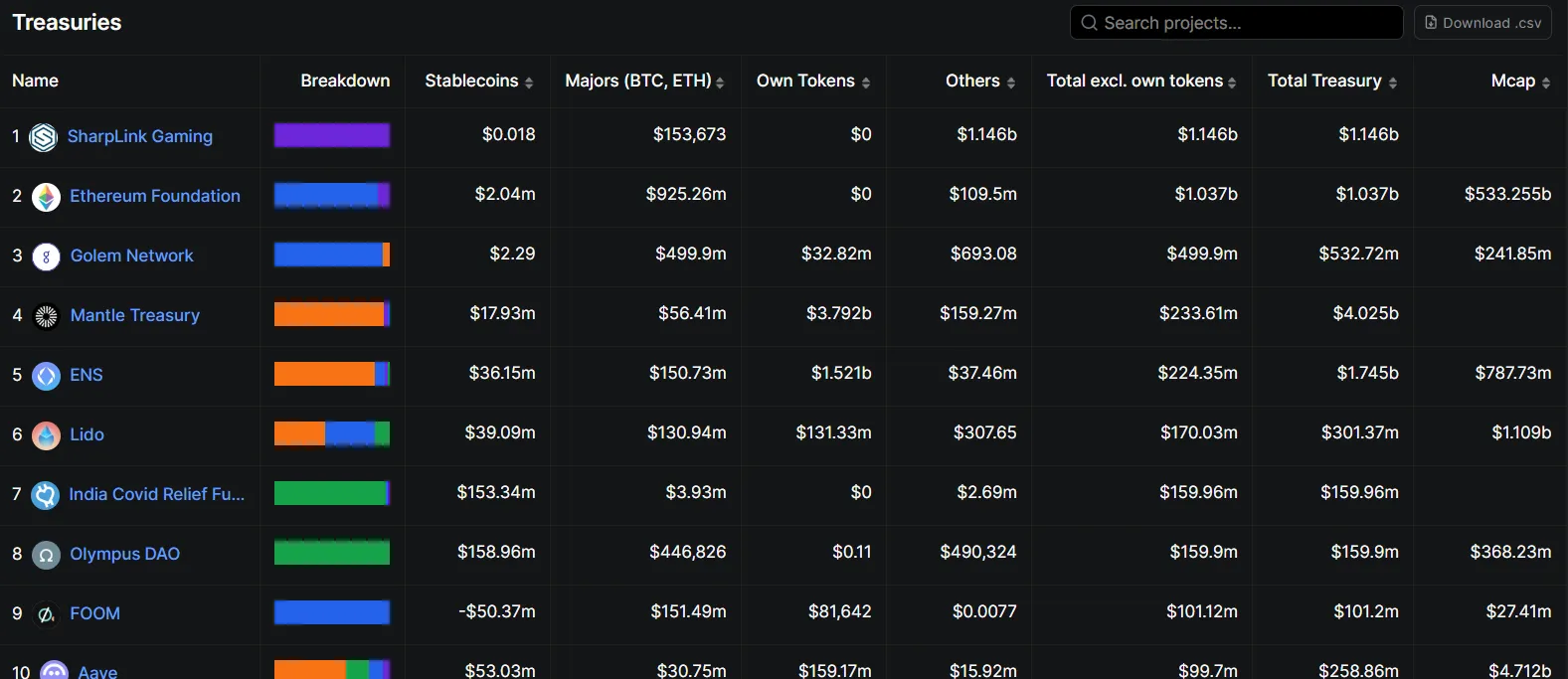

According to recent news, Mantle, the Ethereum Layer 2 network, has made headlines after surpassing $4 billion in total treasury assets. This highlights Mantle Treasury’s rapid ascent in the DeFi sphere, particularly at a time when wider market sentiment remains cautious.

It has officially surpassed the $4B threshold in asset holdings, taking a leading role in crypto projects. It has surpassed Uniswap, ENS, Arbitrium DAO, Optimism Foundation, Cardano, etc, and tops the list.

The official documentation of the project by states that the treasury management approach of the project is sustainable growth, interoperability, and liquidity support.

Source: Lookonchain X

This success is reflected in a wider trend in DeFi in which well-endowed reserves are an indicator of project health and community trust. Indeed, a 2023 study by the National Bureau of Economic Research discovered that projects that have treasuries of over one billion dollars have about 40% more staking activity than smaller treasuries. This recent milestone could thus become a factor in its further adoption and liquidity in its ecosystem.

While it has surged past $4B, updated figures provide a more detailed snapshot of its composition. It is structured as follows:

Stablecoins: $17.93 million

Major assets (BTC & ETH): $56.41 million

Own tokens: $3.792 billion

Others: $159.27 million

This brings the overall total treasury of $4.025 billion, excluding its own tokens, approximately $233.61 million.

However, despite the impressive figure, the project does not stand as the single largest asset holder in crypto. Projects such as SharpLink Gaming ($1.146 billion), Ethereum Foundation ($1.037 billion), and Golem Network ($532.72 million) collectively surpass Mantle in non-native token reserves.

Here, it is important to note: Although the total treasury of Mantle is enormous, a large proportion of its value is held in its own token holdings, unlike more diversified holdings in terms of stablecoins and key assets.

Source: DefiLama

The milestone comes at a time when the altcoins are under pressure and investor sentiment is bearish on social media sites. It is on this background that the strong asset position defies the current story and demonstrates its confidence in the long-term plan.

The collaborations of the project with Bybit, especially, have been crucial in the process of connecting DeFi and CeFi. This interoperability gives an advantage of increasing the sources of liquidity, enticing institutional players, and strengthening community involvement.

Raising its reserves to more than $4 billion, Mantle crypto is sending a message to its retail and institutional investors that it possesses the capabilities to absorb volatility, motivate their involvement, and keep expanding its Layer 2 solutions.

With the crypto market in a period of volatility, the strength can be a foundation on which to continue innovation, liquidity, and user confidence. Though initiatives such as the Ethereum Foundation and SharpLink Gaming continue to outpace Mantle are still a force in the development of defi. You can also go through other reports, such as the Public Bitcoin Treasury Report 2025. Click to know who is the biggest BTC holder in the crypto industry.

Sakshi Jain is a crypto journalist with over 3 years of experience in industry research, financial analysis, and content creation. She specializes in producing insightful blogs, in-depth news coverage, and SEO-optimized content. Passionate about bringing clarity and engagement to the fast-changing world of cryptocurrencies, Sakshi focuses on delivering accurate and timely insights. As a crypto journalist at Coin Gabbar, she researches and analyzes market trends, reports on the latest crypto developments and regulations, and crafts high-quality content on emerging blockchain technologies.