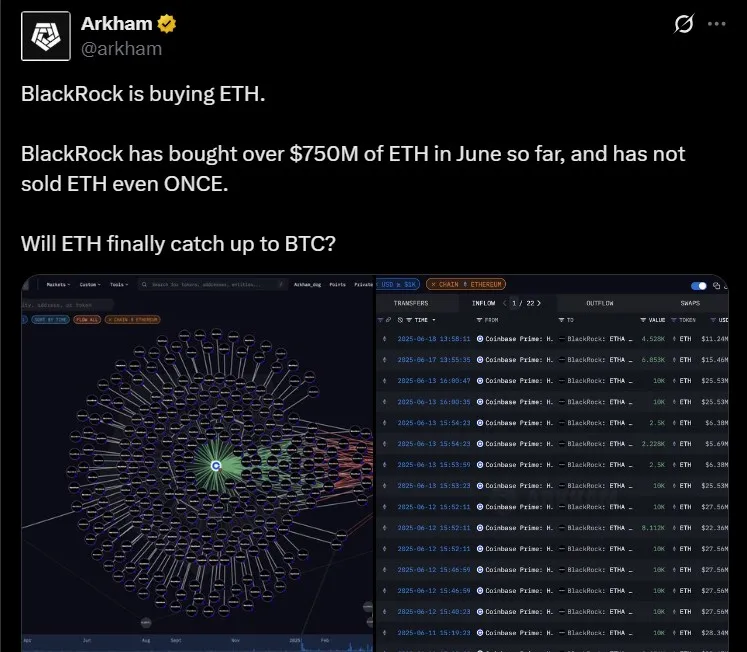

In June, BlackRock Ethereum investment activity shocked many analysts. The world’s largest asset manager has picked up over $750 million tokens, based on on-chain data from Arkham. What’s more surprising? Not a single token has been sold since then, and even Ethereum price crashed today.

Source: Arkham Data X Account

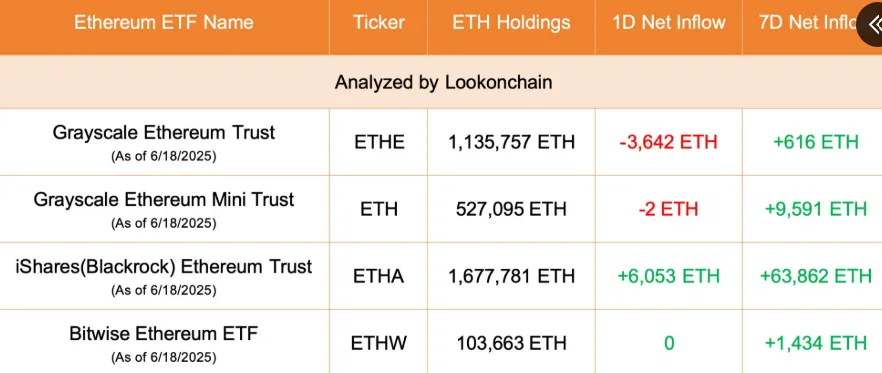

Their crypto-focused fund currently holds around 1.67 million tokens worth approximately $4.23 billion. In the latest news today, the ETF inflows remain strong, with over 6,000 tokens added just this week, fueling growing market curiosity, as per Lookonchain data.

Source: Lookonchain X Official Account

Many are asking: Why it is going down today, well despite rising demand, the price crash is being reflected on the charts. It is still trading close to $2,490. Traders and analysts are now debating whether ETH will hold support or break down. Short-term signals such as RSI at 46.85 and a negative MACD histogram indicate weakening momentum.

For now, the coin must stay above $2,450, or else a dip toward $2,350 is possible, as per TradingView chart.

Source: TradingView

Many traders believe this range is the real breakout zone. Although it faces hard resistence which is also one of the reasons behind the fall, but If it gains strength, a push beyond $2,600 could set the stage for a rally toward the next major Ethereum price target around $2,800–$2,900.

AI crypto tools like Alva suggest that the current market moves are less about panic and more about “tactical rotation.” This means capital is shifting between ETH vs BTC, but both remain key holdings for long-term strategies.

Looking 3–6 months ahead, many see ETH ETF updates and Layer-2 adoption as strong bullish signs. Projects like Optimism, Base, and zkSync are contributing to increased network activity. These Layer-2 news trends are making this coin more scalable, which investors value.

The ETH future forecast includes potential gains up to $3,600, if demand remains steady and broader economic conditions stay favorable. But there are risks too: macro shifts could push ETH back down to $2,000, which would test lower support resistance zones.

Right now, all eyes are on whether BlackRock Ethereum investment will inspire a wave of new buyers. Even though the Ethereum price crash had been reflecting, strong fundamentals and ETF backing are giving $ETH a solid foundation for its next big move.

As a crypto analyst, I’ve noticed that when BlackRock crypto news lines up with low retail activity, it often signals something big is coming. These institutional moves aren't just numbers—they’re quiet power plays.

So keep an eye on resistance level, and make sure to do your own research before investing in any cryptocurrency because the crypto market is highly volatile and price changes frequently here.

Sara Sethiya is an experienced crypto journalist with five years of experience in blockchain research, price movements, and market analysis. With a background in mass communication and journalism, she specializes in data-driven news articles, in-depth market reports, and SEO-optimized content. As a team lead and content writer at CoinGabbar, she examines on-chain metrics, evaluates liquidity trends, and analyzes tokenomics to uncover market patterns. Her analytical approach helps traders and investors interpret market shifts, identify potential opportunities, and understand the broader impact of blockchain innovations on the financial ecosystem.