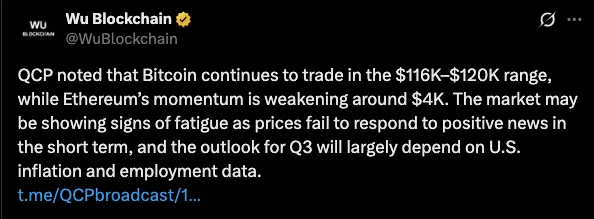

Despite a wave of encouraging developments, the crypto market appears to be losing momentum. Bitcoin remains locked in a tight trading range between $116K and $120K, showing limited upward movement. Ethereum is also experiencing a slowdown, struggling to maintain strength near the $4K mark.

Analysts at QCP have observed that the markets failure to react positively to news may signal investor exhaustion. Short-term enthusiasm seems to be waning, which could reflect broader uncertainty.

Market watchers suggest that upcoming U.S. economic indicators especially inflation and job data, will play a crucial role in shaping the third-quarter outlook.

Source: tweet

Volatility continues to elude the crypto market, with Ethereum struggling and Bitcoin locked in a tight trading range. Despite attempts at recovery, major digital assets remain sensitive to broader macroeconomic indicators.

Investors are treading carefully, awaiting pivotal developments that could either restore confidence or extend the current stagnation.

Following a sharp downturn triggered by massive Bitcoin transfers last week, the crypto market briefly regained momentum. Investor sentiment stabilized as total market capitalization rose, but the rebound lacked strength. As of Monday, the total crypto market cap stood at \$3.87 trillion, registering a slight 0.3% daily increase. However, this uptick has since reversed, with a 0.7% decline observed over the last 24 hours.

Bitcoin experienced a notable dip, falling below $117,000 on Tuesday before rebounding above $118,200 during Wednesday’s European session. Despite this modest recovery, Bitcoin continues to face strong selling pressure near the $119,000 mark.

Traders are closely watching the $116,000 to $120,000 price range, viewing it as a critical zone that could determine the asset’s near-term direction. Analysts warn of potential false breakouts and stress the importance of waiting for confirmed consolidation outside this range.

At the same time, Ethereum is also in decline. Its non-reaction to the bullish news is another indicator of its cooling-off time.

According to markets participants, the increasing influence of institutional investors is the cause of this behavior, as institutional investors sometimes implement the same strategies that tend to be more traditional according to financial standards.

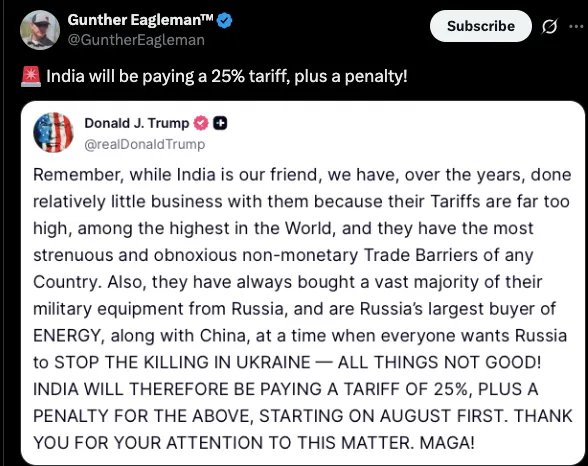

To make the situation even more unpredictable, the geopolitical tensions have been re-emerging. Trump has recently made harsh remarks on India in regard to its economy. He condemned its military relations with Russia and pledged to slap 25 percent duties on the Indian imports.

Moreover, Trump offered massive reductions in foreign aid that involved a 75% reduction of funding, a 50%cut on budget of State Department, ceasing aid to NATO, and more than 20 international institutions.

Source: X

To sum up, the crypto markets is coming to be indicatively inaudible against upbeat data, as investors increasingly feel cautious. Largely uncertain is the direction of the markets amidst major macroeconomic and geopolitical moves likely coming up, which now largely depends on the external driver such as decisions by the Fed and global economic clues.

Sara Sethiya is an experienced crypto journalist with five years of experience in blockchain research, price movements, and market analysis. With a background in mass communication and journalism, she specializes in data-driven news articles, in-depth market reports, and SEO-optimized content. As a team lead and content writer at CoinGabbar, she examines on-chain metrics, evaluates liquidity trends, and analyzes tokenomics to uncover market patterns. Her analytical approach helps traders and investors interpret market shifts, identify potential opportunities, and understand the broader impact of blockchain innovations on the financial ecosystem.