Gemini has announced that its customers in the European Union(UN) can now buy tokenized shares of MicroStrategy(MSTR) directly on the platform.

Recently, Gemini shared on its X post that “Tokenized stocks have arrived”.

Source:X

This made U.S equities accessible worldwide through blockchain, blending traditional finance with the 24/7/365 nature of crypto.

It is also known as tokenized equity which is a digital version of a real-world company share. It is recorded and maintained on a blockchain or distributed ledger.

Each token represents either a full or a fractional share of a publicly listed company.

Through it, users can access tokenized stocks provided by Dinari(SEC-registered U.S. transfer agent specializing in token securities.), Inc. branded as dShares .

Dinari offers tokenized stock trading and said on X that it is the first to secure U.S approval to offer blockchain based stock trading.

Source: X.

These digital assets are fully backed on a 1:1 basis by actual U.S stocks and, where regulations allow, offer the same financial rights as the original securities.

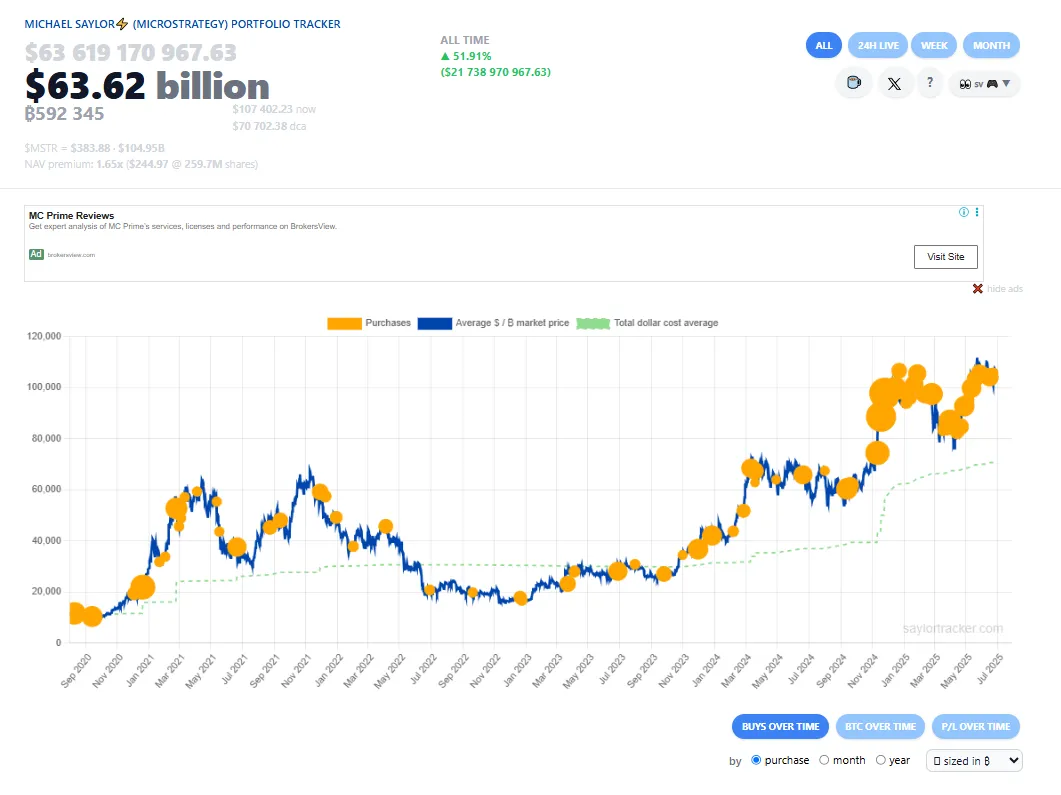

It has strategically launched MicroStrategy as its first tokenized stock in the US, which might be the reason that according to Top Public Bitcoin Treasury MSTR is ranked one and is 5th world largest 592,345 Bitcoin holder.

MicroStrategy naturally appeals to both crypto enthusiasts and traditional investors, making it an ideal bridge between the two financial worlds.

Source: MicroStrategy

Its high share price around $540 makes it a perfect candidate for fractional ownership, allowing European users to invest in premium U.S equities worth as little as €10-20.

By tokenizing MSTR on blockchain, networks like Arbitrum, Gemini enables seamless, 24/7 global trading which will be free from limits of time zones and traditional settlement delays.

Backed by its MiFID II license(financial industry reform legislation) in Malta and Dinari’s regulatory approvals in U.S

Gemini ensures that these digital shares are not only accessible but also legally compliant and fully secured.

This launch marks a bold move towards bringing real-world assets to the blockchain and reshaping how global investors interact with U.S markets.

The tokenization of U.S stocks is reshaping the financial landscape which allows investors to trade equities directly on the blockchain. This innovation offers 24/7 global trading, faster settlements.

It will reduce the costs by cutting out intermediaries like brokers. For global and retail investors, stocks lower entry barriers through fractional ownership, making high-value shares accessible for as little as $10.

This shift also raises regulatory concerns, including compliance with SEC laws, KYC/AML standards and potential tax complexities.

The crypto market is likely to see increased demand for stablecoins and rise of decentralized stock trading platforms.

With growing interest from institutional players, tokenization could extend beyond stocks to ETFs, bonds and real estate which marks a major evolution in global finance.

Fueled by evolving regulation like MiCA and SEC engagement, it's not only Gemini. Various exchanges like Kraken, Coinbase and Robinhood are rapidly embracing equities using models that offer 24/7 trading, fractional ownership and blockchain based settlement.

As these platforms secure licences and launch services, these stocks are positioning themselves to become a mainstream asset class all over the world.

Companies that might be next on Gemini List are as follows:

Companies which are holding BTC as their Treasury Asset like GameStop, MARA Holdings, Coinbase, Grayscale Bitcoin Trust etc.

Those companies with Strong Brand Recognition and investor interest like Tesla, Nvidia etc.

Companies having the Digital Asset Space like Coinbase.

Companies having innovative business models can be next on Gemini’s list.

Gemini’s launch of tokenized MSTR shares in the EU marks a pivotal shift which brings US equities on chain, enabling globally, 24/7 trading with fully backed digital shares and blending traditional finance and crypto under clear regulatory.

Akanksha is a dedicated crypto content writer with a strong enthusiasm for blockchain technology and digital innovation. With a growing footprint in the Web3 space, she specializes in turning intricate crypto topics into clear, engaging narratives that resonate with readers across all experience levels. Whether it's Bitcoin, emerging altcoins, DeFi platforms, or NFT trends, Akanksha delivers timely and insightful content that helps audiences stay informed in the ever-evolving crypto market. Her analytical approach, combined with a passion for decentralized finance, allows her to craft informative pieces that empower both new and experienced investors. Akanksha firmly believes in the transformative power of blockchain to reshape global systems and drive financial inclusion.