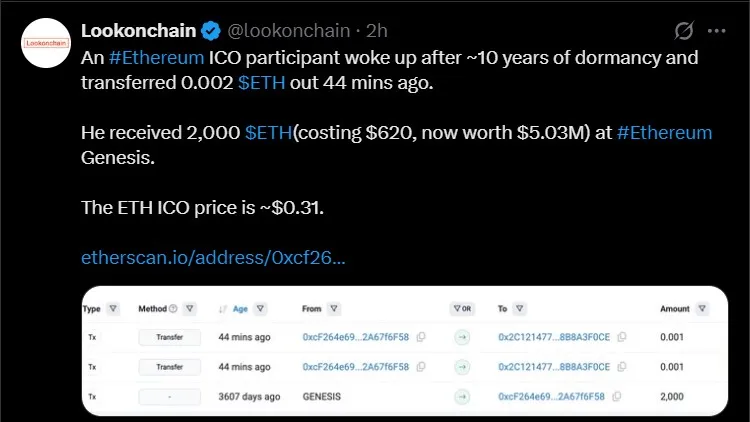

In a surprising turn, an old Ethereum whale wallet from 2015 has suddenly become active, sparking buzz across the crypto community. According to Lookonchain, the wallet received 2,000 ETH during its ICO for just $620 — when the price was around $0.31. That same stash is now worth over $5 million.

Source: Lookonchain X

The wallet sent a tiny 0.002 tokens on June 14, 2025 — a small transfer, but one that suggests the owner is testing access after years of dormancy. This ICO wallet move has stirred speculation around possible large transfers or even a full liquidation.

Such whale moves in June 2025 have always drawn attention, especially when they appear after years of silence. These early investors often hold significant amounts, and any activity from them could impact market trends. Some even believe this marks the beginning of a larger whale acquisition phase as prices begin heating up.

In other Ethereum latest news today, Coin Bureau reported that the strong ETH ETF inflow streak, which lasted 19 straight days from May 16 to June 12, has finally ended.

Source: Coin Bureau X Account

During that period, a total of $1.37 billion flowed into spot ETH ETFs, the highest since its ETF launch in July 2024.

However, on June 13, this streak was broken by a $2.1 million ETF outflow — a sign that momentum could be cooling off briefly.

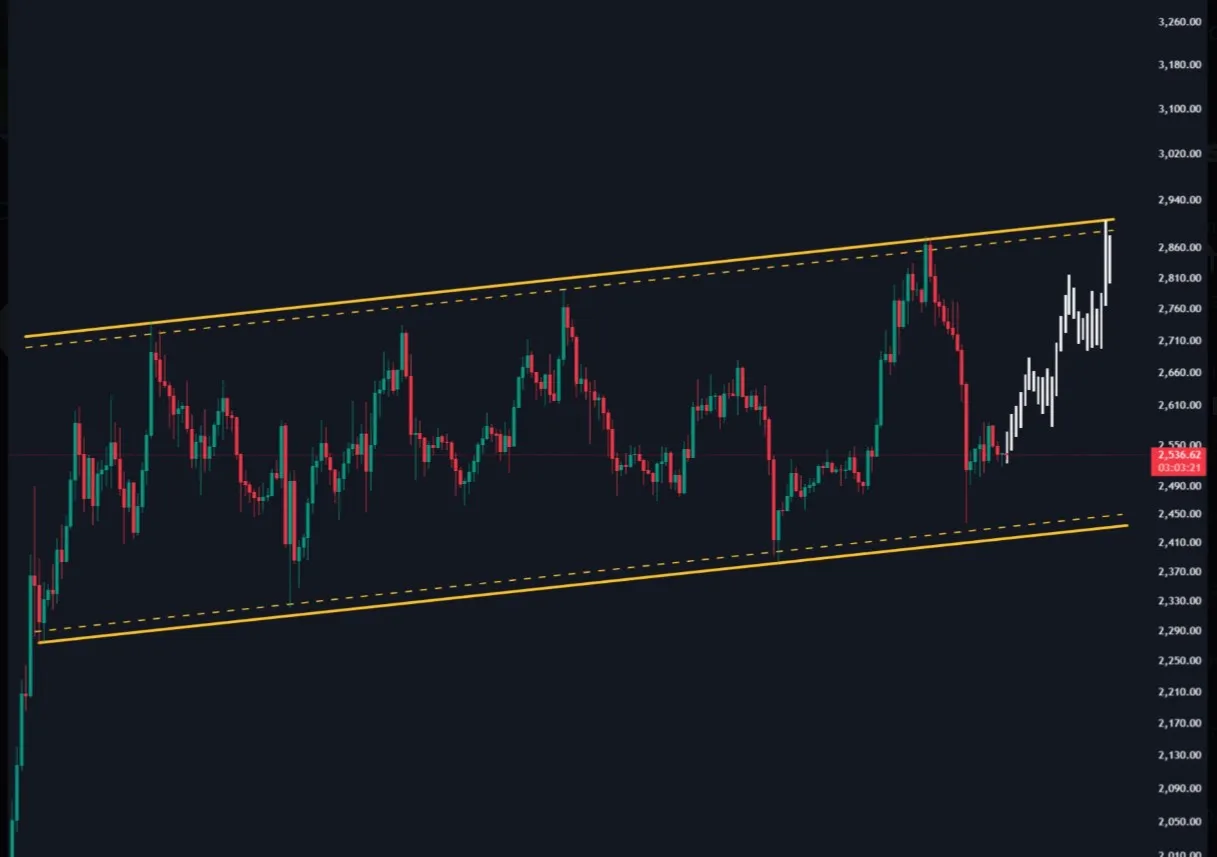

Currently, the price is trading sideways but remains technically strong. Analysts have pointed out that this altcoin continues to form higher highs and higher lows, a bullish signal. For now, the key resistance to watch is $2,950.

Source: X

Many traders believe that once it breaks above this $2950 breakout level, we could see a major ETH rally in 2025. This could potentially push the Ethereum price update well beyond the $3,000 mark and start a new leg up for the market.

With ETF trends shifting and whale wallet 2025 activity returning, things are getting interesting. If you're following its price prediction closely, this could be the calm before a big move.

Sara Sethiya is an experienced crypto journalist with five years of experience in blockchain research, price movements, and market analysis. With a background in mass communication and journalism, she specializes in data-driven news articles, in-depth market reports, and SEO-optimized content. As a team lead and content writer at CoinGabbar, she examines on-chain metrics, evaluates liquidity trends, and analyzes tokenomics to uncover market patterns. Her analytical approach helps traders and investors interpret market shifts, identify potential opportunities, and understand the broader impact of blockchain innovations on the financial ecosystem.