Over the past 24 hours, the cryptocurrency market has faced intense selling pressure. Bitcoin’s value dropped by 8.80%, trading near $93,200, while Ethereum recorded a substantial 15% decline, landing around $3,150. Leading altcoins, including Solana, Cardano, and XRP, also registered double-digit losses, signaling widespread bearish sentiment.

Federal Reserve Chair Jerome Powell’s recent comments hinting at a slower pace of interest rate reductions in 2025 coincided with Bitcoin’s downturn. Concurrently, U.S. Bitcoin ETFs witnessed a hefty net outflow of $680 million after 15 consecutive days of inflows. Major institutions like Fidelity and Grayscale made significant withdrawals, amplifying uncertainty.

El Salvador, the pioneering nation to legalize Bitcoin as tender, has agreed to alter its Bitcoin policies under a $1.4 billion loan agreement with the International Monetary Fund (IMF). This political and economic move has further contributed to Bitcoin’s recent slump.

Despite the market’s downward trajectory, the Fear and Greed Index surprisingly remains in ‘Greed’ territory. While some investors maintain a bullish outlook, Bitcoin’s week-long slide of 4.8%—breaking critical support levels between $94,500 and $94,000—suggests a more cautious stance. The next significant support range for Bitcoin is now at $91,500-$90,500.

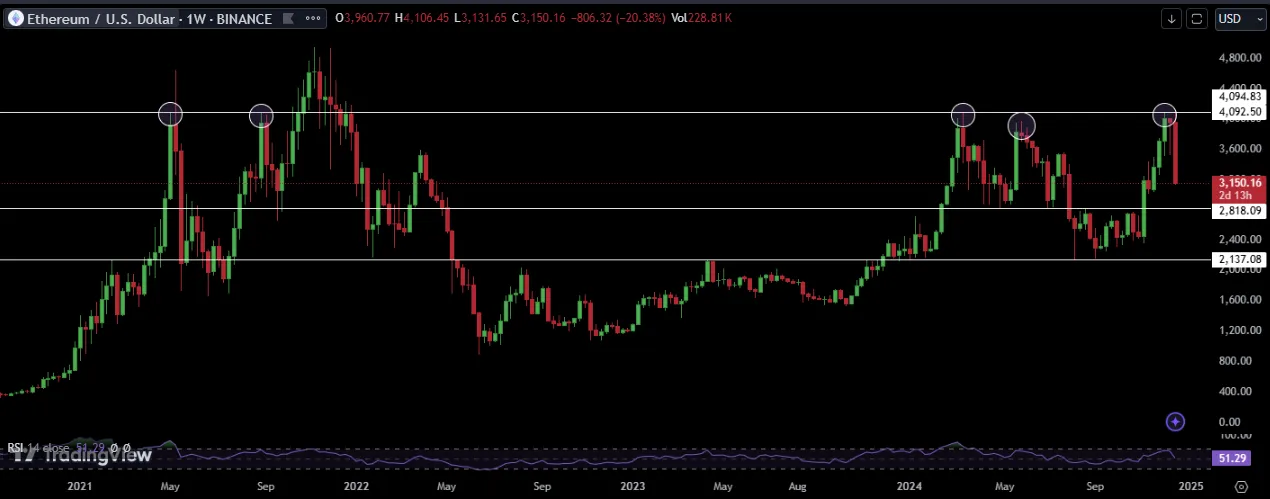

Ethereum’s failure to breach the longstanding $4,000 weekly resistance—tested multiple times since 2021—led to a steep decline below crucial support levels at $3,550 and $3,200. With prices trending toward the $3,000-$3,050 zone, holding this range could present a viable buying opportunity. A sustained defense at $2,800 is critical for Ethereum’s near-term recovery.

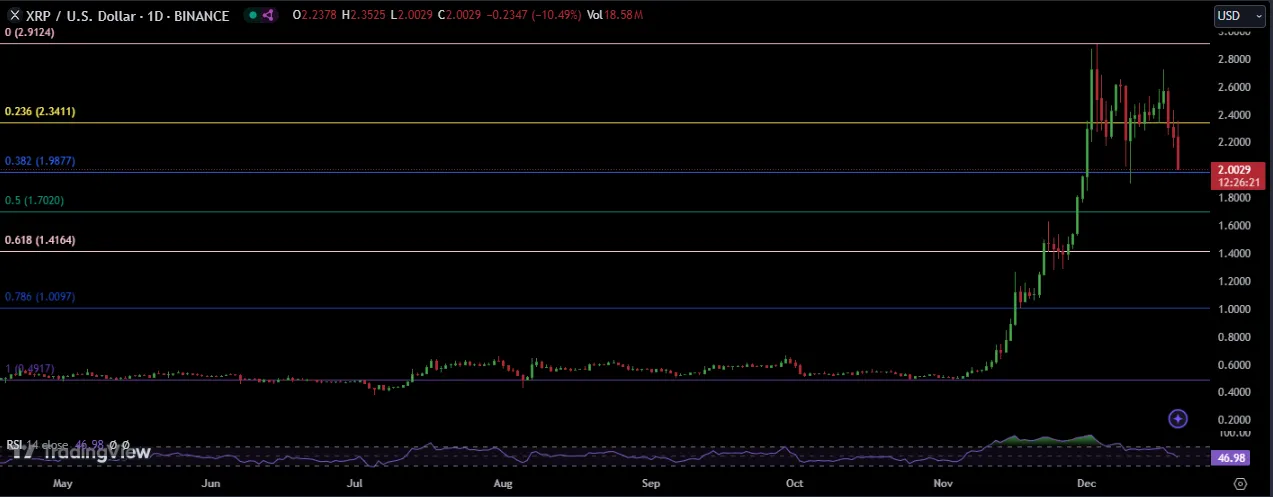

XRP encountered strong resistance at the psychological $3.00 mark and has since retraced to the $2 support level, aligning with the 38.20% Fibonacci retracement. If bullish traders protect this support, XRP could potentially aim for a new all-time high, driven by renewed momentum and positive market sentiment.

Solana’s price action has turned bearish following the Federal Reserve’s hawkish policy indications. Over the past month, Solana has been confined within a falling wedge pattern. Recently, it broke below the critical $200-$185 support zone and now trades around $176—a 16% dip influenced by broad market sell-offs, declining total value locked (TVL), and reduced on-chain participation. If bulls can hold the $165 level, Solana may rebound, potentially targeting the $200-$250 price range in the near term.

The crypto market remains in flux, with traders closely monitoring key support and resistance levels to navigate the ongoing volatility.

Lokesh Gupta is a seasoned financial expert with 23 years of experience in Forex, Comex, NSE, MCX, NCDEX, and cryptocurrency markets. Investors have trusted his technical analysis skills so they may negotiate market swings and make wise investment selections. Lokesh merges his deep understanding of the market with his enthusiasm for teaching in his role as Content & Research Lead, producing informative pieces that give investors a leg up. In both conventional and cryptocurrency markets, he is a reliable adviser because of his strategic direction and ability to examine intricate market movements. Dedicated to study, market analysis, and investor education, Lokesh keeps abreast of the always-changing financial scene. His accurate and well-researched observations provide traders and investors with the tools they need to thrive in ever-changing market conditions.

3 months ago

Crypto market trends

3 months ago

Bitcoin market trends

3 months ago

Crypto market trends

3 months ago

Cryptocurrency trading news

3 months ago

Blockchain updates

3 months ago

DeFi news updates

3 months ago

Best crypto news sources

3 months ago

Blockchain updates

3 months ago

News on crypto lending

3 months ago

News on crypto regulations