The world holds its breath. The war between Israel and Iran is escalating rapidly, and now there's a possibility that the United States will intervene. But how does that impact Bitcoin and the rest of the cryptocurrency market?

BTC had already fallen below $103,000 when Israel struck Iran's nuclear facilities last week. Also days ago, the same thing happened with Tehran, and it was attacked by Israel. Ethereum and other cryptocurrencies followed suit, falling. Everyone is frightened, markets are unstable, and the question is simple but frightful.

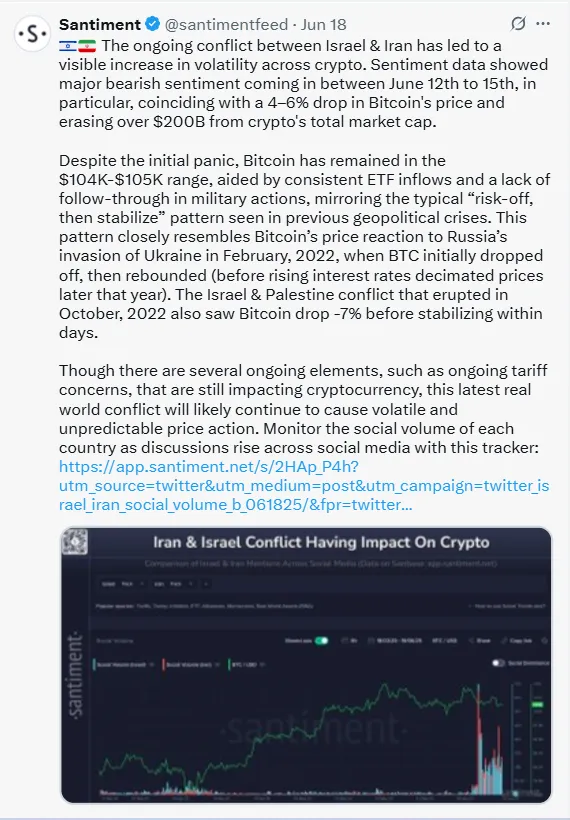

Source: Santiment on X

Let's break down what's occurring now, what might occur in the future, and what it all means for cryptocurrency.

Current Situation: Bitcoin Already Suffering:

On June 13th, Israel bombed Iran.

BTC immediately plummeted, losing more than $200 billion in total crypto market value.

Ethereum dipped to $2,400, and meme coins such as Doge and Pepe tanked.

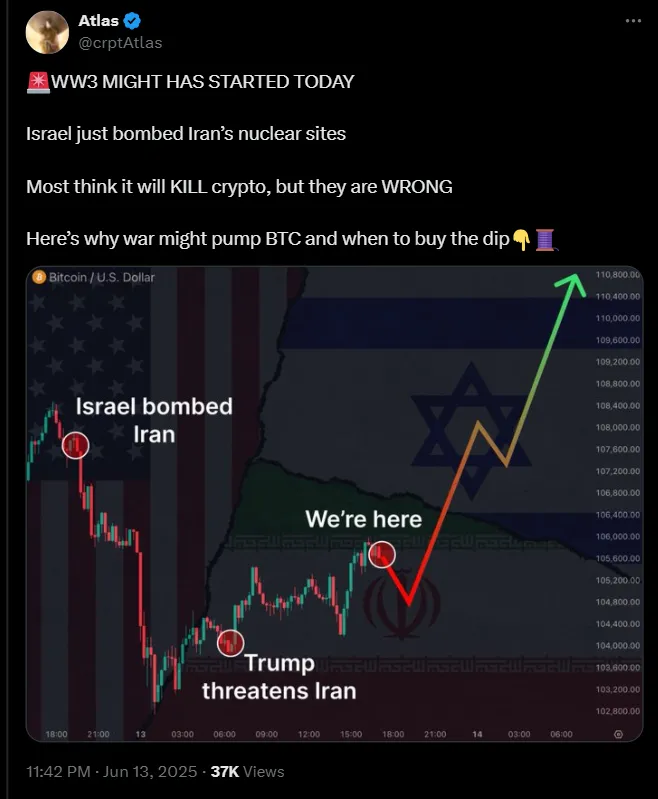

Crypto analysts Atlas on X cautioned of WW3 panic, yet also hinted at a rebound after the dip.

Source: Atlas on X

Although prices recovered a bit from the $104k to$105k range, the fear has not disappeared. People are waiting to see what happens next in the U.S. The White House reports that it will decide within 2 weeks whether or not to join the war. And if it does, another crash could ensue.

If the U.S. enters the conflict, according to experts, BTC can drop 10–20% in a matter of minutes.

Why so fast?

Investors will panic and sell quickly.

Money will be shifted to safer destinations such as gold or the U.S. dollar.

Large investment companies can withdraw their funds.

Adding fuel to the fire, Donald Trump started the debate with his recent tweets. His words are brief but could amplify investors' anxiety and accelerate crypto sell-offs.

Source: Donald J. Trump on X

What can happen:

Bitcoin may fall to $85K–$95K

Altcoins such as Solana, ADA, and XRP can crash even more severely.

Volatility (crazy price moves) will increase rapidly.

Traders can close risky bets, and crypto prices can change rapidly in hours.

Here's the good news. History proves Bitcoin can bounce back—even during war.

After Russia invaded Ukraine in feb 2022, BTC fell for a week… then skyrocketed 16%.

During the 2023 Israel-Gaza War, BTC increased within 50 days.

Currently, even amidst Iran tension, digital assets are staying firm above $104K.

Additionally:

Large investors such as Michael Saylor's MicroStrategy purchased $1 billion in Bitcoin this month.

U.S. Bitcoin ETFs welcomed $300 million of inflows last week, just before the airstrikes.

So the market might crash in the short term, but recover within the next 4–6 weeks if it does settle down.

It's not only the war. Other major issues are rattling the crypto market as well:

Fed Interest Rates: The Fed did not reduce rates this month, so crypto is not receiving the fuel it requires.

Oil Prices Rising: War is pushing oil prices up 7-11% after the strike, which causes more inflation fears.

Iran Exchange Hack: Pro-Israel hackers reportedly stole $90M- $100M from Iran’s Nobitex exchange.

US Tariff Policy: A deadline is coming on July 9 for new trade tariffs. That’s making investors nervous.

What Should Investors Do?

If you’re in crypto, here’s how to prepare:

Stay Calm during the dips.

Monitor for indicators: oil prices, ETF inflows, Fed statements, and war news.

Don't FOMO or panic-sell—crypto bounces back after fear subsides.

Monitor Bitcoin's correlation with gold and USD as risk indicators.

Final Thoughts:

Digital currency may be shaken, but not broken. If America gets drawn into the Israel-Iran war:

Short-term, prepare for panic and price crashes.

Long-term, Crypto could bounce back again, just as it has in previous conflicts.

Now, more than ever, Smart investors are turning into war developers, and broader economic signals like inflation, oil, and Fed policy, as the Bitcoin future depends on both.

The world is watching as digital currency finds itself back in the limelight—not only as a currency, but also as a haven, a gamble, and a tale of survival.

Muskan Sharma is a crypto journalist with 2 years of experience in industry research, finance analysis, and content creation. Skilled in crafting insightful blogs, news articles, and SEO-optimized content. Passionate about delivering accurate, engaging, and timely insights into the evolving crypto landscape. As a crypto journalist at Coin Gabbar, I research and analyze market trends, write news articles, create SEO-optimized content, and deliver accurate, engaging insights on cryptocurrency developments, regulations, and emerging technologies.