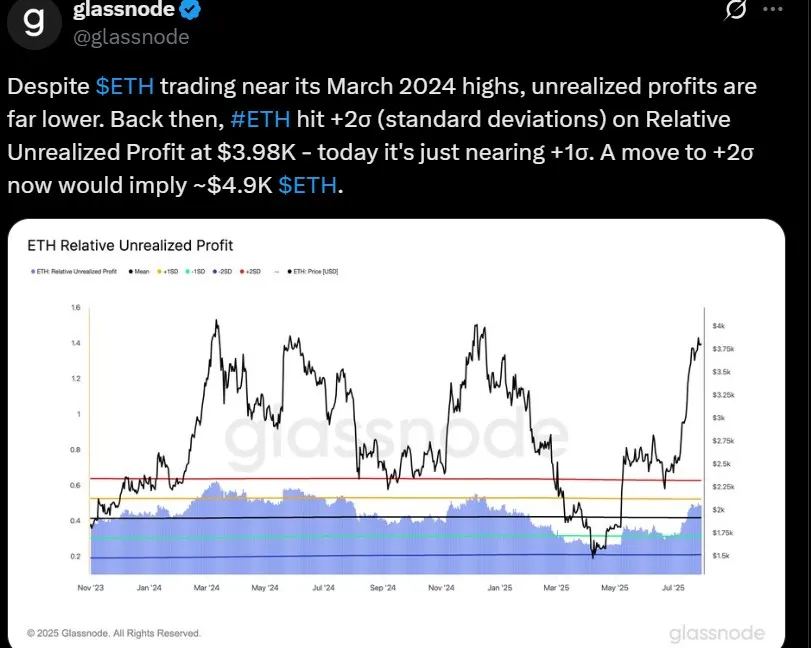

Ethereum is in the news again as it's heading back to its March 2024 high of $3.98K, but the difference is despite Ethereum price surge, holders are not seeing an increase in profit. This suggests that profit is still in the works as this rally seems to be less explosive than previously acknowledged, raising a key question: Is $4.9K the actual level?

As of writing, $ETH trades at $3,861, just similar to its earlier 2024 March high. But this isn’t a typical repeat. According to Glassnode Relative Unrealized Profit metric, traders are holding far fewer paper gains than they did during the March rally.

Back then, it hit the +2σ deviation zone—a strong signal of overheated profits. Now, it’s only grazing +1σ. This means despite the token climb, the broader market hasn't yet cashed in, which is a matter of concern not only for traders, but for the whole market. So let’s understand the numbers.

In the latest Ethereum news today, Glassnode data, a trusted source for on-chain analytics, suggests the cryptocurrency still has a runway. In March 2024, the +2σ level aligned with the $3.98K top.

In contrast, the current surge shows weaker profit-taking pressure, leaving room for Ethereum price surge to climb toward $4.9K to reach that same threshold.

This level isn’t just mathematical—it’s a psychological trigger, signaling equilibrium between bullish momentum and trader exit points.

This altcoin has surged from below $2,000 to over $3,800 in a steep parabolic curve. It’s now re-testing resistance near March’s peak according to the TradingView chart.

1. MACD Insights

The MACD remains bullish, but the histogram shows slowing momentum. A crossover could spark consolidation unless volume returns.

2. RSI Check

The RSI sits at 80.58, suggesting it’s overbought. While this doesn’t confirm a drop, it does hint at a possible pause.

Hitting $4,000 is no doubt an important psychological mark to reach an All time high, and this altcoin may cross it again soon. But many seasoned traders are now fixated on $4.9K. Why?

Because that’s the price level where Relative Unrealized Profits would again hit +2σ, likely triggering sell pressure from smart money. That’s when the average holder might finally feel “in profit.”

As a crypto analyst, I see this gap between current price and profit potential as a hidden strength. It means ETH price today still has fuel left in the tank—as long as macro and on-chain conditions stay favorable.

According to OKX analyst Ted Pillows, it is currently executing a "classic liquidity grab," still holding strong above key support, and answering to questions surrounding " when will ethereum hit $4000 again?”

"If it clears $4,000 and sustains it, the path to $4.9K becomes technically valid," says Ted.

Short-Term Range: $3,760 – $3,820 support

$ETH Price Target This Week: $4,000 – $4,100

Mid-Term Projection: $4,700 – $4,900

Breakout Trigger: +2σ on Glassnode’s metric

The current Ethereum price surge might feel underwhelming to some—but that’s exactly the bullish signal traders are watching. With unrealized profits still low and token nearing breakout territory, this isn’t just a repeat of March.

This time, $4.9K isn’t just a hope — it’s the on-chain checkpoint for serious profit realization. Stay cautious around overbought signals, but don’t underestimate this rally’s hidden potential, and always do your own research before investing in any cryptocurrency

Sara Sethiya is an experienced crypto journalist with five years of experience in blockchain research, price movements, and market analysis. With a background in mass communication and journalism, she specializes in data-driven news articles, in-depth market reports, and SEO-optimized content. As a team lead and content writer at CoinGabbar, she examines on-chain metrics, evaluates liquidity trends, and analyzes tokenomics to uncover market patterns. Her analytical approach helps traders and investors interpret market shifts, identify potential opportunities, and understand the broader impact of blockchain innovations on the financial ecosystem.