The U.S. SEC has once again delayed its statement on proposed crypto exchange-traded funds (ETFs), emphasising on altcoins, XRP and Dogecoin. These delays are part of a broader trend where the commission uses the full time allowed under law to carefully review applications.

The delay in decision has affected three major proposals:

Grayscale Dogecoin

21Shares Core XRP ETF

Grayscale XRP

These ETFs help traders access XRP and Dogecoin without taking ownership of the currency. Approval would allow them to be listed on main American stock exchanges, Arca if through Grayscale and Cboe if through 21Shares.

Each ETF would consider particular price indexes. For instance, Dogecoin by Grayscale would follow the Price Index of this particular coin by Coindesk. On the other hand, the XRP would consider the XRP Price Index by the same platform.

In filings published Tuesday, the SEC announced it was “instituting proceedings” to further review the proposals. This move does not need to be considered as a rejection. It gives the commission more time to assess whether these ETFs follow rules under Exchange Act Section 6(b)(5). It makes sures that markets are fair, prevent fraud, and safeguard investors’ interest.

The commission is now requiring the public to share insights on the ETF proposals. Public will have 21 days from the point of publication in the Federal Register to submit respective comments. Rebuttals are allowed within 35 days. This input from the public is a general part of the ETF review procedure.

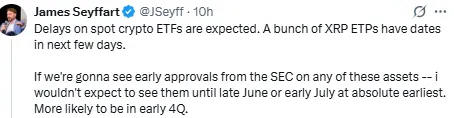

ETF analyst James Seyffart from Bloomberg Intelligence said that these kinds of delays are expected. According to him, the SEC usually takes the full 240-day window for a decision. While some are hopeful for early approvals, Seyffart noted that such fast-tracking is rare.

"All of these filings have final dates for decision in October. Early decisions would be out of the norm,” Seyffart said on X (formerly Twitter). He added that even if the current SEC leadership is more crypto-friendly, delays are still likely due to the cautious legal process.

Source: James Seyffart

Source: James Seyffart

In addition to these two ETFs, the SEC has also delayed decisions on two Solana (SOL) ETF proposals from 21Shares and Bitwise. Like the others, these are now under extended review as the commission opens proceedings to determine if they meet all legal requirements.

This follows another recent delay involving Bitwise’s Ethereum ETF, which includes a staking feature. The SEC is still considering whether that setup aligns with regulatory standards.

While the SEC approved spot Bitcoin ETFs in January and recently gave the green light to Ethereum ETFs, it’s still being very cautious with altcoin-based funds. This includes products based on XRP, Dogecoin, Solana, and others like Cardano and Litecoin.

For now, corporate organisations and investors are required to wait till Quarter 3 or Quarter 4 of 2025 for a final statement. The bunch of pending applications demonstrates strong interest, but approval deadlines remain unclear.

Still, industry experts say this could be a step toward broader crypto Exchange Traded Funds adoption in the future.

Muskan Sharma is a crypto journalist with 2 years of experience in industry research, finance analysis, and content creation. Skilled in crafting insightful blogs, news articles, and SEO-optimized content. Passionate about delivering accurate, engaging, and timely insights into the evolving crypto landscape. As a crypto journalist at Coin Gabbar, I research and analyze market trends, write news articles, create SEO-optimized content, and deliver accurate, engaging insights on cryptocurrency developments, regulations, and emerging technologies.