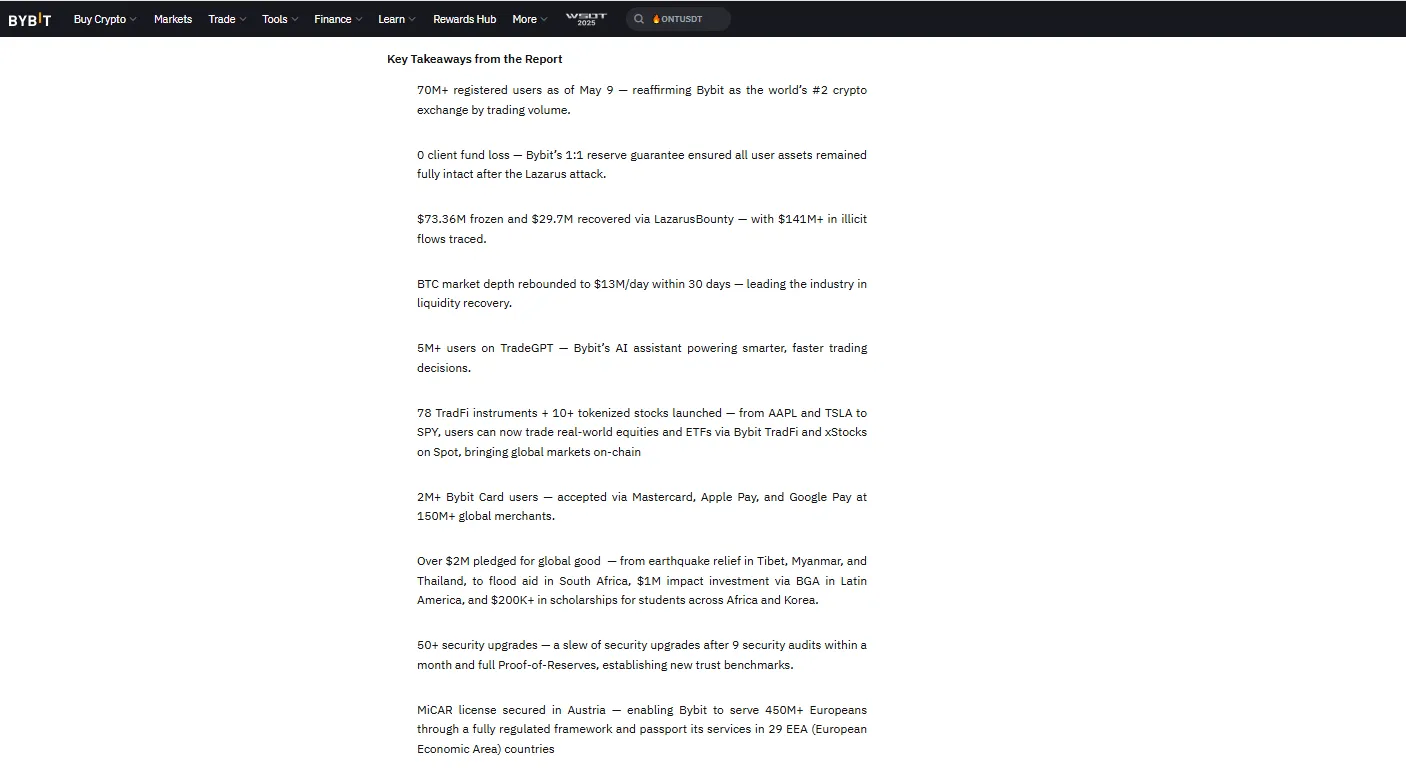

The Bybit report stayed strong in 2025 with zero user fund loss, quick BTC liquidity recovery and 70M+ users. It launched stocks trading, expanded its card to 2M+ users, boosted security, gained EU license and supported global aid.

Source: Official site

Apart from Bybit report the firm is also growing its physical footprint. New offices are already live in Poland, Portugal and Spain with the further expansion lined up for France, Germany, Italy and Romania.

In the UAE the exchange has received initial approval from Abu Dhabi’s Securities and Commodities Authority while registration with India’s FIU has opened doors for regulated operations there as well.

The Bybit report also highlights its push into AI-powered tools, real world asset tokenization and advanced trading features. These steps show its commitment in structuring how users are interacting with crypto assets and making Web3 more accessible to everyday users.

Akanksha is a dedicated crypto content writer with a strong enthusiasm for blockchain technology and digital innovation. With a growing footprint in the Web3 space, she specializes in turning intricate crypto topics into clear, engaging narratives that resonate with readers across all experience levels. Whether it's Bitcoin, emerging altcoins, DeFi platforms, or NFT trends, Akanksha delivers timely and insightful content that helps audiences stay informed in the ever-evolving crypto market. Her analytical approach, combined with a passion for decentralized finance, allows her to craft informative pieces that empower both new and experienced investors. Akanksha firmly believes in the transformative power of blockchain to reshape global systems and drive financial inclusion.