The global decentralised market is showing red signals today. According to the data of CoinGeckoAs of now the total crypto market stands at $3.94 trillion a 0.4% low recorded in the last 24 hours. While the trading volume of the market is $148 billion.

As per the data of CoinMarketCap, at the time of writing, Bitcoin is trading at $115,014 and running down today by 0.29%, Ethereum is trading at $4,236.32 with a downfall recorded in a day of 0.86%, whereas Solana at $179.93 with a down of 0.55%.

The recent dip in the crypto is not random but is is closely tied to global economic events The following below mentioned reasons could be the possible reasons of system facing downfall these days:

Jackson Hole Economic Symposium (Aug 21-23):- Fed Chair Jerome Powell’s upcoming speech has put the traders on edge. If he wants to lower the interest rate, which is 4.25% to 4.5% then the Crypto world will see a high surge in the prices. If he supports cuts then it could bring more liquidity into decentralised world.

Recently, Trump and Putin meeting in Alaska was expected to be a discussion for the Russia-Ukraine war, but no outcome like it has been seen. Fear, uncertainty, and global economic ripple effects from the war are pressuring Bitcoin, Ethereum, and altcoins, pushing prices down.

Ongoing court reviews of Trump-era tariffs are creating trade uncertainty that is making investors cautious. This fear is pressuring BTC, ETH and other cryptocurrencies adding to the recent drop.

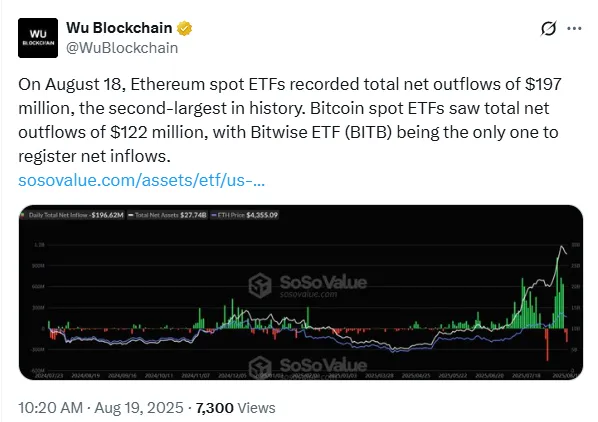

As on August 18, Ethereum ETFs recorded a total net outflows of $197 million and Bitcoin ETFs showed a total outflow of $122 million.

September Fed Meeting (Sept 16-17):- The two day FOMC meeting, less jobs could add pressure to ease the rates. Now pricing a 61% chance of a 25bps cut. Since Ethereum and Bitcoin are moving high correlation with US equities, stock market sentiment will directly influence prices.

Source: X

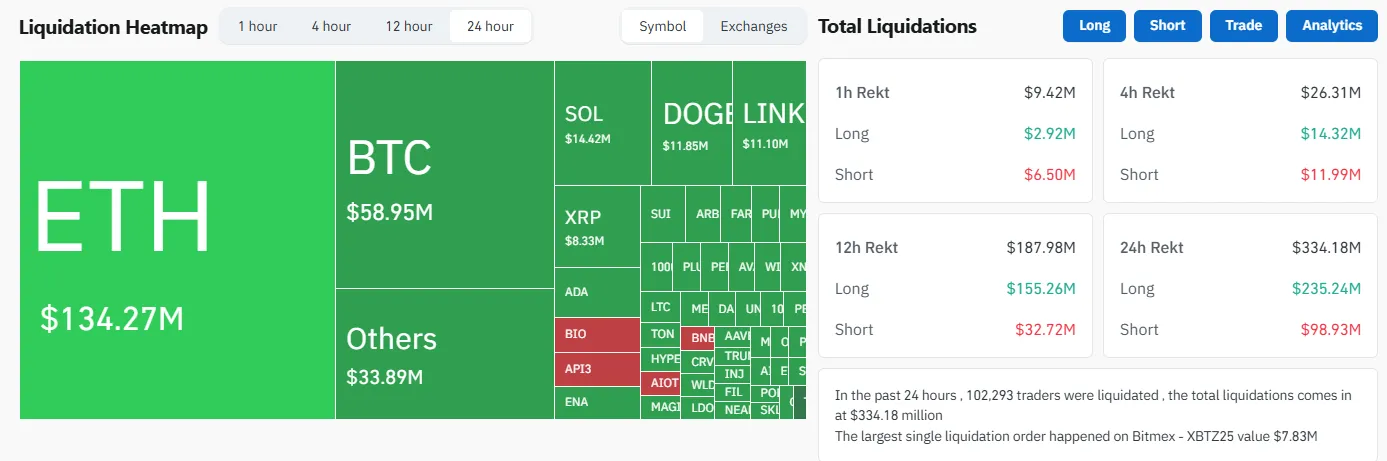

In the past 24 hours the digital asset market saw a total of $334.18 million in liquidations impacting 102,293 traders.

Ethereum suffered the most at $134.27million, followed by Bitcoin at $58.95M, Solana $14.42M, Dogecoin $11.85M and Chainlink $11.10M.

The long positions dominated with $235.24million while shorts accounted for $98.93M. The largest single liquidation was on Bitmex for $7.83M. This shows the high leverage and short-term volatility across major cryptocurrencies.

Source: Coinglass

As the Crypto Fear and Greed Index is showing 56 that is indicating mild greed and people are slightly confident in the decentralised world. As compared to the previous data the greed was higher yesterday at 60, last week it was 68 and last month it was 72.

So, while traders are still optimistic the excitement has slightly cooled down over the past month.

Source: Alternativeme

The decentralised world is facing a temporary dip due to global economic uncertainty and ETF outflows. However mild optimism among the traders suggests a potential recovery could be on the horizon.

Akanksha is a dedicated crypto content writer with a strong enthusiasm for blockchain technology and digital innovation. With a growing footprint in the Web3 space, she specializes in turning intricate crypto topics into clear, engaging narratives that resonate with readers across all experience levels. Whether it's Bitcoin, emerging altcoins, DeFi platforms, or NFT trends, Akanksha delivers timely and insightful content that helps audiences stay informed in the ever-evolving crypto market. Her analytical approach, combined with a passion for decentralized finance, allows her to craft informative pieces that empower both new and experienced investors. Akanksha firmly believes in the transformative power of blockchain to reshape global systems and drive financial inclusion.