Crypto News, 11 March:BTC Hits $72,600, ETH Surpasses $4,000

- The US Federal Reserve is scheduled to convene next week to determine interest rates, while focus now turns to the Bureau of Labor Statistics' release of February 2024 CPI data.

- Bitcoin is trading above $71,000, with Ethereum surpassing $4,000 in value

- The overall cryptocurrency market has experienced a 4.90% increase, reaching a total market capitalization of $2.85 trillion

Crypto currency market surged 4.90%, hitting $2.85 trillion

The cryptocurrency market demonstrates optimism as Bitcoin approaches $72,000, while Ethereum remains steady above $4,000.

Upcoming weeks feature key central bank updates from the Fed, Bank of Japan, and Bank of England, with a focus on CPI data, Unemployment Claims, and Core Retail Sales.

Major Events To Watch

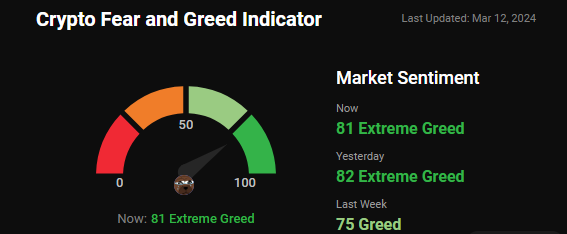

Crypto Fear and Greed Index:

Despite the 'Fear and Greed Index' surging to an exceptionally high level of 81 out of 100, signaling widespread market optimism in the recent day.

Latest Market Update:

#Bitcoin surpassed the $72,000 threshold early Tuesday, later consolidating above $70,000.

#Ethereum ($ETH) also reached the $4,000 milestone and displayed stability in its price.

Other altcoins such as #Dogecoin ($DOGE), #Ripple ($XRP), #Solana ($SOL), and #Binance Coin ($BNB) experienced gains.

#Toncoin ($TON) emerged as the top gainer, recording a significant 24-hour increase of nearly 25 percent.

Conversely, Memecoin #dogwifhat ($WIF) experienced the largest decline, with a 24-hour dip of nearly 7 percent.

Total crypto market volume over the last 24 hours stands at $165.66 billion, reflecting a notable increase of 41.30%.

DeFi's total volume currently amounts to $13.56 billion, constituting 8.19% of the overall crypto market's 24-hour volume.

The volume of all stable coins has reached $149.47 billion, representing a significant 90.22% of the total crypto market's 24-hour volume.

Bitcoin's dominance currently sits at 52.00%, marking a slight increase of 0.05% compared to the previous day.

Major Worldwide News Update:

The US Federal Reserve convenes next week to determine monetary policy. Attention now shifts to February's US CPI numbers, set for release today by the Bureau of Labor Statistics. January's inflation data surprised with a 3.1% annual rate (0.3% month-on-month), slightly higher than the expected 2.9%. Market anticipates a mixed outcome for February, with 3.1% for CPI and 3.7% for core inflation.

In early January 2024, the launch of spot Bitcoin ETFs marked a milestone, amassing $55 billion in assets with trading volume exceeding expectations. Fidelity’s FBTC and BlackRock’s IBIT led performance. Market positivity reflects growing confidence in cryptocurrencies. Attention now shifts to potential Ethereum ETFs, with Hong Kong possibly leading the way.

Bitcoin's dominance slips to 48% as altcoins surge. Ethereum dominance stands at 17%. Stablecoins gain 5% dominance. Market liquidity spreads to altcoins. Stablecoin supply rises, boosting altcoin liquidity. Positive market outlook expected to boost valuations. Bitcoin anticipates ETF inflow and halving event. Ethereum's DenCun Upgrade could drive demand.

Blackrock hires GSR analyst Matt Kunke as Digital Assets Product Strategist, focusing on improving crypto ETF offerings. Kunke's appointment coincides with Ethereum ETF anticipation. Market uncertainty persists as SEC delays decisions. Blackrock strategizes to maintain leadership, with IBIT's success setting high expectations.

VanEck intensifies its spot Bitcoin ETF strategy with a significant sponsor fee reduction, offering fee-free investment until March 31, 2025. The move aims to attract new investors and stay competitive. If assets exceed $1.5 billion, a nominal 0.20% fee applies. This offer aligns with VanEck's commitment to investor-friendly terms amid Bitcoin's soaring prices.

President Biden's budget proposal targets digital asset regulations to tap into the market's potential revenue. Measures include wash trading rules, a crypto mining tax, and closing tax loopholes. The plan aims to generate $10 billion by 2025, with long-term projections exceeding $42 billion.

The imminent Ethereum Dencun upgrade promises reduced gas costs and improved scalability for Layer 2 platforms. Ethereum's gas cost may stabilize at $18.75, while others like Arbitrum and Optimism anticipate significant drops. This upgrade heralds cost efficiency enhancements, driving anticipation within the cryptocurrency community.

COIN GABBAR Views: Is the soaring open interest in Bitcoin futures a warning sign for BTC's price? With BTC surpassing $72K, are bulls eyeing even higher targets? Might Ethereum follow suit as Bitcoin reaches unprecedented highs? Is it possible for Bitcoin's price to surpass the $100K mark post-halving? To get latest news Stay tuned us at coingabbar

Disclaimer: Coingabbar's guidance and chart analysis on cryptocurrencies, NFTs, or any other decentralized investments is for informational purposes only. None of it is financial advice. Users are strongly advised to conduct their research, exercise judgment, and be aware of the inherent risks associated with any financial instruments. Coingabbar is not liable for any financial losses. Cryptocurrency and NFT markets could be highly volatile; users should consult financial professionals and assess their risk tolerance before investing.

Also Read: Crypto News Today,11 March: Bitcoin Tops $72K for First Time