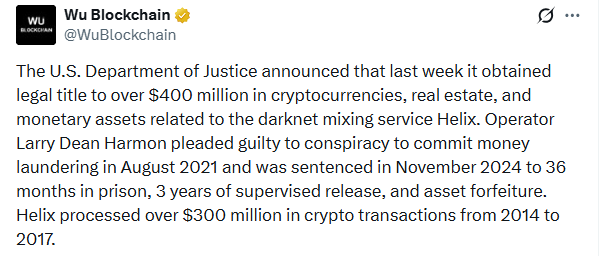

In a landmark conclusion to a long-running case, the United States Department of Justice (DOJ) announced on January 29, 2026, that it has officially obtained legal title to over $400 million in assets. These funds are linked to the notorious Helix Darknet Mixer, a service once used by cybercriminals to hide their tracks. The forfeiture, finalized by a federal court order on January 21, includes a massive haul of cryptocurrencies, high-end real estate, and various bank holdings. This news marks a major victory for federal authorities in their fight against the digital infrastructure that supports online crime.

Source: X(formerly Twitter)

Source: X(formerly Twitter)

The Helix Darknet Mixer was a go-to "tumbling" service between 2014 and 2017. It served as a primary hub for drug dealers and hackers looking to "clean" their money. According to court records, the service moved at least 354,468 Bitcoin, which was worth about $311 million at the time. However, because the value of digital assets has skyrocketed over the years, the seized property is now worth much more. This makes it one of the largest asset recoveries in the history of the Justice Department.

The man behind this operation, Larry Dean Harmon, pleaded guilty to money laundering back in 2021. After years of legal battles, Harmon was sentenced in November 2024 to 36 months in prison. Along with jail time, he was ordered to give up all the property he bought with his illegal earnings. Investigators found that Harmon actually designed the Helix Darknet Mixer to connect directly with darknet drug markets, making it incredibly easy for criminals to move money without being caught.

To understand why this forfeiture is such a big deal, you have to look at how a Helix Darknet Mixer actually functions. It wasn't just a simple privacy tool; it was a engine built specifically to hide where money was coming from.

Mixing Funds: The service took Bitcoin from many different people and threw it all into one big digital "pot."

Breaking the Trail: It then sent that money through thousands of small, confusing transactions to make it impossible to follow.

Payout: Finally, it sent "clean" coins to the user's new address, taking a 2.5% fee for the service.

This case shows a major shift in how the government handles crypto crime in 2026. While officials are becoming more friendly toward legitimate crypto businesses, they are coming down harder than ever on "laundering hubs."

Experts believe the government's ability to track these funds even years after the service closed sends a clear warning to other criminals. By taking legal ownership of these millions, the U.S. removes the "paycheck" for running these illegal services. It also shows that working with international partners, like the government of Belize, means there are fewer places for cybercriminals to hide their wealth.

Yash Shelke is a crypto news writer with one year of hands-on experience in covering cryptocurrency markets, blockchain technology, and emerging Web3 trends. His work focuses on breaking crypto news, token price analysis, on-chain data insights, and market sentiment during high-volatility events.

With a strong interest in DeFi protocols, altcoins, and macro crypto cycles, Yash aims to deliver clear, data-backed, and reader-friendly content for both retail investors and seasoned traders. His analytical approach helps readers understand not just what is happening in the crypto market, but why it matters.