What looked like the next big Web3 Chainbase airdrop victory has suddenly turned into a chart-topping freefall. With top exchanges listing its $C token and early access windows already opening, here’s why this drop is turning serious heads across the Web3 industry.

Within hours, it crashed over 34%. What went wrong? Was it hype, sell pressure, or something deeper? Here’s what really happened—and what comes next.

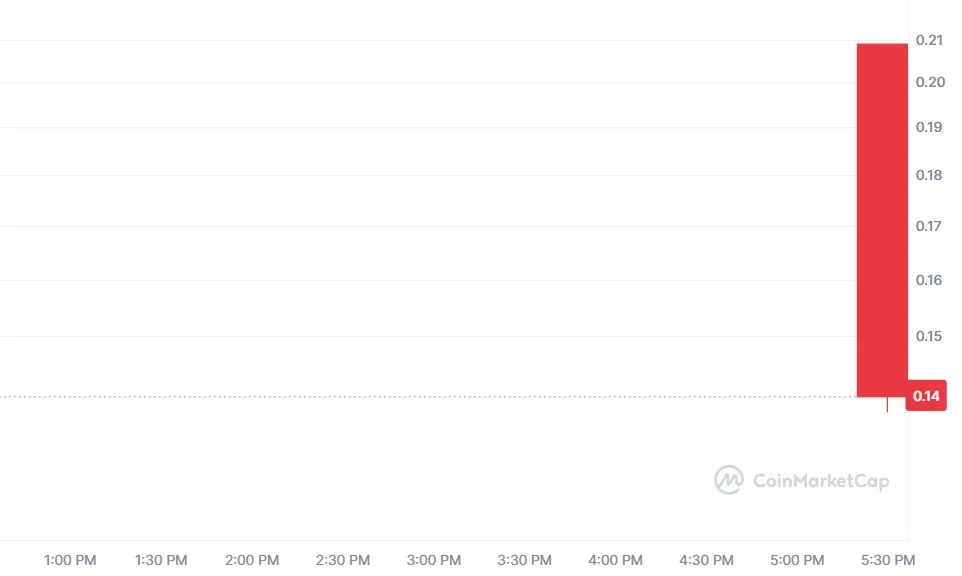

Today, the crypto market witnessed another classic pattern: $C, the native token, launched at $0.20, only to crash 34% within hours, now trading around $0.14.

Source: CoinMarketCap

Despite a multi-exchange listing on Binance, KuCoin, MEXC, and Bitget, and a strong early narrative around powering the DataFi economy, the price couldn’t sustain. The massive 24-hour trading volume of $525.5K (up 19,833%) shows just how many rushed in — and how quickly many rushed out.

According to its official team release on X, the eagerly anticipated Chainbase airdrop is now live, successfully setting off the DataFi revolution.

A total of 3.5% of the $C supply (35 million tokens) has been allocated to Season 1, distributed based on a contribution scoring system that evaluates real impact—not just wallet activity.

But here’s the catch:

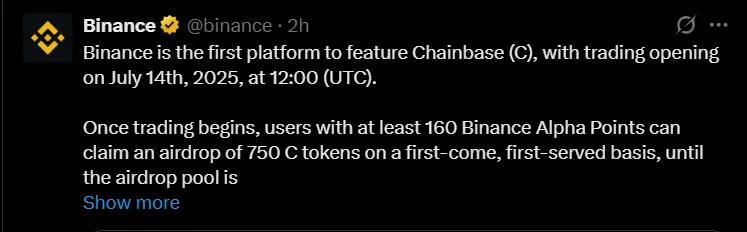

The token launched with 16% unlocked, and many users received free tokens via Binance Alpha Points, with 750 $C claimable per user. That created instant sell pressure from free coin hunters, not long-term holders.

While $C launched on some of the biggest crypto exchanges, including Binance at 5:30 PM IST. Even the Alpha Points-based airdrop on Binance—designed to drive user growth — may have backfired in the short term, as users rushed to sell tokens obtained for free.

Having covered many token listings, this strategic rollout across top exchanges ensures maximum liquidity, global exposure, but this price volatility is changing how everyone sees the coin potential.

The total supply of $C is 1 billion, with allocation designed for long-term sustainability:

40% – Ecosystem & Community

13% – Free rewards Incentives

12% – Worker Rewards

17% – Early Backers

15% – Core Contributors

3% – Liquidity

While only 16% was unlocked at launch, that’s still enough to drive high price volatility, especially with thousands receiving free tokens in a short time window.

Now that the initial hype has faded and $C is trading around $0.14, here’s what to expect next:

Short-Term: Expect more volatility in the $0.12–$0.16 range. As token distribution claims continue and more users sell, pressure may remain high.

Mid-Term: If it can demonstrate real utility for the Hyperdata Network and onboard actual projects, a slow recovery to $0.18–$0.20 is possible.

Long-Term: If the token finds product-market fit in the AI + DataFi sector, it could reclaim $0.25–$0.30 by Q4 2025. But that will require real ecosystem traction—not just exchange listings.

Yes, the Chainbase airdrop is legit, and the project has genuine long-term potential. But like many recent launches, hype without utility leads to instant dumps. If you claimed the coins, hold tight—or set realistic targets. If you missed it, this might be your second chance to enter at a more grounded valuation.

Keep an eye on how the crypto deploys its Hyperdata Network and whether $C finds real usage. Until then, Chainbase token price prediction will be driven by both speculation, and fundamentals.

Sara Sethiya is an experienced crypto journalist with five years of experience in blockchain research, price movements, and market analysis. With a background in mass communication and journalism, she specializes in data-driven news articles, in-depth market reports, and SEO-optimized content. As a team lead and content writer at CoinGabbar, she examines on-chain metrics, evaluates liquidity trends, and analyzes tokenomics to uncover market patterns. Her analytical approach helps traders and investors interpret market shifts, identify potential opportunities, and understand the broader impact of blockchain innovations on the financial ecosystem.