Indonesia Crypto Tax Policy Sets Stage for a Domestic Boom

As digital asset adoption grows worldwide, the state is stepping up with a major overhaul of its digital asset levy rule, starting today as August 1. It marks one of the first serious efforts by a large Asian economy to bring structure to the fast-evolving sector.

While immediate effects on traders and miners remain to be seen, the move signals a shift toward building a more stable and locally grounded digital currency environment.

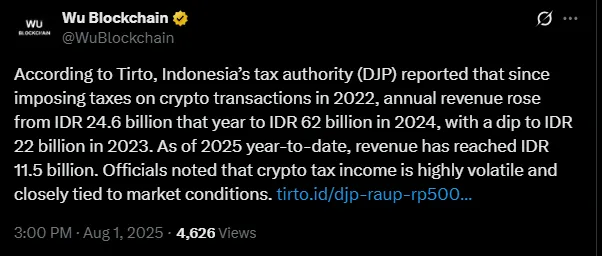

Indonesia Crypto Tax start in 2022. In the first year, it collected IDR 24.6 billion ($1.54M) in revenue. Collections surged in 2024, reaching IDR 62 billion ($3.87M), before dropping to IDR 22 billion (1.38M) in 2023. So far in 2025, Indonesia Crypto Tax income stands at IDR 11.5 billion ($718k).

Source: X

So, the major shift is not about impositions only, it is about making virtual assets a recognized part of the national financial structure.

Local sellers now pay 0.21% per transaction, up from 0.1%

Buyers benefits from VAT removal, previously 0.11% to 0.22%

Miners are charged 2.2% VAT

Mining income tax of 0.1% will be removed in 2026, shifting to standard income levy rules.

Though the higher charges may appear restrictive at first, it frames the most required needs of the country. Local platforms could see improvement as users move away from foreign exchanges, while lower costs and clearer rules will benefit the retail traders. Under OJK and National Bank this creates a more unified regulatory path.

Could this position the state as Southeast Asia’s next digital currency hub, if paired with the right incentives?

Japan and Denmark are among the toughest places for digital currency investors, with excise rates reaching 55% and 52% respectively. On the other hand, EI Salvador, Hong Kong, and the UAE have created zero duty environments to draw in capital and startups.

Indonesia Crypto Tax is taking a more balanced route, keeping seller charges high for foreign platforms while easing VAT and opening doors for local growth.

The country’s view of digital currency has shifted significantly, from treating it as a commodity to recognizing it as a financial asset. Statista projects $4.4 billion in crypto revenue by the end of 2025, rising to $44.5 billion in 2026. User growth is also on the rise, with 50 million by next year.

But the question is, with rising adoption and enhancing rules, is the nation ready for a digital currency-driven economy?

With clearer norms, and strong support from regulators, the country could be laying the groundbreak for a decentralized economy. Still, how far it advances will depend on whatever it can strike the right balance between control and innovation.

Bhumika Baghel is a rising crypto content writer with a deepening interest in blockchain technology and digital finance. With a keen understanding of market trends and cryptocurrency ecosystems, she breaks down intricate subjects like Bitcoin, altcoins, DeFi, and NFTs into accessible and engaging content. Bhumika blends well-researched insights with a clear, concise writing style that resonates with both newcomers and experienced crypto enthusiasts. Committed to tracking price fluctuations, new project developments, and regulatory shifts, she ensures her readers stay informed in the fast-moving world of crypto. Bhumika is a strong advocate of blockchain’s potential to drive innovation and promote financial inclusion on a global scale.