Between July 21 and July 27, 2025, Galaxy Digital finalized the sale of over 80,000 BTC, worth more than $9 billions. The transaction, executed on behalf of a Satoshi-era investor, caused Bitcoin to drop below the $115,000 mark. This historic deal is one of the largest in Bitcoin's history by notional value.

The crypto market reacted with reduced activity. Decentralized exchange (DEX) trading volumes fell compared to the previous week. Both spot and perpetual contract markets saw declines in volume.

Source: tweet

PancakeSwap led spot activity with $38.47 billions, but that marked a 14% weekly drop. Uniswap recorded $25.66 billion, while Raydium was the only major platform to show growth, up 4.76% at $8.8 billions.

For perpetual contracts, volumes dipped 4.43% overall. Hyperliquid remained dominant with $88.8 billions in volume despite an 8.62% drop. Jupiter gained 13.63%, while edgeX surged by over 54%, hitting $5.23 billion.

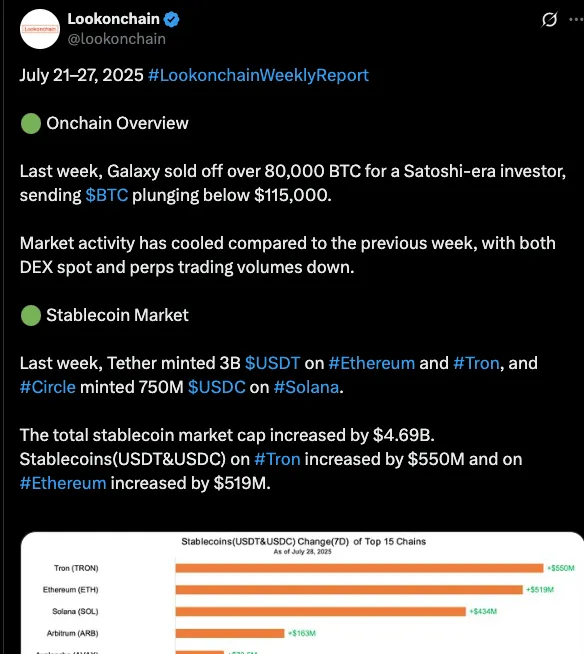

Stablecoin issuance climbed rapidly last week. Tether minted 3 billion USDT on Ethereum and Tron combined. Meanwhile, Circle introduced 750 million USDC on the Solana blockchain. Overall, the stablecoin market cap increased by $4.69 billion.

Tron experienced the largest weekly gain in stablecoins, up $550 million. Ethereum followed closely, seeing a $519 million increase. Solana gained $434 million, showing robust stablecoin demand across all three chains.

Other notable increases occurred on Arbitrum and Avalanche, while Optimism and Base witnessed moderate outflows.

This capital inflow into stablecoins reflects continued investor interest in blockchain-native dollars, particularly on faster and cheaper chains like Tron and Solana.

Institutional investors remained active in Ethereum markets. Eight new wallets accumulated 583,248 ETH, totaling $2.17 billion since July 9. One wallet belonging to SharpLink acquired an additional 77,210 ETH, worth $295 million. These consistent purchases suggest growing confidence in Ethereum’s long-term utility.

On the Bitcoin side, 17 publicly listed companies announced Bitcoin purchases last week. Combined, they acquired 6,315 BTC at an estimated cost of $746 million. Volcon led all firms with 3,220 BTC, while Metaplanet and Sequans purchased 780 and 755 BTC, respectively.

However, MicroStrategy did not participate in Bitcoin buying last week, breaking from its usual accumulation strategy. The average buying prices ranged from $94,773 (Semler Scientific) to $119,687 (Bitcoin Treasury Capital).

Source: tweet

In summary, a key week was experienced in the market when Galaxy finalized multi- billion- dollar sale of Bitcoin. There was an ever-so-slight decrease in volumes, but the strong institutional-level accumulation in ETH and thriving stablecoin activity provided some balance to it all. The sector is currently keen on how the markets will react to the re-assignment of more than 80,000 BTC.

Deepak Choudhary is a solid two years of writing experience and crypto enthusiast. He writes about blockchain games, Telegram games, and tap-to-earn platform. Like his audience, he writes with clarity, simplicity, and lots of useful tips in his articles. He helps those unfamiliar with various aspects of crypto world in a very simple way. He also provides regular updates on the fast growing world of blockchain, with great articles covering current and expected trends and guides. His writings on crypto games as well as crypto earning apps on Telegram are quite useful and informative for people novice and experienced. His aim is to help more people explore and profit from Web3 ecosystem.