Big news for the crypto world – This token official account on X just shared its plan for launching TGE date and also gave the final rules for getting the Season One airdrop.

The Klink airdrop listing date is coming very soon. Right now, the team is working with big crypto exchanges and launch platforms to choose the best time to launch, especially since the market is starting to bounce back.

As someone who has covered dozens of token launches, but why does this launch feel unique? Let’s analyze its tokenomics, total supply, airdrop criteria, and price prediction

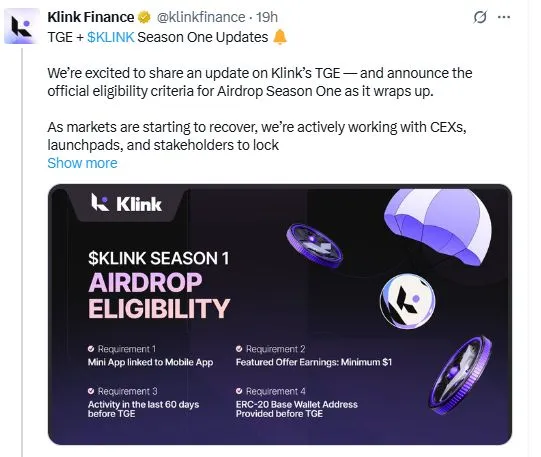

Source: Klink X Account

Here’s a quick breakdown of the its eligibility criteria that you must meet to claim your rewards:

1. Connect Your Telegram to its official App

You need to link your Telegram Mini App with its mobile app (available on iPhone and Android).

2. Earn at Least $1 from Offers

You have to make at least $1 by completing the offers. Even the offers that are still "pending" will count! You can find offers both in the app and in the Telegram Mini App.

3. Stay Active

You must have used your account at least once in the last 60 days before the token launch (TGE). If you didn’t log in or do anything, you won't qualify.

4. Give Your Wallet Address

You need to give them your own self-custody ERC-20 wallet address (means you control it yourself). This step will come in the next app update

Important: If you don't give your wallet address, you will lose your tokens — no second chances!

Tip: This coin will soon add a special "eligibility checker" inside the app to help you quickly see if you qualify!

Why It Is More Than Just Another Listing Token?

It is a tool that helps Web3 apps and games get users and make money easily. A user who tried their offer wall said, it was super simple — you do tasks and earn real USD. The mobile app and Telegram Mini App work together smoothly. This makes it better than most other giveaway projects.

According to the official Klink Finance website, It has a total supply of 1 billion tokens, the allocation is structured for long-term sustainability and user growth:

Community: 21.2% – The biggest chunk, going straight to users

Community Rewards: 13.2% – Incentives for active participants

Treasury: 15% – Reserved for development and operations

Team & Hiring: 11% – Long-term team expansion and sustainability

Liquidity: 10% – Ensuring smooth market trading

Marketing: 9.5% – Driving ecosystem awareness

Private Sale: 8.1% – Strategic early backers

Seed Round: 7.5% – Very early investors

Advisors: 6.5% – Experts supporting growth

Partners: 6.3% – Strategic collaborations

Ecosystem: 6% – Platform utility development

Public Sale: 3.4% – Final token sale event

Airdrop: 2% – Small but valuable pool for early users

Unlike many projects, only 2% is reserved for airdrops, meaning rewards will remain limited and potentially more valuable per eligible user.

Let’s compare $KLINK to Dolomite ($DOLO), a recently launched token also with a 1B supply. Dolomite listed at $0.107 but has since crashed to around $0.06892.

Here’s where Klink airdrop price has an edge:

Real user activity and offer-based earnings

More utility across multiple platforms

Tighter airdrop supply

Web3 infrastructure play, not just another DApp

Considering all this, a Klink listing price between $0.10 to $0.14 is reasonable. With enough momentum and top exchange listings, we could even see $0.18–$0.22 within the first month.

Conclusion

With the Klink airdrop tge date set to launch soon, make sure to meet the eligibility requirements and submit your Base wallet.

The claim window starts 3 days after TGE, with 5% unlocked immediately, and the rest vested over 180 days.

Don't forget: Users will have 5 months to claim their tokens before they expire. Check your eligibility. Submit your wallet. And get ready for the biggest crypto project of 2025.

Sara Sethiya is an experienced crypto journalist with five years of experience in blockchain research, price movements, and market analysis. With a background in mass communication and journalism, she specializes in data-driven news articles, in-depth market reports, and SEO-optimized content. As a team lead and content writer at CoinGabbar, she examines on-chain metrics, evaluates liquidity trends, and analyzes tokenomics to uncover market patterns. Her analytical approach helps traders and investors interpret market shifts, identify potential opportunities, and understand the broader impact of blockchain innovations on the financial ecosystem.