Iran's largest cryptocurrency exchange, Nobitex, was hit by a massive cyberattack this week (Crypto Exchange Curfew), putting nearly $100M in user funds at risk. In response, Iran has introduced a new nationwide curfew, restricting operations to daylight hours.

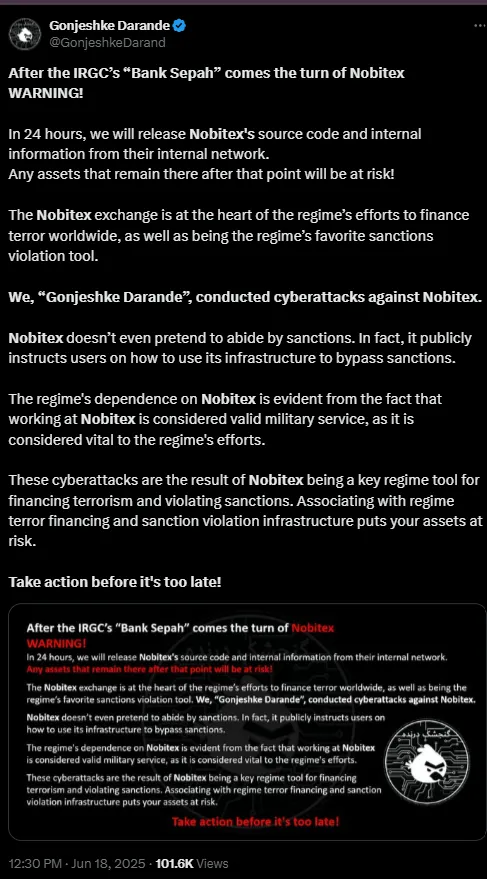

The attack was conducted by a collective named "Gonjeshke Darande", which, " took responsibility for a tweet published on X. They dropped a strong threat; in 24 hours, they would leak Nobitex's complete source code and internal materials. They even wrote that whatever funds were remaining on the crypto exchange would be at risk.

"After IRGC Bank Sepah, comes Nobitex. We will publish the source code and internal data within 24 hours. Assets left there will be jeopardized! "- Gonjeshke Darande on X

Source: X

It is more than an Iranian crypto exchange—it's a lifeblood for finance. Used by more than 10 million people, it aids citizens in hedging against inflation, sending value across the world, and evading U.S. sanctions. It is so important that reports suggest working for them is tantamount to serving in the military in Iran. But today, users are locked out, bewildered, and anxious about what happens next because of the curfew.

Hacker Claims: Terror Links and Sanction Evasion

The hackers labeled Nobitex as an instrument employed by the Iranian regime to fund terrorism and evade sanctions. They say that the platform publicly guides users on how to circumvent worldwide restrictions, which they say closely links them to Iran's hardline financial policies. Symbolically, the hackers didn't steal the funds—rather, they torched them by sending crypto to non-recoverable wallet addresses with anti-IRGC statements such as "F*ckIRGCterrorists.

The group asserts Nobitex functions as Iran's chief sanctions-evading vehicle. Their press release makes the following accusations:

Directing terror financing

Public sanction-evading tutorials

Military service credit to employees

Emergency Measures Effective Immediately

Iran's government did not take the violation lightly. In a swift action, it declared a nationwide curfew, limiting all exchanges to only accept transactions between 10 a.m. and 8 p.m. Chainalysis expert Andrew Fierman stated that this enables the government to more effectively track big transactions and keep out late-night cyber intrusions, which are more difficult to recognize and act upon.

Nightly transaction ban (8 PM to 8 AM local time)

Maximum $500 daily withdrawal per user

Regular security audits for all exchanges

What Nobitex is Doing

To safeguard remaining funds, it was stated that:

Transferred all funds from hot wallets to safe cold storage.

Shut down external network access.

Triggered a Reserve Fund to fund any customer losses.

Up to now, the crypto exchange curfew asserts that no customer funds have been lost. But the more significant issue now is the security of data, was user identity or transaction information exposed in the Hack? They haven't confirmed yet.

Gonjeshke Darande's manifesto reads:

"Nobitex doesn't pretend to follow sanctions. It teaches evasion techniques. Working there serves the regime's terror financing."

Some are optimistic that the platform will be restored in a few days after the Hack. Others are freaking out, worried about long-term limitations or greater government control. Users are inquiring if this is an isolated incident or if additional crypto exchange curfew attacks are on the horizon.

Frozen withdrawals: Numerous users are experiencing stalled transactions

Market crash: Local Bitcoin rates declined 42% overnight

Panic selling: Traders selling positions at huge losses

Verification delays: New KYC rules are leading to backlogs

Iran's parliament finance committee suggested:

Forced government wallets by Q3 2025

Blockchain analysis incorporation on all exchanges

Harsh mining license checks

International transactions tracking

What's Next?

This event illustrates how crypto exchange curfew, censorship, and cyberwarfare are all converging in Iran's economy. The Hack comes on the heels of a similar attack on Bank Sepah, another IRGC-affiliated bank. Is Iran's financial network now under synchronized digital assault? And what might result if another crypto exchange curfew is targeted next?

Muskan Sharma is a crypto journalist with 2 years of experience in industry research, finance analysis, and content creation. Skilled in crafting insightful blogs, news articles, and SEO-optimized content. Passionate about delivering accurate, engaging, and timely insights into the evolving crypto landscape. As a crypto journalist at Coin Gabbar, I research and analyze market trends, write news articles, create SEO-optimized content, and deliver accurate, engaging insights on cryptocurrency developments, regulations, and emerging technologies.