Cathie wood Invest Buys 339K $BMNR Shares

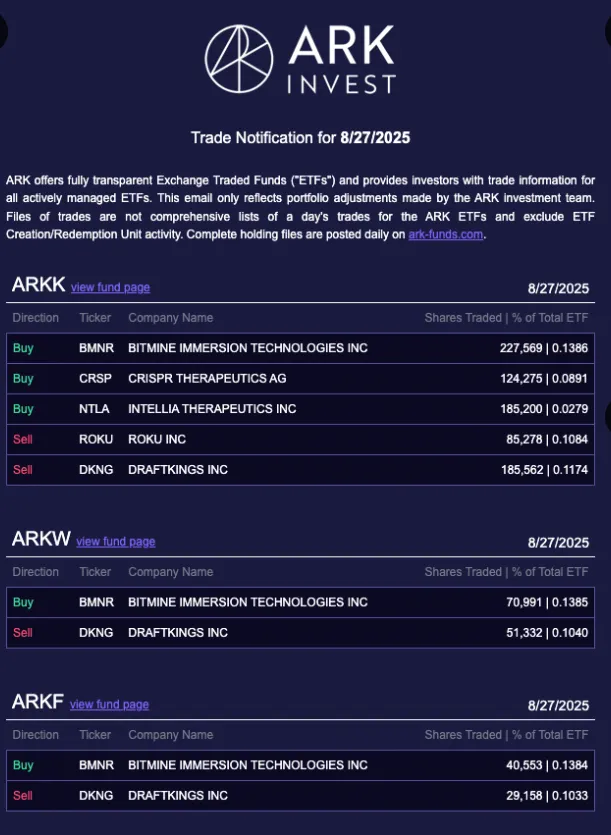

Yesterday, Cathie wood Invest made notable moves in the crypto and stock market by purchasing a significant 339,113 number of shares in Tom Lee, BitMine Immersion Technologies Inc (OTC: $BMNR). The firm these shares are across three of its ETFs and purchases:

ARK Fintech Innovation ETF (ARKF) : 40,553 shares

ARK Innovation ETF (ARKK) : 227,569 shares

ARK Next Generation Internet ETF (ARKW) : 70,991 shares

Source: Cathie wood Invest

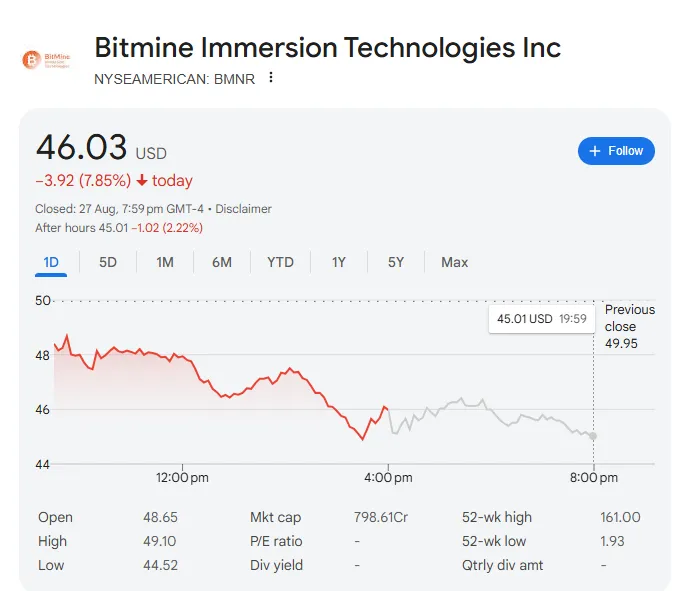

Bitmine Immersion ($BMNR) closed at $46.03 yesterday, down 7.85% from the previous close of $49.95. That brings the total investment around $16.94 million. This purchase shows Cathie wood Invest ongoing focus on tech and biotech sectors with BitMine emerging as a key target in their strategic portfolio expansion.

During the day, the stock reached a high of $48 but steadily declined to close near $46.

Source: Google

Cathie wood Invest through its ARKK ETF continued to buy 124,275 shares of CRISPR Therapeutics (NASDAQ: CRSP) for about $6.82 million yesterday, its consistent purchase shows confidence in the gene-editing company’s growth potential.

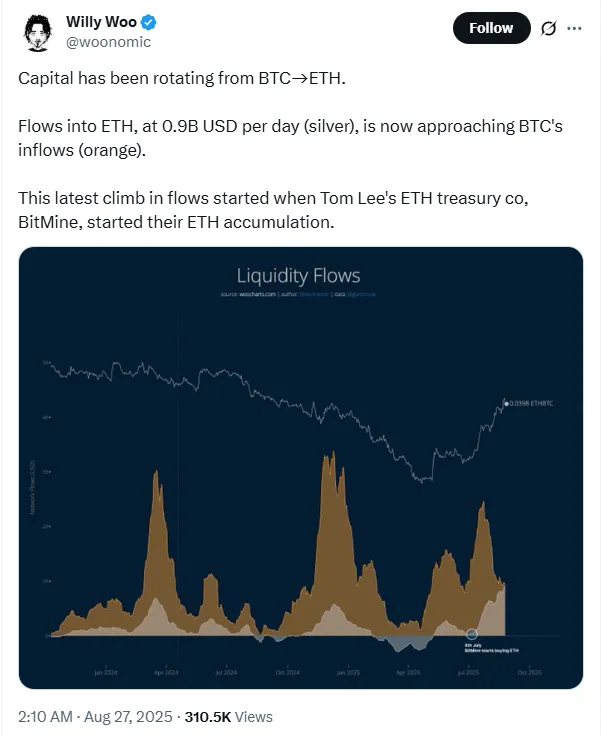

Willy Woo, crypto analyst highlighted in his recent X post that the daily inflows into Ethereum (ETH), around $0.9 billion are now getting close to Bitcoin’s (BTC) daily inflows. A graph showed that this capital rotation started after BitMine began accumulating ETH in early July.

Source: Willy woo X handle

According to him, Bitcoin’s market dominance has dropped from 64.5% to 57.2%, while Ethereum’s share has risen from 9.2% to 14.4% as per the data of CoinMarketCap. This rotation is clearly reflected in prices: BTC has grown only 2.9%, whereas ETH has surged by a huge 82%.

The past few days regular purchases of BitMine are helping ETH ETFs rise and creating competition for Bitcoin. On the following dates BitMine Ethereum purchasing reached its total treasury of 1,713,899 ETH.

August 11 : +317,126 Ether to 833,137 holding

August 18: +373,110

August 25: +190,526

Bitmine Ethereum buying strategy is also boosting its own shares. Other companies like Cathie wood Invest are buying BitMine shares too, since the stock prices are going up.

It’s possible that the profits company earns from its shares could be reinvested back into Ethereum, further strengthening this cycle.

Startegy’s CEO Micheal Saylor Bitcoin’s strategy follows the same rule. This method has made the Strategy to be the biggest Bitcoin holder with 632,457 Bitcoins.

Currently Bitcoin is trading at $112,759.94, and Michael Saylor sees Bitcoin as the buying opportunity for the BTC fans.

At the time of writing Eth is trading at $4,567.07 with a down of 0.55% seen in 24 hours, the Ethereum market is running down today, might be this price dip comes from stakers taking profits, technical resistance and capital shifting to altcoins.

But steady ETF inflows and institutional buying show strong fundamentals, while short-term traders are just cashing in on overbought conditions without deeper weakness.

Source: CMC

As per the data of SoSo Value the daily total ETF inflow is recorded at $81.25M, on August 25. And from the past 3-4 days the ETF inflows are showing positive signals, these ETFs inflows are boosting market confidence and on the other hand firm like Cathie wood Invest getting profits in stock market.

Source: SoSo value

Firm’s steady Ethereum buying is reshaping the market, boosting both ETH and its own shares. Cathie wood Invest (Ark Invest) big bet on BitMine shows growing confidence in this strategy. With ETFs gaining and institutions backing ETH, the cycle looks set to continue.

Akanksha is a dedicated crypto content writer with a strong enthusiasm for blockchain technology and digital innovation. With a growing footprint in the Web3 space, she specializes in turning intricate crypto topics into clear, engaging narratives that resonate with readers across all experience levels. Whether it's Bitcoin, emerging altcoins, DeFi platforms, or NFT trends, Akanksha delivers timely and insightful content that helps audiences stay informed in the ever-evolving crypto market. Her analytical approach, combined with a passion for decentralized finance, allows her to craft informative pieces that empower both new and experienced investors. Akanksha firmly believes in the transformative power of blockchain to reshape global systems and drive financial inclusion.