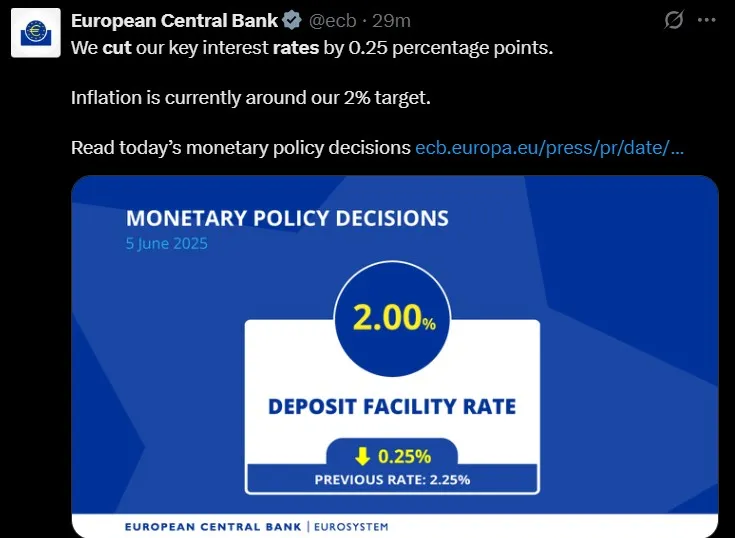

The ECB rate cut decision 2025 is now official. On June 5, the European Central Bank lowered all three of its key interest rates by 25 basis points. The deposit facility is now at 2.00%, refinancing operations at 2.15%, and the marginal lending interest at 2.40%, confirmed by the official account on X.

Source: European Central Bank X Account

This is the eighth yield cut in a row and matches the expectation from most analysts. But this isn’t just about interest yield—it could affect everything from inflation in Europe to how crypto prices behave next.

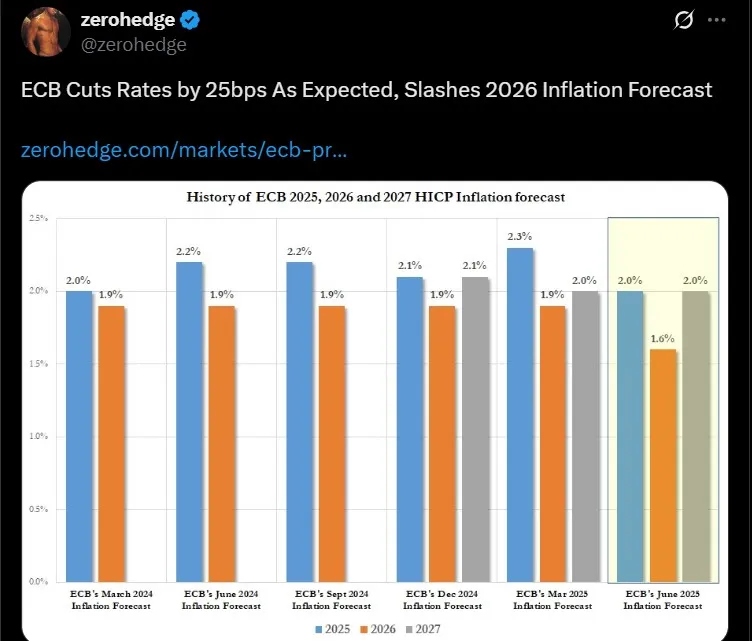

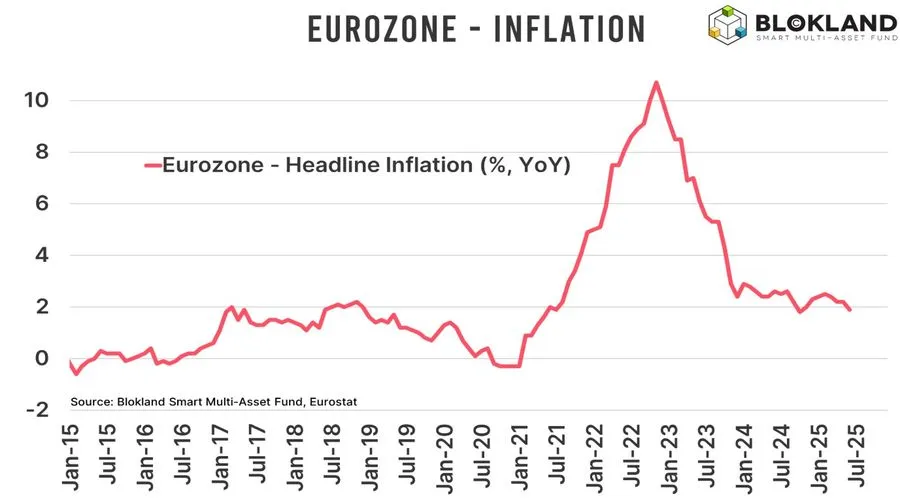

The reason behind this ECB rate cut decision is falling inflation. The bank now believes inflation will average 2.0% in 2025, 1.6% in 2026, and go back up to 2.0% in 2027. Energy prices are falling, and the euro is getting stronger—both help push inflation down.

If you're wondering how much did it monetary easing, the answer is 25bps (0.25%) for each main fee. This is now big news across financial circles, as seen in the latest ECB rate cut news.

Even Zerohedge, a popular finance channel on X, shared a chart saying:

“Rate Cuts by 25bps As Expected, Slashes 2026 Inflation Forecast.

Source: X

That gives more weight to how serious this move is.

Even though general inflation is dropping, core inflation (excluding food and energy) is still a bit high—at 2.4% for 2025. It’s expected to come down to 1.9% by 2026 and 2027. Wages are still rising, but not as fast as before, which helps slow down price rise pressure.

Source: BLOCKLAND Chart X

The Central Bank hasn’t said clearly whether it will drop the yield or increase next time. That’s because the future is uncertain—things like trade tensions and oil prices can still shake things up.

The central bank, sees Europe’s economy growing slowly—0.9% in 2025, then 1.1% in 2026, and 1.3% in 2027. It’s not a huge boost, but some good signs are there. Government spending on things like defense and infrastructure should help in the coming years.

At the same time, businesses may hold back a bit due to global uncertainties. All of this will play a role in shaping how investors, including those in the cryptocurrency world, move forward.

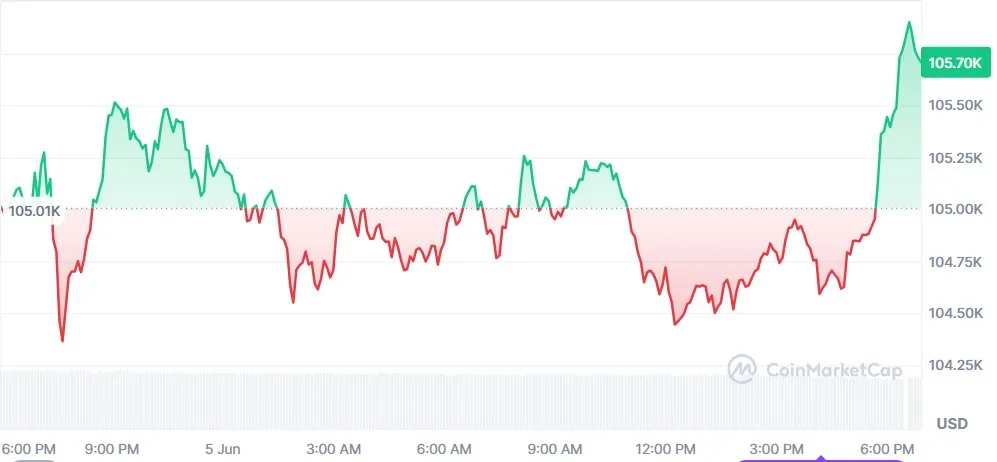

So how does this affect crypto? As per my analysis, its impact on crypto market could be big. Lower interest fees usually make borrowing easier and increase market activity. A weaker euro can make people look at cryptocurrnecy, like Bitcoin, as a safer option.

As per my analysis, past trends show that BTC after ECB interest drop decision events often sees price spikes. To back this up, here’s how the Bitcoin price is reacting after the latest rate cut news today. At the time of writing, according to CoinMarket cap, $BTC is trading around $105,925.49, reflecting an increase of around 1%, just after today’s continuous crash.

Source: CoinMarketCap

The bank said it will decide on future moves one step at a time—based on the data. And that creates room for market swings, which crypto traders usually like.

This European Central Bank rate cut is a strong signal that it wants to support the economy. But they are also being cautious. They’re trying not to push inflation back up while still helping growth.

For crypto investors, this ECB rate cut decision is a moment to stay alert. With monetary easing, simpler borrowing, and a flexible policy ahead, things could move fast in both traditional and crypto markets.

Sara Sethiya is an experienced crypto journalist with five years of experience in blockchain research, price movements, and market analysis. With a background in mass communication and journalism, she specializes in data-driven news articles, in-depth market reports, and SEO-optimized content. As a team lead and content writer at CoinGabbar, she examines on-chain metrics, evaluates liquidity trends, and analyzes tokenomics to uncover market patterns. Her analytical approach helps traders and investors interpret market shifts, identify potential opportunities, and understand the broader impact of blockchain innovations on the financial ecosystem.