Eigen coin price is in the spotlight again — but this time, not for a pump. Despite the long-awaited EigenCloud launch and a massive $70 million token buy by a16z crypto, the price dropped nearly 10% in 24 hours. The token now trades around $1.19, even as volume surged 74.80% to $151 million.

So, what happened? Why did the token price crash when the fundamentals seem stronger than they have ever been? Let's drill down on this inflection point for one of the most ambitious infrastructure plays in all of crypto.

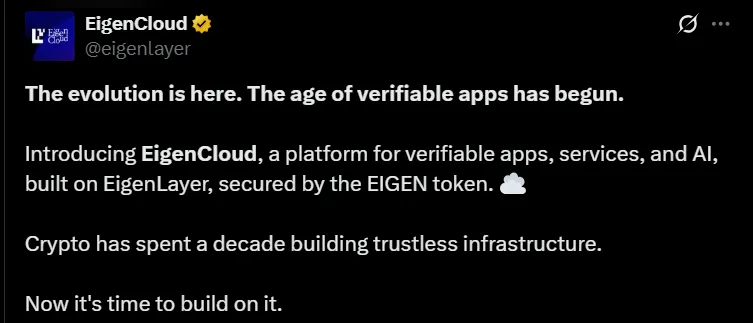

It is a powerful platform that brings verifiability-as-a-service to Web2 and Web3.

“This platform will enable mass-market crypto apps... It makes virtually anything verifiable onchain.”

— Sreeram Kannan, CEO of the company

Source: X

This move creates a new stack for trustless cloud computing, reshaping Ethereum from a ledger into a programmable trust engine — a key factor driving long-term coin price prediction optimism.

This news hit when a16zcrypto revealed a $70 million direct token purchase, right after previously investing $100 million in its Series B round (Feb 2024).

Source: Ali Yahya X Account

This renewed funding highlights their belief in layer’s token-centric model, where apps pay usage fees in this token — fueling both growth and restaking rewards.

Let’s answer the big question — why is it token falling today, despite the hype?

Reason 1: “Buy the Rumor, Sell the News”

Early buyers exited after its Cloud launch, locking in profits. This is a classic market move.

Reason 2: Bearish Chart Signals According To TradingView

![]()

Source: TradingView

Support broken at $1.30

RSI at 42.65, nearing oversold

MACD bearish crossover confirmed

This bearish structure incited fear in the short-term holders per my analysis being a cryptocurrency writer, and then quickly forced out some of those that were quick to sell.

Reason 3: Retail Volume Cooling

Though volume surged on the day of the news, it's still below May's peak, indicating lower retail conviction — a key reason behind the Eigen coin price falling trend.

| Indicator | Signal |

|---|---|

| RSI (14) | 42.65 – Weak, but not oversold yet |

| MACD | Bearish crossover below 0 |

| Support Levels | $1.15 and $1.00 |

| Resistance | $1.35 and $1.50 |

| Overall Trend | Short-term downtrend |

The Eigen Coin price has succumbed to profit taking, bearish technicals, and uncertainty in the short term. However, the fundamentals are strong backing, actual adoption, and visionary tooling; therefore, this might be accumulation time in the range of $1.00 - $1.15. Traders should wait, nonetheless, for trend reversal confirmation. Also, remember to always DYOR for cryptocurrency investments.

Sara Sethiya is an experienced crypto journalist with five years of experience in blockchain research, price movements, and market analysis. With a background in mass communication and journalism, she specializes in data-driven news articles, in-depth market reports, and SEO-optimized content. As a team lead and content writer at CoinGabbar, she examines on-chain metrics, evaluates liquidity trends, and analyzes tokenomics to uncover market patterns. Her analytical approach helps traders and investors interpret market shifts, identify potential opportunities, and understand the broader impact of blockchain innovations on the financial ecosystem.