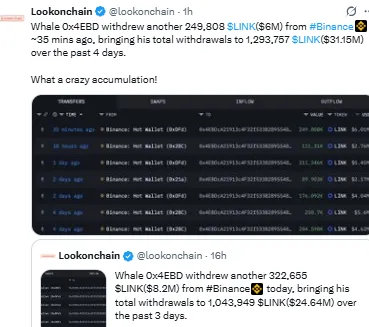

As reported by the Lookonchain, Chainlink Whale has been causing a stir in the crypto space with some large withdrawals from Binance.

In the latest transaction, the wallet address 0x4EBD withdrew 249,808 LINK worth approximately $6 million in one transaction.

This takes his overall haul to an enormous 1,293,757 LINK, worth over $31.15 million, all in four days.

Source: Lookonchain

Earlier, this same address had withdrawn 322,655 LINK ($8.2 million), sending his balance past one million tokens.

Such relentless accumulation has already become the talked about subject in the crypto community, with traders questioning whether these actions indicate a wider price movement for LINK.

Huge LINK withdrawals like this usually indicate whales transferring tokens to cold storage instead of holding them on exchanges.

This is typically an indication of long-term belief, not short-term speculation.

By taking coins off of exchanges, whales also withdraw from the liquid supply, which can pave the way for supply pressure down the line.

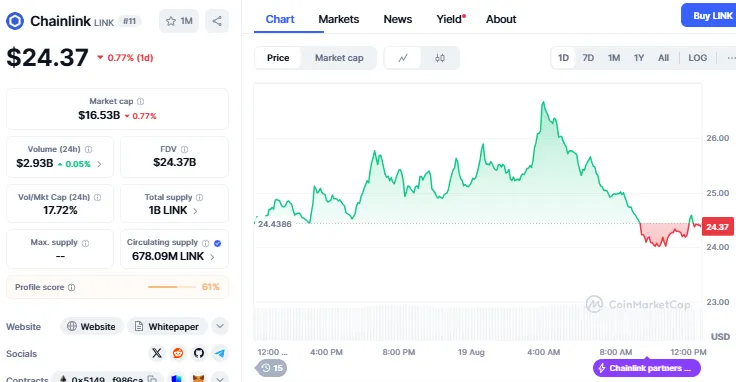

The latest Chainlink Whale activity comes as the currency trades at $24.37, down 0.77% over the past day.

Source: CoinMarketCap

Nevertheless, it remains up over 13% in the last week and close to 30% in the last month.

The minor dip is largely attributable to a wider crypto correction, with Bitcoin and Ethereum undergoing almost $500 million in liquidations.

Meanwhile, profit-taking has also accelerated after some of the large investors locked in profits following the altcoin reaching a six-month high at around $27.

What makes these whale transactions more compelling is how they fit with broad-brush confidence in this project as major infrastructure.

The 0x4EBD wallet's $31 million four-day haul replicates what venture capital funds tend to do, acquiring infrastructure assets over applications in risky markets.

During bear cycles, infrastructure ventures such as Chain-link tend to be regarded as safer longer-term bets.

To this, in another Chainlink news, has also just signed a significant deal with Intercontinental Exchange (ICE). This aggregates foreign exchange and precious metals information from more than 300 worldwide exchanges into the network.

For institutions, asset managers, and banks, this translates to trusted information for tokenized assets and DeFi products. Such actions demonstrate why whales might be gearing for the long term instead of seeking quick trades.

Short-Term

Bear Case: In the near term, LINK meets with resistance at $25.62. If its price declines below $24.03, it may test support at $22.39.

Bull Case: On the higher side, a breakout above $25.62 with high volume might drive it to $29.

Long-Term

In the longer term, Project's Cross-Chain Interoperability Protocol (CCIP) and increasing involvement in the tokenization of RWAs may underpin steady demand.

With tokenized markets to reach $30 trillion by 2030, LINK's status as the "rails" of on-chain finance appears secure.

The long-term price prediction 2025, indicates a target of $50 for LINK price, due to whale accumulation and institutional buy-in.

Source: X (Previously Twitter)

Some analysts also suggest a target of reaching $47, near $50. While the currency breaks this, it might go up to $88.

Continuous Chainlink Whale accumulation confirms this perspective, despite short-term volatility.

The recent Chainlink Whale moves feature a combination of market conviction and smart accumulation strategies.

By transferring tokens off exchanges, whales constrict supply and demonstrate faith in altcoin's position as essential infrastructure for global finance.

If it remains above $24 and demand keeps rising, a move towards $50 might arrive before long.

Muskan Sharma is a crypto journalist with 2 years of experience in industry research, finance analysis, and content creation. Skilled in crafting insightful blogs, news articles, and SEO-optimized content. Passionate about delivering accurate, engaging, and timely insights into the evolving crypto landscape. As a crypto journalist at Coin Gabbar, I research and analyze market trends, write news articles, create SEO-optimized content, and deliver accurate, engaging insights on cryptocurrency developments, regulations, and emerging technologies.