The wait around Celia mainnet verification is entering a decisive phase. After months of silence, the latest wallet update and roadmap signals suggest that the project's ecosystem is finally aligning toward a Q1 2026 rollout. With February already underway, market watchers are closely tracking how mainnet verification, migration, and the long-awaited Celia listing date connect in the coming weeks.

This is not a hype-driven move. It is a sequence-driven rollout: Wallet first, verification next, and launch at last.

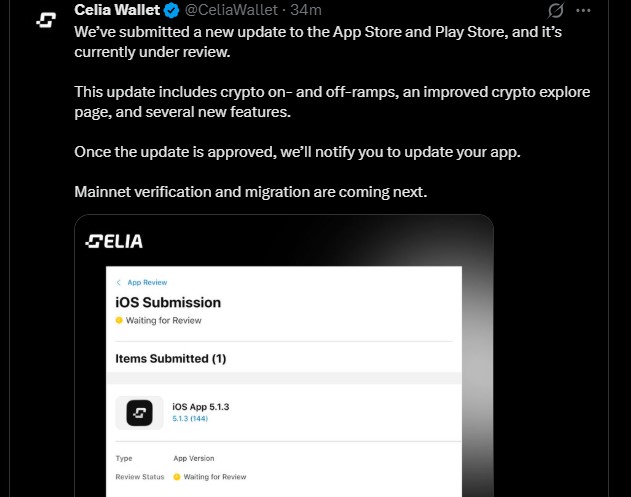

Celia Wallet has officially submitted a new update to both the App Store and Play Store, and it is currently under review. According to the team, this update introduces crypto on- and off-ramps, an improved cryptocurrency explore section, and several system-level upgrades designed to support 2026 TGE activity.

Once this update is approved, Celia mainnet verification and migration will begin. Any pending verifications will be reviewed and approved once users complete the required steps. This positions the wallet update as a technical preparation, not a cosmetic release.

The project’s roadmap clearly ties TGE identification to token migration. The first batch will include mined and airdropped tokens moving to the operational network. To support this, the team is improving the mainnet checklist to make onboarding smoother and reduce friction during verification.

As per the latest crypto news today, the total token supply is fixed at 800,000,000 tokens. Of this, 87.5% (700,000,000 coins) is allocated to the community through mining, airdrops, and staking. Contributors receive 2% (16,000,000 coins), while 10.5% (84,000,000) is reserved for CEX listings and marketing. Over the next five years, 350,000,000 tokens are scheduled for distribution.

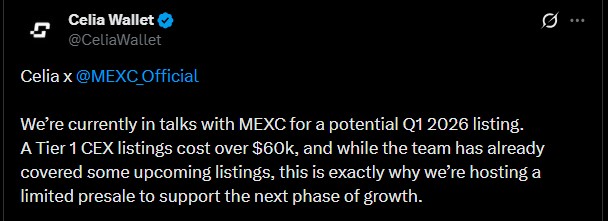

The project also conducted an early access presale at $0.20 per token, with instant distribution and a limited supply of 500,000 tokens. The presale ended successfully, and during that period, the team confirmed discussions with MEXC and BingX for a potential Q1 2026 listing date.

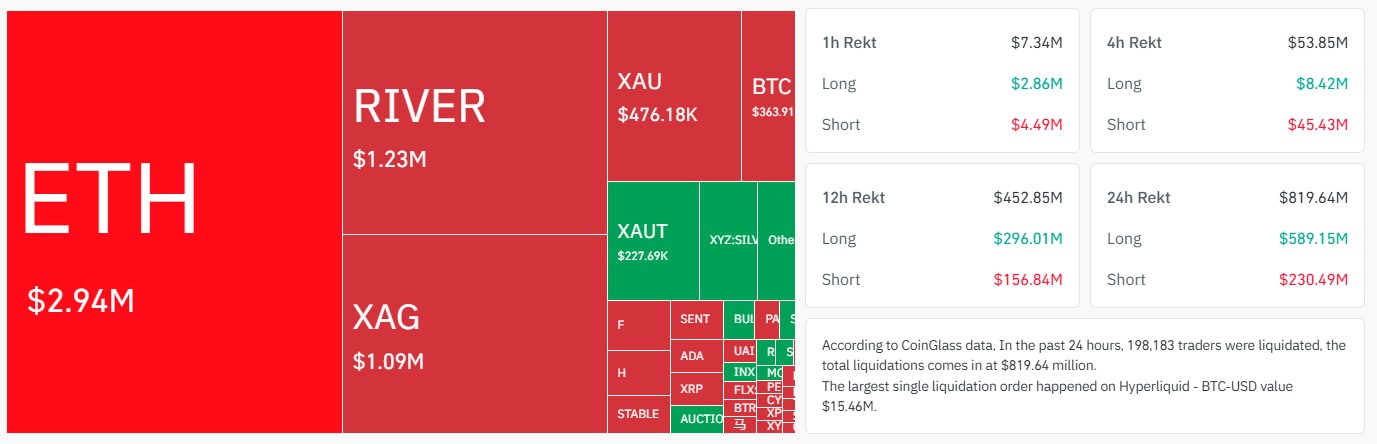

Despite strong internal progress, no fresh confirmation on the Celia listing date has been shared since December. This caution appears tied to broader market pressure. The total crypto market has dropped nearly 3.43%, while Bitcoin and Ethereum fell between 3% and 8% in a single day. Market sentiment has slipped into Extreme Fear at 14.

CoinGlass data shows 199,708 traders liquidated in the past 24 hours, with total liquidations reaching $823.40 million. The largest single order, a BTC-USD position worth $15.46 million, occurred on Hyperliquid. In such conditions, announcing a token launch strategy becomes significantly more complex for emerging projects.

Industry observers suggest that, based on Q1 timelines, the launch date may realistically fall between mid-March 2026 to Q2 extension possible, once wallet stability, verification, and migration updates are fully aligned.

The mainnet verification is no longer a distant promise but an active rollout phase. The next steps are clearly defined: smoother identification, phased migration, DEX and CEX listings, and full-scale wallet expansion.

While the Celia listing date remains unannounced, technical progress, and market timing suggest a disciplined early 2026 launch approach rather than rushed execution.

YMYL Disclaimer: This article is for informational purposes only. The crypto market is volatile, so always do your own research before investing.

Sara Sethiya is an experienced crypto journalist with five years of experience in blockchain research, price movements, and market analysis. With a background in mass communication and journalism, she specializes in data-driven news articles, in-depth market reports, and SEO-optimized content. As a team lead and content writer at CoinGabbar, she examines on-chain metrics, evaluates liquidity trends, and analyzes tokenomics to uncover market patterns. Her analytical approach helps traders and investors interpret market shifts, identify potential opportunities, and understand the broader impact of blockchain innovations on the financial ecosystem.