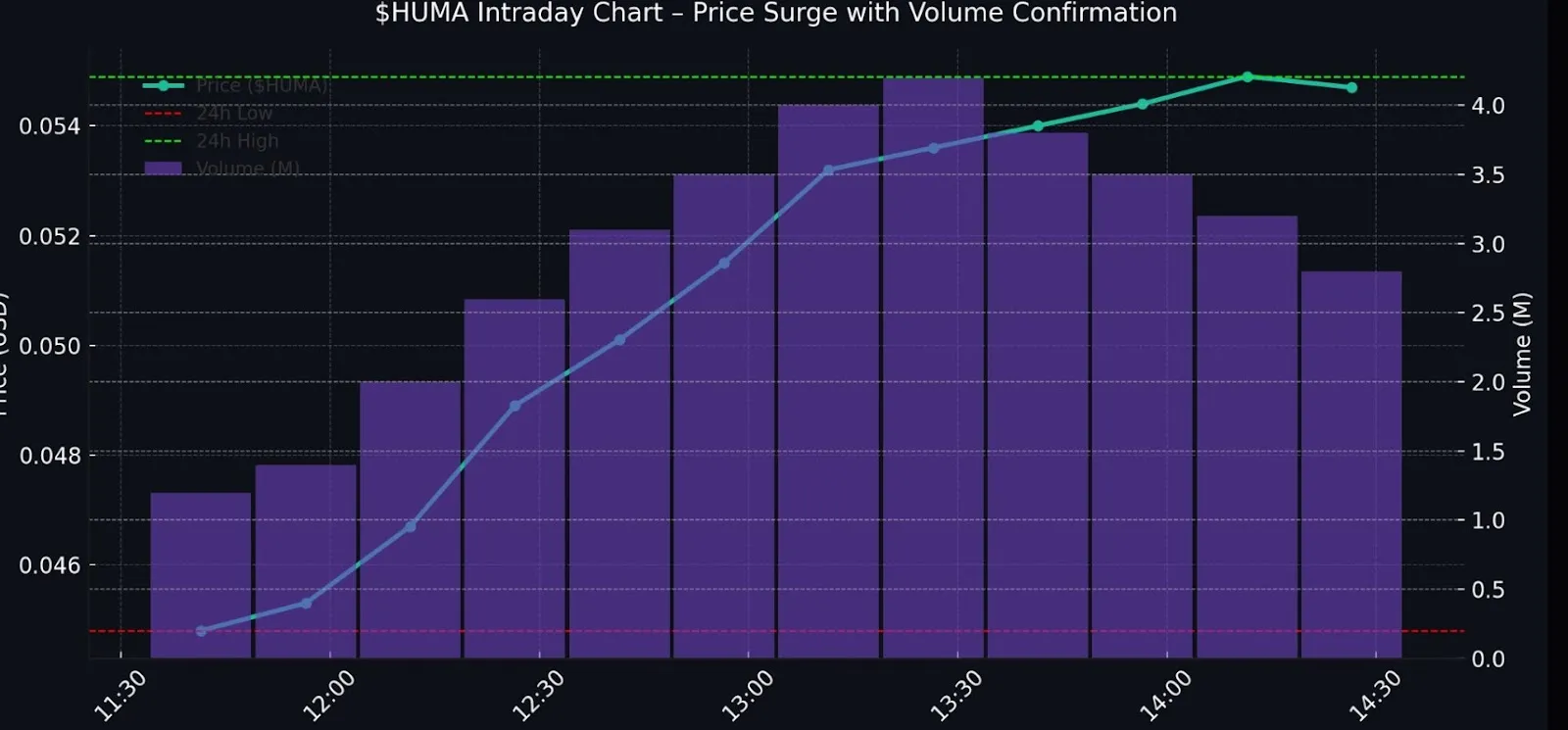

The Huma finance coin price surge caught everyone’s attention after the token jumped nearly 20% in a single day. The token rose from around $0.045 to a high of $0.05432, before slightly cooling down and settling at approximately $0.050 — still up 18% on the day.

The token's 24-hour trading volume increased by 38% to $439 million, according to CoinMarketCap. Strong market interest is indicated by this dramatic increase in price and volume. However, the question still stands: Why is Huma token price going up today?

Let's discuss some of the motivations behind this run

1. Most of the Airdropped Tokens are Already Staked for Rewards

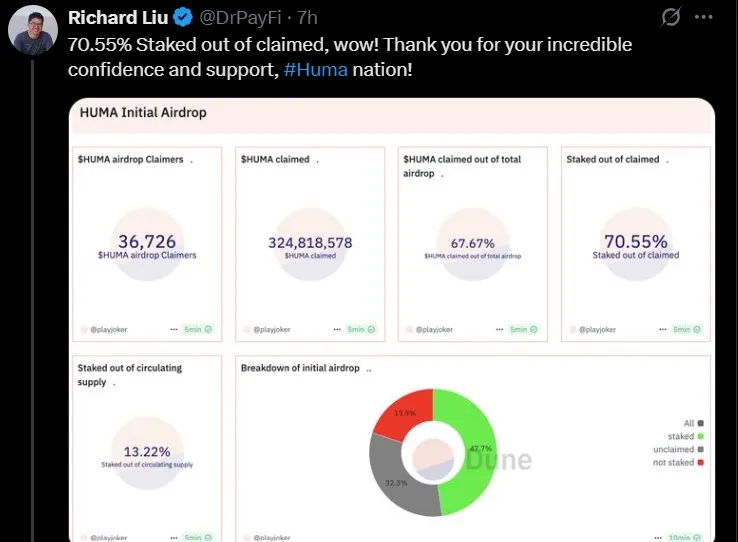

After the recent Huma Finance airdrop, an outstanding 70.55% has been staked by users. This means, most holders are not selling and are locking tokens to earn rewards. Its co-founder Richard Liu, shared this on X. This high staking reduces the token’s supply, which helps the finance coin price surge when demand rises.

Source: Richard Liu X

2. The 2.0 Update

The team announced they're opening up its 2.0 deposits again on June 6, 2025. Everyone can start putting money in on June 11, but people who signed up get a head start. They can begin 24 hours earlier, on June 10 at 10:00 UTC.

3. Live Integration with Stargate Boosts Ecosystem Reach

One more factor behind the Huma finance coin price surge is its real-time connection to Stargate, a well-known cross-chain system.

To understand whether this rise is sustainable or not, let’s look at the technical indicators shared by crypto analyst gemxbt on X. As per his 1-hour chart shows a strong uptrend with higher highs and lows.

Source: Gemxbt X Account

As per TradingView, it has moved above all major moving averages — 5MA, 10MA, and 20MA — and is holding above them. It's also touching the upper Bollinger Band, which means it’s in a strong and fast-moving bullish phase.

The RSI is close to 70, which means it is in the overbought zone, and the MACD still shows bullish momentum, but it’s slowing down a bit.

Source: TradingView

Right now, the key support levels are at $0.048 and $0.050, while resistance is near $0.0535 and $0.060.

Based on current data and trend behavior, here are the possible scenarios:

Scenario 1 – Healthy Pullback Before Bouncing Again

This is the most probable course of action. The price may dip down to the $0.048 - $0.049 range in a cooling, and then bounce off of it (if volume returns) back towards $0.055.

Scenario 2 - Breakdown After a Fakeout

If selling pressure kicks in and the price goes below $0.048, it could go down to $0.044 - $0.046.

Scenario 3 – Fresh Rally to New Highs

If trading volume increases again and staking interest stays strong, the price target could make another rally. In that case, it might test the $0.087–$1 range.

For this to happen, RSI must stay between 60 and 70 with continued buying pressure.

Some may think this is just another token pump today, but the facts say otherwise. The Huma finance coin price surge is supported by real reasons — strong staking, active airdrop users, the latest Huma finance coin news–the 2.0 update, and a big tie-up with Stargate.

Short-term traders should watch for a small dip, but overall prediction stays positive if more users join after the 2.0 launch and momentum stays strong.

Sara Sethiya is an experienced crypto journalist with five years of experience in blockchain research, price movements, and market analysis. With a background in mass communication and journalism, she specializes in data-driven news articles, in-depth market reports, and SEO-optimized content. As a team lead and content writer at CoinGabbar, she examines on-chain metrics, evaluates liquidity trends, and analyzes tokenomics to uncover market patterns. Her analytical approach helps traders and investors interpret market shifts, identify potential opportunities, and understand the broader impact of blockchain innovations on the financial ecosystem.