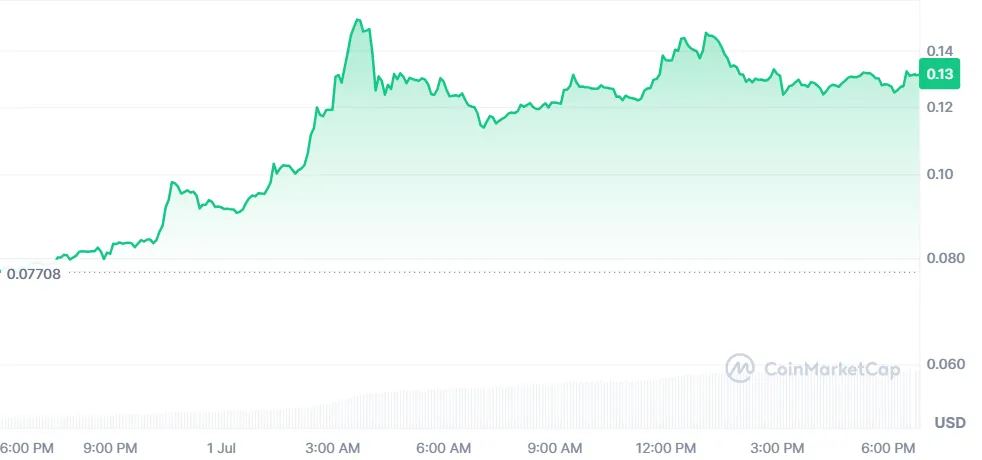

Something big is going on with the HFT token and no, it's not just a flash pump. In just the last 24 hours, the Hashflow token price surged over 66%, currently trading at about $0.1300 with a $612 million Trading volume (24 hours).

Source: CoinMarketCap

The spike has brought Hashflow news to the front page in crypto headlines today, and traders are now wondering: Why it is surging today?

Let’s break down everything that’s fueling this incredible move—and whether Hashflow price prediction points toward even more upside.

1. Solana Integration Is a Game-Changer for $HFT

On June 11, 2025, the team officially announced that this coin is now live on Solana. They’ve also confirmed integrations with big names like Jupiter, Kamino, and Titan, and hinted that more are coming. For many traders, this is the beginning of a multi-chain future for this cryptocurrency.

Source: Hashflow X Account

As per my analysis who’s been tracking this coin for a long time now, it's no surprise that $HFT token buy activity skyrocketed right after the announcement.

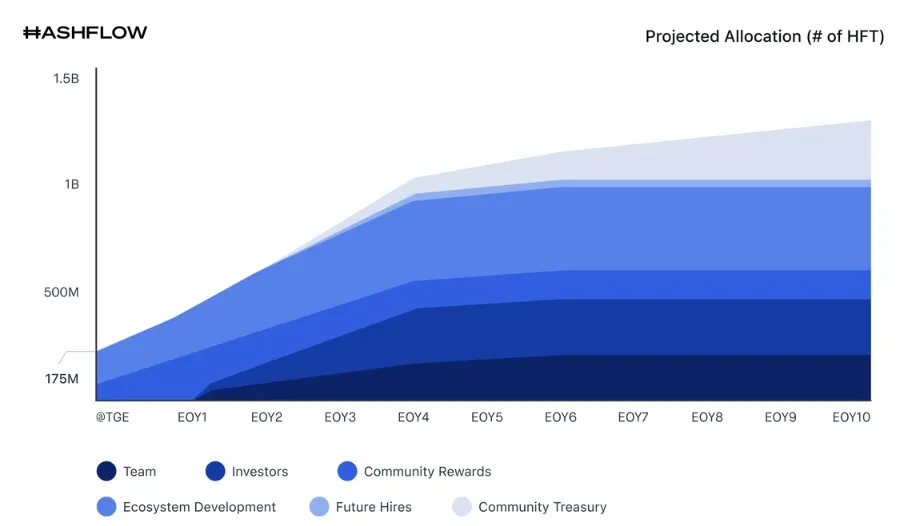

2. Tokenomics Clarity: Why HFT Token Is Increasing in Trust?

Another major factor behind this surge is the Clarity around the token unlock schedule. Previously, there was confusion and fear about possible “token dumps.” But recently, the team made it clear: The tokens unlock linearly every day. No cliffs. No massive release days.

3. It Is Now Available on dYdX — More Utility, More Volume

In even more bullish news today, the asset just launched on dYdX, one of the largest decentralized derivatives platforms.

This opens up new trading options for pro traders and DeFi enthusiasts, boosting volume across the board.

4. Technicals Confirm the Breakout

It broke out of its long $0.05–$0.07 range, surging past $0.10 with strong volume as per TradingView 1 day chart analysis. The RSI is now above 85, showing intense bullish momentum. Meanwhile, the MACD has flashed a bullish crossover, signaling continued upside potential if buying pressure holds.

Source: TradingView Chart

Support: $0.10 (recent breakout base), $0.08 (prior resistance)

Resistance: $0.15 (intraday high), $0.18 (February top), $0.22 (major 2024 rejection zone)

This kind of technical explosion usually indicates whale accumulation, a short squeeze — or both.

Based on both fundamentals and technicals, here’s what to expect next:

Short-Term (2–3 Weeks):

Price could test $0.15–$0.18 again if volume remains high. Any pullbacks to $0.10 may be bought up quickly.

Mid-Term (2–3 Months):

If the altcoin rally continues and more integrations are announced, Hashflow price prediction points toward $0.20–$0.24.

Long-Term (End of 2025):

If $HFT gets listed on major platforms like Coinbase or expands further into Binance's ecosystem, a run toward $0.35–$0.40 is very realistic.

Let’s not forget — HFT coin all-time high was $2.58 in November 2022. That leaves a lot of room for growth.

Here’s the bottom line — HFT token price 100% rally shows a project that’s gaining traction fast. With clear tokenomics, multi-chain support, and a huge surge in trading volume, the Hashflow price prediction remains strong,

While some short-term volatility is possible (especially since RSI is high), the fundamentals look solid. If you're watching for a long-term revival, this might be your moment, but as always, make sure to research thoroughly before making any crypto investment.

Sara Sethiya is an experienced crypto journalist with five years of experience in blockchain research, price movements, and market analysis. With a background in mass communication and journalism, she specializes in data-driven news articles, in-depth market reports, and SEO-optimized content. As a team lead and content writer at CoinGabbar, she examines on-chain metrics, evaluates liquidity trends, and analyzes tokenomics to uncover market patterns. Her analytical approach helps traders and investors interpret market shifts, identify potential opportunities, and understand the broader impact of blockchain innovations on the financial ecosystem.