Stablecoins can increase the dollar's influence in digital banking and support its global domination. The GENIUS Act is a wise move that will establish the United States as a pioneer in the development of digital assets. Crypto traders frequently utilize stablecoins, a kind of cryptocurrency that is intended to keep a steady value, usually linked 1:1 to the US dolla, to transfer money between tokens.

In his tweet on Wednesday, Bessent stated that "crypto is not a threat to the dollar" and described digital assets as "one of the most important phenomena in the world right now" that have been "ignored by national governments for far too long."

Source X

Treasury Secretary Scott Bessent said in an interview that "these can reinforce USD supremacy," pushing back against opponents who see cryptocurrency as a danger to America's currency power, as President Trump encouraged Congress to expedite momentous legislation.

He also stated that "Stable coins could end up being one of the largest buyers of U.S. treasuries or T-bills," describing how a user of a dollar-backed stablecoin in Nigeria could conduct transactions without actually owning actual US currency.

Bessent stated, "I think there's a very good chance that crypto is actually one of the things that locks in US Currency supremacy," pointing out that the Biden administration attempted to "make it extinct" rather than welcome innovation.

US President Donald Trump has asked the House to approve the Guiding and Establishing National Innovation for USDC Act as soon as possible so that he can sign it into law. He wants to accelerate the adoption of stable coins to promote Digital assets. The GENIUS Act has the potential to serve as a link between a digitally strengthened dollar and traditional financial dominance, making stablecoins a long-term economic pillar.

Source X

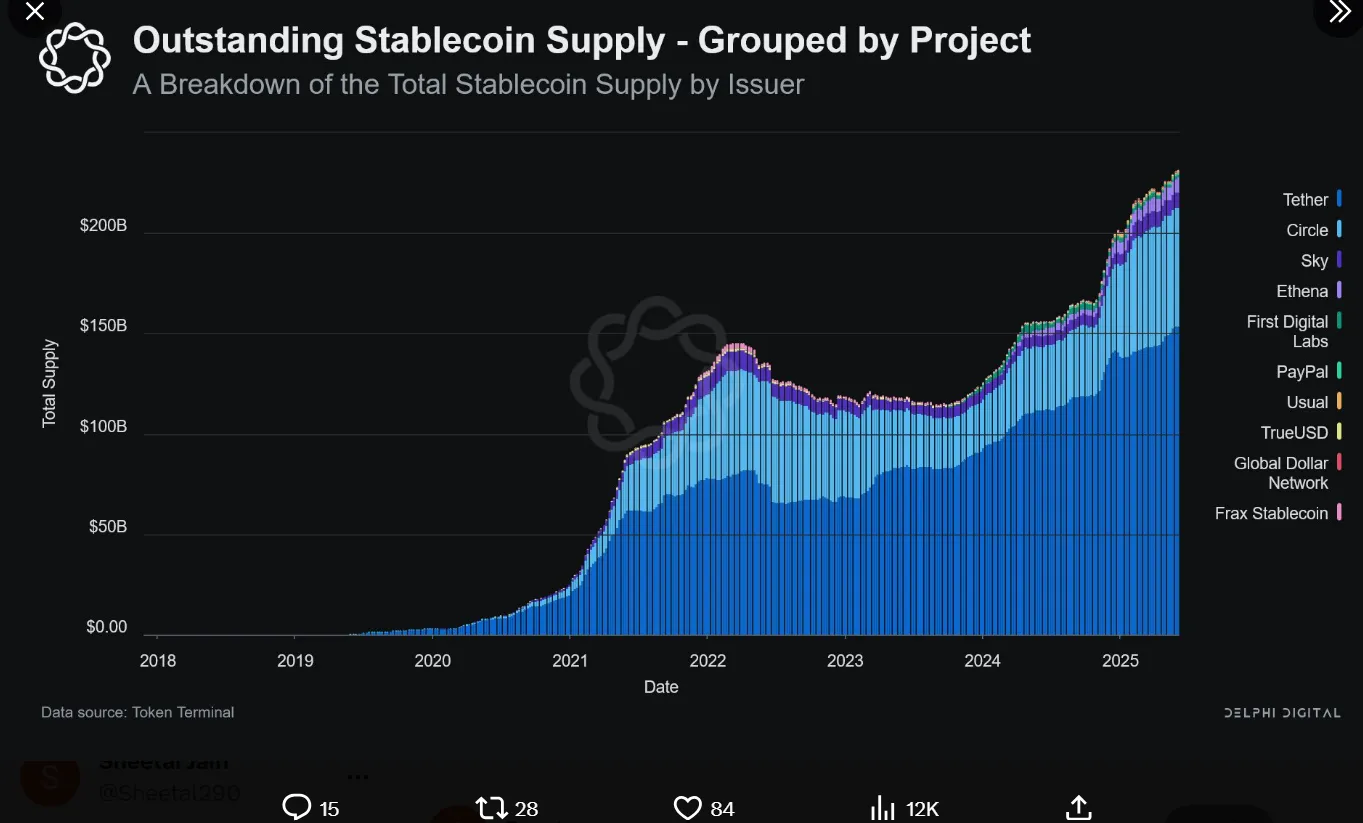

Stable coins with high yields are expanding quickly. Since its inception, Ethena has expanded to about $6 billion. Tether and Circle continue to hold a combined 86% of the outstanding supply. The diversity of issuers is growing. More than ten stablecoins are currently worth over $100 million. Stable coins are a liquidity sink outside of regular markets, holding more than $120 billion in the U.S. Treasuries. Compared to 2022, the market appears considerably different.

Source X

Global currency values and the international financial scene could be impacted by stablecoins in a number of ways, particularly those that are based on significant fiat currencies like the US currency:

1. Increased Demand for Reserve Currencies: Since the great majority of stable coin are currently based on the US dollar, their widespread use could boost demand for USD and the assets that support them, such as Treasury bonds, thus solidifying the dollar's position as the primary reserve currency.

2. Enabling Cross-Border Payments: When compared to conventional ways, stable coins provide a quicker and more affordable means of sending money internationally. Remittances and international trade may become more efficient as a result.

Stable coins may become more widely used as a means of exchange as a result, which could have an effect on foreign exchange markets and the relative worth of conventional currencies.

Sheetal Jain is a seasoned crypto journalist, content strategist, and news writer with over three years of experience in the cryptocurrency industry. With a strong grasp of financial markets, she specializes in delivering exclusive news, in-depth research articles and expertly optimized on-page SEO content. As a Crypto Blog Writer at CoinGabbar, Sheetal meticulously analyzes blockchain technologies, cryptocurrency trends and the overall market landscape. Her ability to craft well-researched, insightful content, combined with her expertise in market analysis, positions her as a trusted voice in the crypto space.