JP Morgan crypto loan may allow customers to get lendings on cryptocurrencies like Bitcoin and Ethereum as collateral. This would operate similarly to a standard lending secured by a home or stock holdings. However, your digital coins would be worth more in this situation

Source: Financial Times

According to Financial Times spot Bitcoin ETFs can now be accepted as collateral by the bank. Those familiar with the talks said the program could start as early as 2026 if it is implemented.

This might be very significant for those who have cryptocurrency investments but do not wish to sell. Long-term holders would benefit from being able to borrow money without having to give up their BTC or other holdings.

According to reports, BlackRock's iShares Bitcoin Trust and other SEC-approved spot-BTC ETFs will be accepted in JPM's first phase. If the assets are held with authorized third-party custodians like Coinbase or Anchorage, in compliance with U.S. regulatory requirements, a second stage would entail lending directly against BTC and Ethereum. In addition to maintaining exposure to cryptocurrency markets, the move puts JPMorgan in a position to serve institutional and ultra-high net worth clients looking for liquidity.

JP Morgan crypto loan could give the bank a bigger picture to expand in the digital currency space. JPMorgan may have a capital-efficient revenue coming from lending against cryptocurrency holdings. This could allow the bank to produce high revenue without pushing clients to liquidate lengthy assets positions.

Additionally, this model can push new operational and regulatory factors. As major US banks do not have digital currency on their balance sheet JPMorgan would probably utilize a third-party custodian to store the loaned assets.

The business will have to deal with concerns including ownership transfer, the legality of smart contract-based commitments, and how these assets are handled under US bankruptcy law. Direct lending against cryptocurrencies requires procedures for handling defaults and selling digital assets.

JP Morgan crypto loan service provided by the bank is incorporating virtual money into its everyday use, a move that signals a significant shift in the cryptospace. Previously, big banks were hesitant to engage with the cryptocurrency market.

Longtime Bitcoin critic Jamie Dimon, the CEO of JPMorgan, has stated that the bank will participate in stablecoins, even though he has previously expressed dislike of the BTC ecosystem due to issues including money laundering, leverage, and misuse.

This could lead other banks like Bank of America and Citibank offering similar services, advancing stablecoin development or virtual assets programs. It's a sign that JP Morgan crypto loan is no longer just a risky investment but a real part of mainstream finance.

Circle and Ripple have recently expressed their interest in the banking industry. In a social media post, Ripple CEO Brad Garlinghouse announced that the company is submitting an application for a national bank charter in the US. Additionally, Circle has submitted an application for a national banking license. It's fascinating to see these large, cryptobacked institutions expressing interest in banking and financial banking are trying to ignite their interest in cryptocurrency.

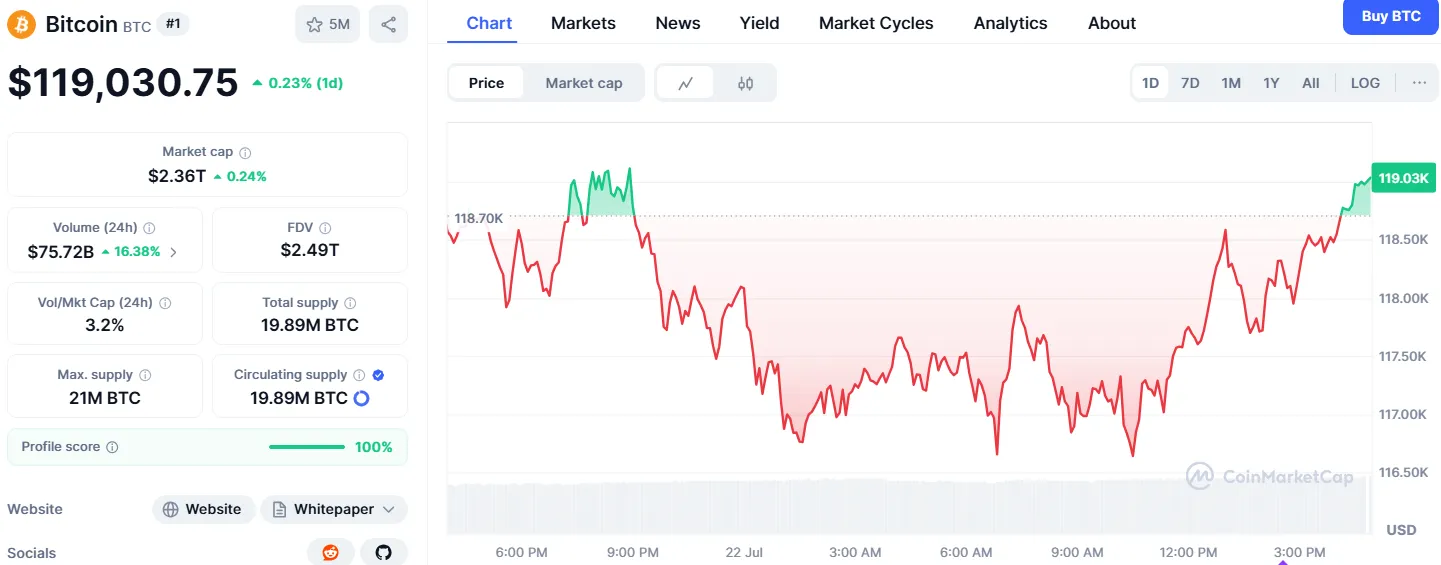

Source: Coinmarketcap

Bitcoin has increased by 0.23% in past hours and is currently trading at $119,030. Bitcoin is experiencing a boom due to institutional purchasing and financial banking interest. Interest in Bitcoin has surged since US President Donald Trump ran a campaign that focused on making the US the worldwide hub for cryptocurrencies. The JP Morgan crypto loan expands the options available to institutional and individual investors for exposure to the digital currency.

Sheetal Jain is a seasoned crypto journalist, content strategist, and news writer with over three years of experience in the cryptocurrency industry. With a strong grasp of financial markets, she specializes in delivering exclusive news, in-depth research articles and expertly optimized on-page SEO content. As a Crypto Blog Writer at CoinGabbar, Sheetal meticulously analyzes blockchain technologies, cryptocurrency trends and the overall market landscape. Her ability to craft well-researched, insightful content, combined with her expertise in market analysis, positions her as a trusted voice in the crypto space.

6 months ago

🙃🙃🙃🙃🙃