What happens when the world’s biggest asset manager buys hundreds of millions of dollars in Eth—right in the middle of an Ethereum price crash? That’s exactly what BlackRock just did.

While small investors are worried about falling prices, big institutions are buying like never before. But here’s the real twist: many traders believe the altcoin is now repeating the same pattern that led to a 5,000% rally in 2017. Is it true or just a short term rumour, and did this asset manager firm already knew it?

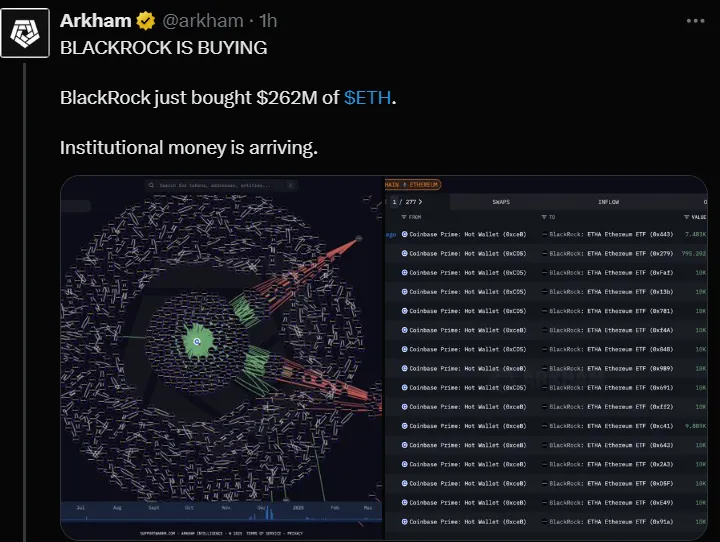

According to Arkham, the company bought $262 million worth of tokens, even though the market is going through an Ethereum price crash.

This is not a small bet—over the past two months, BlackRock has already added nearly $2 billion worth of ETH to its holdings.

Blackrock ETF has quickly become one of the most traded funds on Wall Street. For years, traditional finance was slow to accept altcoins. But this big purchase shows that institutions now see it as the world’s leading programmable store of value.

The inflows into token’s ETFs are breaking records. On August 27, Wu Blockchain reported that its ETF inflows brought in $309 million in a single day, marking five straight days of positive inflows.

Earlier this month, Exchange traded funds added another $455 million, even outperforming Bitcoin for four days in a row.

This clearly shows that Wall Street investors are shifting focus from Bitcoin to this altcoin. Institutions are treating the asset as a serious investment with long-term potential.

Well-known trader Merlijin pointed out that Ethereum 2017 fractal pattern is repeating. The cycle looks like this:

Accumulation → Fakeout → Breakout → Retest → Moon

In 2017, this exact setup gave a 5,000% rally. The difference now is that in 2025, we also have BlackRock Ethereum ETF, global liquidity, and Wall Street backing. That’s why many analysts believe this breakout could be much stronger than before.

Right now, the price crash is creating a buzz in the ETH news today. It is facing short-term selling pressure.

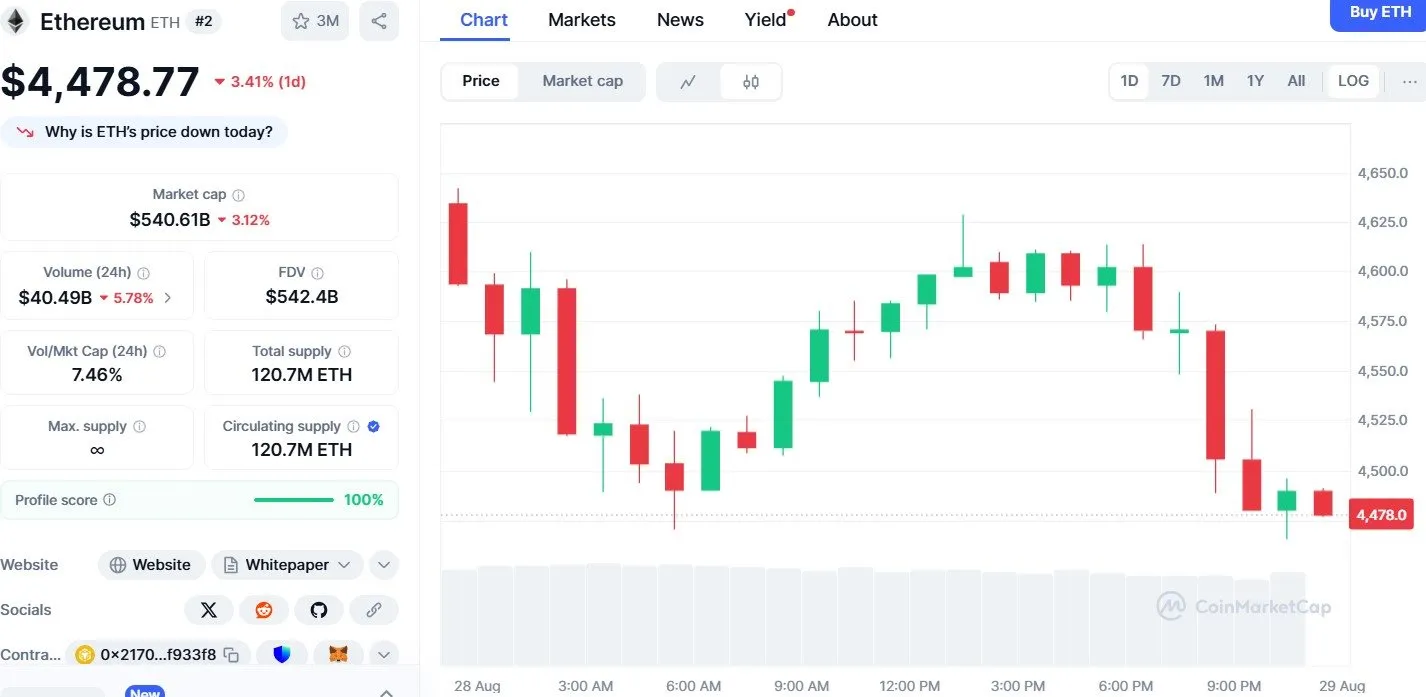

Price: $4,478 (–3.41% in 24h)

Market Cap: $540.6B (–3.12%)

24h Volume: $40.49B (–5.78%)

The coin fell from $4,600 to $4,470. The CoinMarketCap chart shows red candles, which means sellers are in control at the moment. The key support level is $4,400, and the next resistance is at $4,600.

If support resistance stays above $4,400, it could rebound toward $4,600 or even $5,000. But if it drops below support, the price might fall to $4,200 or in the worst case $3,500.

So while the short-term trend looks weak, the long-term ETH price prediction 2025 outlook remains positive thanks to exchange traded funds inflows and institutional buying.

The Ethereum price crash may scare retail investors, but it is giving institutions like BlackRock ETH buy a chance to catch the breakout early. With billions flowing into ETFs, the foundation for a strong future rally is being built.

If history repeats the 2017 fractal, it could once again deliver massive gains. Only this time, the rally would be powered not just by retail traders, but by Wall Street giants like this asset manager firm.

Sara Sethiya is an experienced crypto journalist with five years of experience in blockchain research, price movements, and market analysis. With a background in mass communication and journalism, she specializes in data-driven news articles, in-depth market reports, and SEO-optimized content. As a team lead and content writer at CoinGabbar, she examines on-chain metrics, evaluates liquidity trends, and analyzes tokenomics to uncover market patterns. Her analytical approach helps traders and investors interpret market shifts, identify potential opportunities, and understand the broader impact of blockchain innovations on the financial ecosystem.