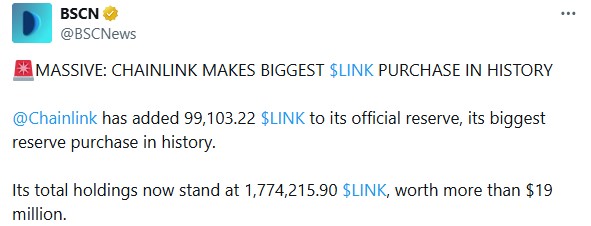

Chainlink, the decentralized oracle network, has created waves across the market with its largest $LINK purchase ever. On January 30, 2026, the network added 99,103.22 LINK tokens to its official reserve bringing the total accumulation to 1,774,215.90, worth more than $19 million according to current price. This purchase marks a major milestone for the Chainlink coin and the network’s growth.

Source: BSCN Official

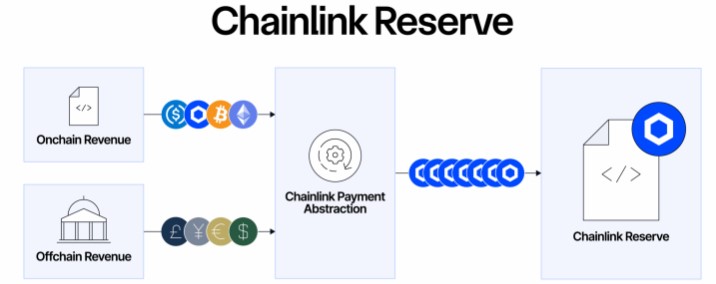

This purchase highlights the revenue-to-token conversion strategy, where coins are not directly bought from the open market to reduce supply immediately. Instead, it converts revenue generated from the in-platform's activity such as Oracle services, partnerships and data feeds into $LINKs.

Source: Official Blog

Around 90% of the recent purchase came from Uniswap swaps, with the remaining from direct LINK fees, showing an indirect buyback approach to strengthen network economics while reducing circulating supply.

Companies use reserve purchases to strengthen their networks sustainability and token economics. Here, Chainlink, by converting revenue into tokens, creates a growing treasury to fund ecosystem development, incentivize validators and support long-term infrastructure.

These purchases also reduce circulating supply without sudden market disturbance, potentially adding scarcity while acting as a subtle form of buyback. For the Chainlink LINK token, this presents that the platform is committed to long-term growth, aligning network revenue with the coin value.

Despite the record accumulation news, the token’s price remains under pressure, trading around $10.40–$10.50 at the time of writing. This is down roughly 3–4% in the last 24 hours aligning with its 14.15% weekly decline. The coin is also presenting the broader crypto market dynamics after 2025 highs.

However, analysts see the coin purchase as a bullish sign for the future. The reserve’s growth could support long-term price stability, especially if the platform expands adoption through real-world asset tokenization and institutional integrations.

While short-term volatility is likely, the news could strengthen confidence among investors in the coming months.

Chainlink’s largest token accumulation shows strategic accumulation, platform growth, and long-term coin scarcity. Some skeptics argue the buy is a routine fee conversion, others highlight its significance as a network-strengthening move, reinforcing trust in the tokenomics.

While the Chainlink coin's price may remain volatile short-term, this move strengthens confidence in the token and its future potential.

Disclaimer: This article is for informational purposes only; It does not provide any financial or legal advice.

Bhumika Baghel is a rising crypto content writer with a deepening interest in blockchain technology and digital finance. With a keen understanding of market trends and cryptocurrency ecosystems, she breaks down intricate subjects like Bitcoin, altcoins, DeFi, and NFTs into accessible and engaging content. Bhumika blends well-researched insights with a clear, concise writing style that resonates with both newcomers and experienced crypto enthusiasts. Committed to tracking price fluctuations, new project developments, and regulatory shifts, she ensures her readers stay informed in the fast-moving world of crypto. Bhumika is a strong advocate of blockchain’s potential to drive innovation and promote financial inclusion on a global scale.