Can a new Layer-1 really change how crypto portfolios work across chains? The Helios blockchain believes it can, and with its airdrop and listing date now confirmed, market attention is rising fast. The platform is entering the spotlight as an AI-powered Layer-1 built for on-chain Exchange Traded Funds, index funds, and automated multi-asset strategies, all without fragmented liquidity.

It is designed to let developers and users create and manage portfolio products that run across multiple blockchains, while settlement stays in one unified system. This approach places it among emerging AI crypto projects focused on real financial use cases.

The Helios blockchain listing date is set for December 19, 2025, at 15:00 UTC. The $HLS token will launch first on Ethereum and Arbitrum, with spot trading confirmed on major exchanges including KuCoin, WEEX, and MEXC. More exchange listings are expected to follow.

Source: X Account

On KuCoin, HLS/USDT trading begins after a call auction from 14:00 to 15:00 UTC. Deposits are already live on the ETH-ERC20 network, and withdrawals open on December 20 at 10:00 UTC.

The Helios blockchain airdrop is tied to KuCoin’s HODLer Airdrops program. A total of 7.5 million HLS tokens will be distributed to eligible users holding at least 20 KCS. The snapshots were taken between December 2nd and December 6th, and the full token airdrop distribution is scheduled for December 19th at 08:00 UTC. This airdrop will bring liquidity and exposure to the community before trading.

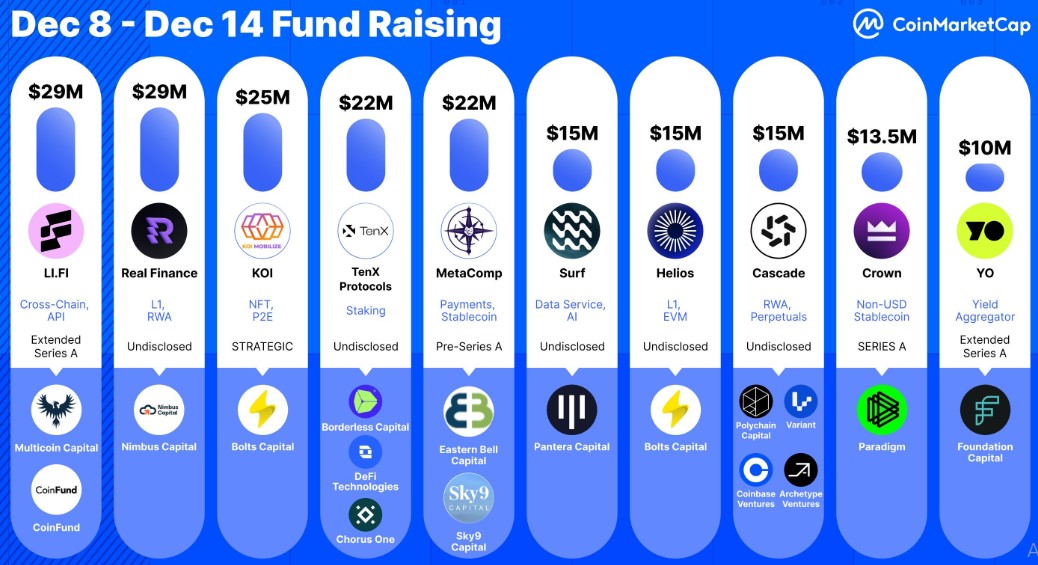

Before listing, Helios blockchain finished its IDO on December 16 through Spores Launchpad and Huostarter. As per the data from CoinMarketCap, it has raised nearly $15 million in funding, making it one of the top crypto projects last week.

Source: CoinMarketCap X

This traction is a reflection of the interest in the Helios AI token story. By integrating AI-managed investment portfolios, natively multi-chain execution, and ETF logic, Helios seeks to introduce known finance concepts to the on-chain world.

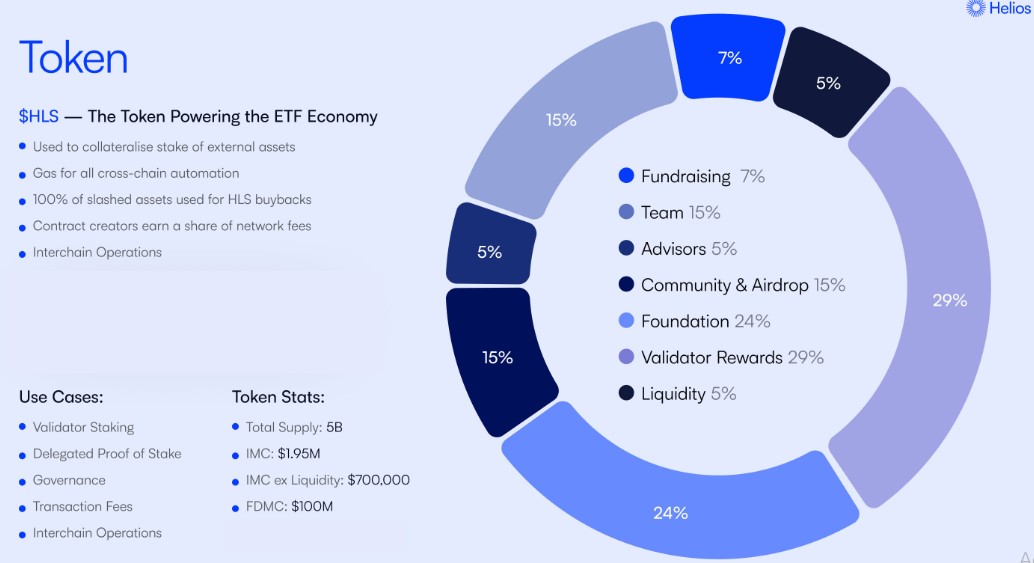

The tokenomics demonstrate a total supply of 5 billion HLS tokens, with a circulating supply of 97.5 million tokens at the time of launch. The distribution is as follows:

Source: Official Website

29% is allocated to validator rewards to secure the network and incentivize staking.

24% is reserved for the foundation to support long-term ecosystem growth.

15% is allocated to the team, aligned with long-term development goals.

15% goes to community incentives and airdrops to boost adoption.

7% is used for fundraising to support early operations.

5% each is allocated to advisors and liquidity provisioning.

Based on supply structure and early demand, HLS coin price prediction discussions place the HLS token price between $0.08 and $0.50 at listing. If additional top-tier exchanges step in, HLS price prediction models suggest short-term upside toward $1–$3, with $5 discussed as a future potential if adoption grows.

There is no confirmation yet on a Binance or Binance Alpha token listing. With one day left before trading, speculation remains, but no official signals have been released.

Market commentators point out that it is unique in its focus on the development of portfolio-level solutions rather than individual DeFi instruments. This makes it closer to traditional finance designs, and if implemented as per the roadmap, this can help in their widespread adoption.

Helios blockchain is entering the market with strong funding, tokenomics, and an airdrop and listing date locked in. As AI crypto projects pick up momentum, its on-chain ETF offering and multi-asset strategy may set the tone for its early-stage growth. The next few weeks will be telling for HLS adoption.

Disclaimer: This is not investment advice, and the content is intended for informational purposes only. Cryptocurrencies are extremely volatile instruments and come with high risk. It is always important to do your due diligence, research tokenomics, risks, and regulations, and consult a qualified financial advisor before making any investment. Past performance does not necessarily indicate future results.

Deepmala Upadhyay is an experienced crypto journalist, content strategist, and News writer with over 5 years of expertise in writing and the crypto industry. Holding a Bachelor's Degree in Computer Science and a deep understanding of blockchain technology and financial markets, she excels in delivering exclusive news, in-depth research blogs, and expertly crafted on-page SEO content. As a team lead and content writer at CoinGabbar, Deepmala is responsible for analyzing blockchain technologies, cryptocurrency, price movements, and the crypto market with precision and insight. Her keen ability to create well-researched, impactful content, combined with her expertise in market analysis, makes her a trusted voice in the crypto space.